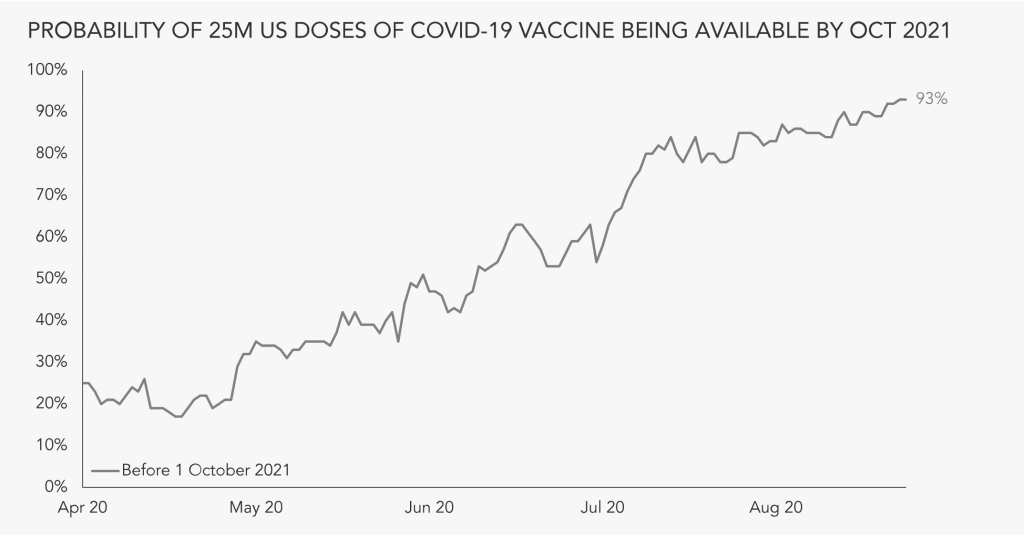

The superforecasters of the Good Judgement Project believe there is a 93% probability we will have an FDA-approved vaccine in a year, and enough of it to inoculate 25 million people in the US. This is up from just 20% in the dark days of April.

A widely available vaccine is the most important hurdle to getting the economy back to normal. No vaccine, no V-shaped recovery. If the superforecasters are correct this will be a triumph for mankind and for life as we once knew it. To foretell the conclusion – a return to normality looks under-priced.

F Scott Fitzgerald said: “The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.” To psychologists this would be a form of cognitive dissonance and we think the market has it.

In theory, the market is forward looking and sees an economic rebound. The market has rallied, but the companies leading the charge benefit most if we never return to normal. Let me explain…

The leaders have been the lockdown winners from e-commerce to subscription-based technology businesses. We have worked up a sweat on Peloton, whilst waiting for our Amazon Fresh delivery to eat dinner in front of Netflix. Imagine saying that sentence a decade ago!

If you think about it, these surging stocks imply investors do not have much confidence in a real economic recovery. If the market and the economy is going to come roaring back, companies such as Zoom may continue to do well, but there are surely others, currently suffering, that stand to benefit significantly more from things getting better. We will venture back out into the real world.

If there is a vaccine in a year, will you be doing more or less video conferencing than you do now?

So, we think if you want to play a vaccine recovery, which is the role equities perform in our portfolio, these stocks are not the obvious choice.

We think the market is pricing perceived certainty very highly in equity markets. Either certainty of growth as in technology or certainty of low revenue and earnings volatility as in consumer staples.

The flipside is a valuation opportunity in uncertainty, and due to our overall portfolio construction that is something we can afford to take. Because of our protective assets we can afford to run with an equity book many would consider too hot to handle but we think has great potential.

Today one can buy stocks that are sensitive to covid-related factors and the economic cycle for near record low valuations. The probability of a vaccine and therefore a real economic recovery is rising and yet the stocks for which this would be most beneficial continue to languish. From a portfolio perspective, there is a clear opportunity in such stocks.

We own stocks exposed to tourism and travel such as Walt Disney, American Express, Vinci and Aena (airports). But we also have stocks to benefit from a boost to real economic activity – such as UK housebuilders, ArcelorMittal and General Motors.

As we move closer to a medical breakthrough, we think the stocks mentioned above might shoot up, spelling a big V for Vaccine. If no medical breakthrough occurs, then the market bounce since March looks very fragile indeed, and the protective positions in Ruffer portfolios should come into their own.

This article was originally published by Ruffer under the title “A vaccine: to v or not to v? That is the question”.