Tech-driven real estate brokerage Purplebricks released its 2019 results last week. After a failed U.S. expansion, the core U.K. business is still growing and remains profitable, but is facing headwinds in a soft property market. The results highlight the critical importance of scale and customer acquisition costs, and offer a reminder that tech-enabled platforms continue to command a rising percentage of the real estate transaction.

Profitable, but mounting headwinds

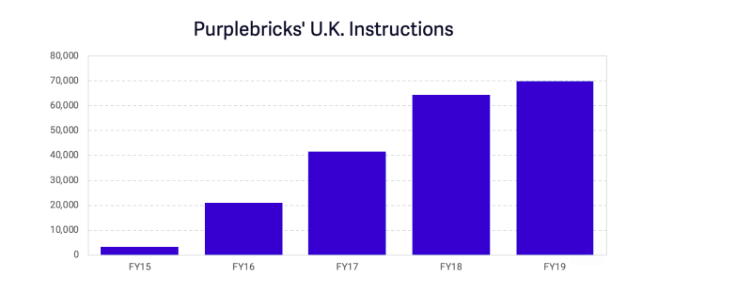

Purplebricks’ impressive growth in the U.K. market continues, albeit at a slowing pace. Overall instructions (or instructions to list) are up again, but only 9% compared to the previous year.

At this scale, the trend is unsurprising. As I said last year in this Financial Times article, “Real estate is very fragmented, there are relatively low barriers to entry to get into the business of selling houses, the products are undifferentiated and there’s no customer loyalty. That leads to natural fragmentation.”

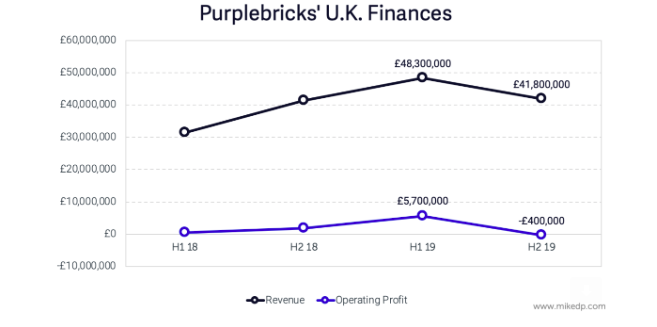

Meanwhile, Purplebricks’ finances for the U.K. operation — while up for the entire year — have taken a hit in the most recent six months (December to April, 2019).

The decline is driven by a drop in revenue. Compared to the first six months of Purplebricks’ financial year, marketing expenses remained steady while revenue dropped £6.5 million. With a soft property market in the U.K., at least partially driven by the uncertainty around Brexit, it is becoming more difficult and expensive for Purplebricks to acquire customers.

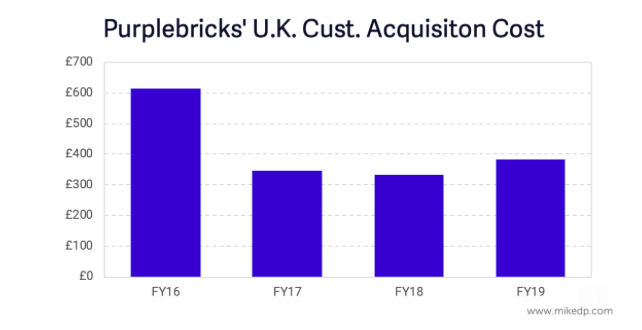

For the first time in its history, Purplebricks customer acquisition cost (or cost per instruction) has increased from the previous year. The trend of increased economics of scale has taken a pause — perhaps temporary, perhaps not.

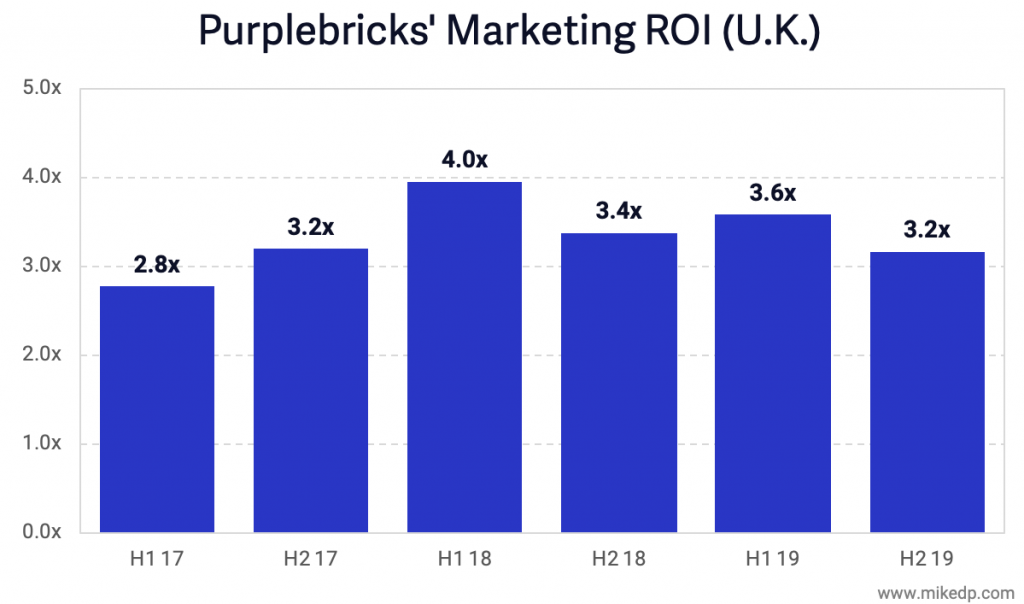

Overall marketing ROI (defined as how much revenue each £ in marketing buys) — while still nicely positive — is down in the most recent six months.

A financial bloodbath in new markets

Purplebricks announced its departure from the Australian and U.S. markets earlier this year. At the time, international expansion was a key driver in Purplebricks’ stock price and investor optimism. But the latest results reveal what a financial bloodbath the moves were.

In 2019, Purplebricks lost nearly £19 million in Australia and £34 million in the U.S. A large part of this expenditure was expensive marketing. The reasons for the failure in international markets are complex, and range from not picking the right markets to ineffective marketing.

Gross margins and the platform play

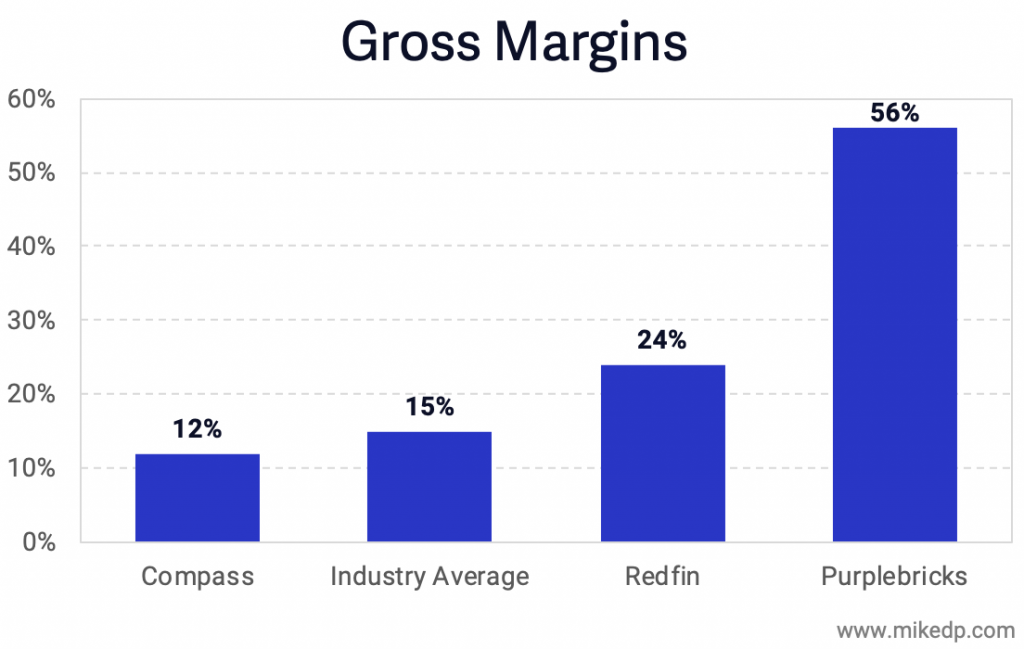

A key highlight in Purplebricks’ results are a reminder of the market power it possesses, and more specifically, its high gross margins. A company’s gross margin is the amount of revenue it retains after paying its cost of sales, which for Purplebricks, are payments to its local property experts (aka agents).

In the U.S., average brokerage gross margins are around 15%. The outliers are Redfin and Purplebricks, whose novel operating models enable a standardized process with corresponding efficiency and economic gains for the company.

Purplebricks’ gross margins in the U.K. increased to 63%, up from 58% in the previous year. In other words, for each £899 listing, the agent keeps around $333 while Purplebricks retains £566 of the fee.

And in the U.S., Realtor.com’s $210 million acquisition of Opcity and Zillow’s new flex pricing product follow the trend, with both charging real estate agents around a 30% referral fee when a transaction closes. These are all examples of the core economics of real estate changing, with technology platforms commanding a higher percentage of the transaction.

Purplebricks’ continued — albeit slowing — growth in the U.K. highlights the importance of customer acquisition costs in the new world of hybrid and online brokers. Having fantastic technology and a great team will only get you so far; at the end of the day, massive advertising expenditures are required to reach scale, and then, profitability.