Originally published 30 September 2020.

Matthew Piepenburg and Thomas Lott, two hedge fund managers with Ivy League pedigrees, have issued a stark warning in their latest book Rigged to Fail. Published in February 2020, the book is as timely as it is easy to read. Although it missed out on encompassing the March 2020 crash, the lessons and advice in the book are timeless.

If anything, the book looks months if not years into the horizon, touching on not the latest investment trends but existential questions relating to monetary policy, public spending, economic theory, and sound investing. The main thesis of the book is that the United States as well as the rest of the modern world is preparing itself for an incredibly painful financial crisis due to a long legacy of poor policy-making and market interference.

For some, the book may come off as an overly pessimistic market bear pitch preaching impending doom that never comes

Essentially, we are in the midst of one of the largest financial bubbles in history and our leaders lack the political will to control it. For some, the book may come off as an overly pessimistic market bear pitch preaching impending doom that never comes. Even if that is the case, the book still features a vast wealth of bluntly spoken economic knowledge that can serve anybody from a new investor to a central banker.

Understanding financial crashes

Recessions play an essential role in the economy. They are a natural and healthy correction where poor investments fail and eventually recalibrate to good investments. The problem comes when governments, in their quest to create everlasting growth, try to interfere with this natural process; like trying to prevent death or stop an infectious disease. The authors use many analogies to frat parties to describe recessions and government policy. Although that is certainly a fine metaphor, it may be a little too realistic.

Imagine the market as a party. The boom cycle, characterised by upward financial growth, is when everyone is drinking and having a good time. People are making investments, spending money, and making money. Eventually, people drink a little too much and they wake up hungover in the morning. That’s the bust cycle or a recession, characterised by downward financial growth. Those who were responsible with their money often escaped with little losses, i.e. they were responsible with their liquor consumption the night before and weren’t hungover.

The authors use many analogies to frat parties to describe recessions and government policy…

it may be a little too realistic

Those who drank too much will be hungover, i.e. making way too many risky investments and overexposing themselves to dangerous assets. There is nothing wrong with this dynamic on its own, as hangovers are natural and they happen to the best of us.

Ideally, you would want a relatively stable financial market characterised by mild booms and busts. Think of a nice dinner party; you won’t be having the time of your life but nobody is getting alcohol poisoning either.

You get a financial crisis when things start getting out of hand. Perhaps there is an unprecedented level of speculation or government manipulation that has created artificial as well as unsustainable incentives that distort investors’ abilities to make sound decisions.

The authors specifically reference the dot-com bubble where investors frantically hopped on trendy and unproven internet-based companies. Another example is the 2008 housing crisis, which former BB&T executive John Allison explains was caused largely in part by a large amount of government-created incentives and interference that led to an unnatural rate of growth that was disastrously unsustainable.

Central bank manipulation

The authors continue with the party analogy when describing the role and influence of central banks, a recent player in the market whose influence has grown to unprecedented levels. Essentially central banks, with their ability to manipulate the money supply, are the uncles who bring the booze to the party. Responsible central bank leaders know how to responsibly monitor the rate of economic growth. The authors note, “Federal Reserve Chairmen William Martin and Paul Volcker deserve equal note for exercising unpopular courage by standing up to bull-market temptations. In 1958, Martin took away Wall Street’s ‘easy money’ punchbowl as soon as he saw that an economic recovery had morphed into greedy, Wall Street speculation and a dangerously overvalued stock market.”

Central banks, with their ability to manipulate

the money supply, are the uncles who

bring the booze to the party

However, most central bankers are not like the ones mentioned above. They continue to indulge in complicated stimulus measures and irresponsible monetary policy much like an uncle who just keeps giving liquor to the frat boys.

By keeping interest rates low for longer than they need to be, central banks not only encourage reckless investing but weaken their ability to react in a recession. AIER has published an article detailing how highly unorthodox practices at the European Central Bank, such as negative interest rates, are causing havoc in the European economy.

Boom and bust cycles, much like supply and demand, have a natural equilibrium that is self-regulating. The problem comes when an outside actor that is completely impervious to market forces attempts to manipulate the market. Arizona State University professor Scott Scheall explains in his latest book that the knowledge problem is associated with political solutions as opposed to market-based ones. In many instances, governments simply lack the political courage to allow recessions to occur naturally and let bad actors fail. They’d rather kick the can down the road, dooming future generations to volatility if not devastation.

The authors point to an example of such behaviour when they cite that: “GE’s [General Electric] dive from $50 to $10 was based on the fact that its finance company’s earnings were essentially $600bn of risky, illiquid assets propped up by mountains of debt ($800bn) and hot money leverage… Did the company learn the necessary lessons of reckless speculation in the fall from its 40x valuation peaks? No. Instead, GE’s CEO took a bailout.”

The market is full of these scenarios where governments artificially prop up failing companies by pumping trillions of dollars into the economy through quantitative easing and other experimental monetary policies. This creates a dynamic where companies are not really creating value but are simply propped up by an unstable house of cards composed of overly complicated interventions. The worst part is that it only prolongs the inevitable and makes the downturn even worse. This creates a vicious cycle where the government can’t afford to not perform a bailout as doing so may substantially harm the economy. This not only incentivises poor behaviour but perpetually adds to the already overbearing pile of problems.

Such behaviour is now the norm all across the world so if the crash comes it will not be a local crisis, but a global catastrophe.

Looking at market signals

The authors run a website called Signals Matter where their main focus is providing sound investing advice on the basis of strong information and conservative strategies. Part of that strategy is paying attention to signals in the market and not being caught flat-footed.

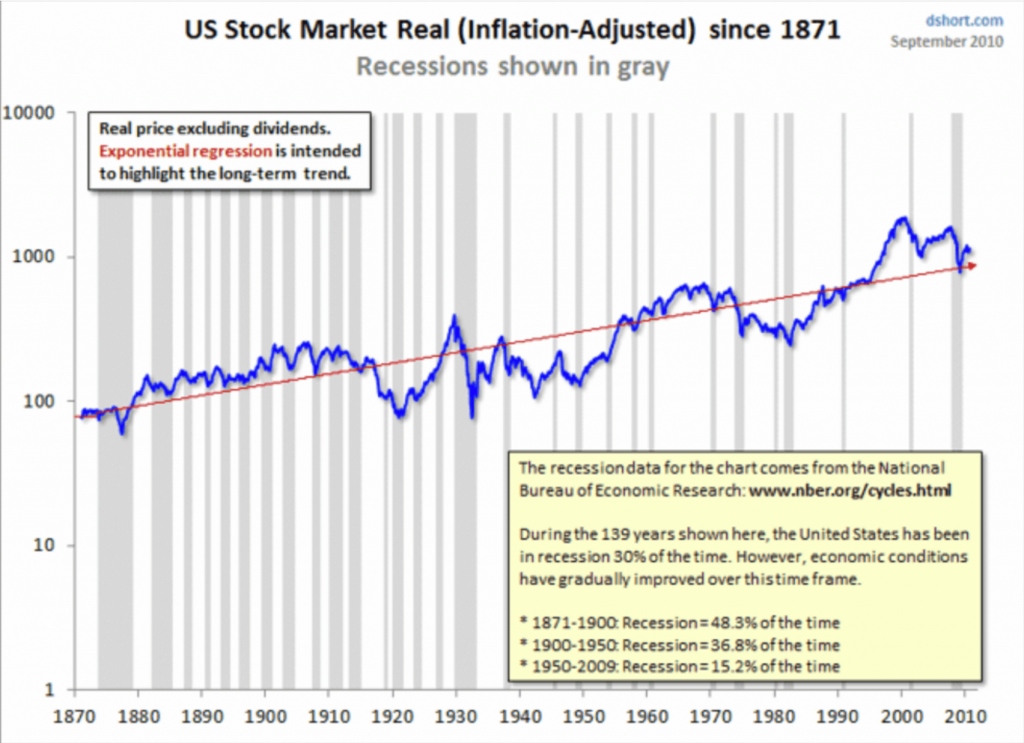

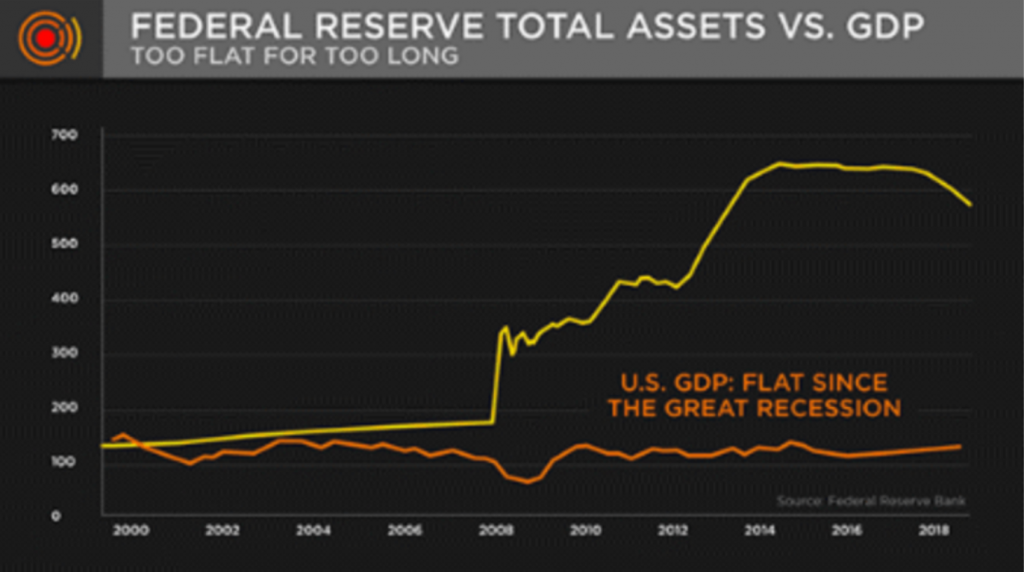

The authors cite this graph multiple times throughout their book to drive home the point that they believe we are in the midst of a central bank-driven bubble. As seen, they mark the dot-com bubble as well as the subprime bubble. In the book, they mark the very top right corner as the “everything bubble”. As indicated, it is driven in large part by central banking stimulus into the economy, propping up companies and stocks that don’t reflect productive activity. Throughout the book, the authors cite a plethora of graphs to drive home their various points but their main focus is on market signals.

From this graph it is clear that bubbles have a certain look to them; although it may not be clear exactly how they look, you know one when you see one. Unnatural expansions crash unnaturally hard and central banks have been fuelling a concerning amount of artificial expansion.

Basic common sense should make us step back and wonder if stock markets are supposed to grow this fast. We can see a scaled-down example as recently as the entire month of September. Throughout the covid-19 pandemic, as the Main Street economy suffered massive losses, the stock market (mainly big tech companies) soared in value. However, the reckoning has come as the entire month of September has been characterised by a considerable stock sell-off.

We can see that over the course of the 20th century the market has become more volatile. A large part of this can be explained by the increasing power and activity of central banks. At the turn of the 20th century, we see the beginning of more interventionist-style policies such as the creation of the US Federal Reserve in 1913. FDR took the US off the gold standard in 1933 via executive order and the advent of an overall drastically larger government.

The current state of the market is like a party featuring a massive amount of hard liquor as well as illicit substances. It won’t end well

The key takeaway is that incompetent and overly involved government intervention in the money supply, as well as the market, has to lead to increased extremes in both growth and retraction. If you look at the current state of the market, which is characterised by trillions of dollars in stimulus spending, corporate bailouts, and low interest rates, you should think of it like a party featuring a massive amount of hard liquor as well as illicit substances. It won’t end well.

Another key signal the authors highlight is the disconnect between Wall Street and the rest of the economy. Although the stock market is supposed to mirror investor confidence rather than the performance of the actual economy, there comes a point where it seems like things are a little too disconnected. This is especially true when we consider the amount of credit expansion and experimental monetary policies being implemented by governments across the world. With the amount of intervention and stimulus that we are seeing today, it might actually be more surprising if Wall Street was actually correlated with the economy.

The authors use this graph to illustrate their point about the utter disconnect between the financial sector and the actual economy. They point out deceptive bookkeeping schemes that are totally permitted by the SEC as well as misleading methodology utilised by the government to calculate things like unemployment. They write that: “That’s why the Fed and the Bureau of Labor Statistics have deliberately lied to us for years about ‘roaring GDP growth’ and ‘contained inflation’. With markets skyrocketing on debt, our actual GDP since the 2008 crisis has only annualised at a pathetic rate of 2%. Thus we have debt (and hence markets and Fed balance sheets) skyrocketing, while GDP flatlines – a classic sign of a rigged-to-fail market.”

The Federal Reserve is out on a spending spree with its buddies on Wall Street using money that seemingly came out of thin air

The Federal Reserve is out on a spending spree with its buddies on Wall Street using money that seemingly came out of thin air. This is because the Fed is a sovereign money creator that can print money at will. Without being collateralised to something like the gold standard, such behaviour is theoretically infinite, but the consequences are just as high. The authors consistently warn the reader throughout the book to be on the lookout for such disconnects, whether it be national economies or individual stocks. Clever bookkeeping, artificial credit, and market hype can produce numbers that are seemingly too good to be true. When the charade is up, investors react accordingly.

A market can only run so long on government-created debt; actual productive activity is needed for long-term sustainability.

The consequences

The obvious thing that can happen if these predictions come true is that people will lose a lot of money, the economy will fall into a savage recession, and political upheaval will likely ensue. This is the stark picture that details the likely consequences of a bubble pop of this size and a government that values short-term performance over long-term stability.

The authors do acknowledge that markets seem to be resilient and with time they return. However, they also point out that such a massive monetary and financial reckoning hit Japan around 1989. Although the Nikkei has returned to its previous levels, that recovery took 30 years. One can only imagine the consequences of a global crisis of this magnitude.

Key takeaways

The book goes into so much detail and covers so much ground that this review only touches on the most general parts. It even offers some general investment advice and goes into detail about various assets such as bonds, precious metals, and so on. Regardless of whether the predictions in the book come true, it offers a timeless set of sound economic principles that can serve both investors and governments who are truly the ones who should heed this message

We know what a drunk looks like and we know an unsustainable market when we see one

The big picture is that sound economics matters. Governments as well as individual investors should be attuned to the basic foundations of free market capitalism. Believing we can break free of the natural cycles of the market is much like trying to conquer nature. Nature always wins in the long run.

At the end of the day, we should all learn from history. We have seen which monetary policies work and which ones fail. It might not be popular to take away the drugs and alcohol at the party, but you might save lives by doing so. We know what a drunk looks like and we know an unsustainable market when we see one. Eventually there are consequences for risky behaviour. Relying on proven principles may not be as glorious or exciting but it will guarantee we actually come out in one piece.

This article was originally published by the American Institute for Economic Research.