Are real estate owners not allowed to use algorithmic or dynamic rent pricing?

On January 30, 2022, ProPublica, an independent non-profit news organization, published an article suggesting the real estate industry was rife with price fixing when it came to setting residential apartment rents. They described the data mining and sharing of market information by RealPage with their YieldStar rent application, suggesting that not only was public information being shared but insider information, which some legal experts claimed could result in cartel-like collusion and price fixing. They described the process as algorithmic pricing.

RealPage software is widely used by large landlords. In Seattle, for example, ProPublica found that 10 property managers oversaw 70% of all multifamily apartments in one neighbourhood — and every single one used pricing software sold by RealPage. That may have been an extreme example, but all large landlords have historically monitored competitor rents via searching on Craigslist, Apartment.com, Zillow, Zumper, Crexi, PropertyPulse, local e-newspapers and more. Local landlords would also send visitors to other apartment complexes to check on occupancy and tenant satisfaction. This may have included a visit to the laundry room where it is easy to conduct a quick survey. RealPage lowered the costs of such research and improved the quality.

As a result of the ProPublica article, personal injury attorneys and class action attorneys felt the urge to launch several lawsuits against both RealPage and several large landlords. In January of 2024, ProPublica came out with the following headline, “We Found That Landlords Could Be Using Algorithms to Fix Rent Prices. Now Lawmakers Want to Make the Practice Illegal.” Most of the largest landlords are now defendants in class action lawsuits brought by the US Justice department, and several states are passing laws to make it illegal to use what they describe as algorithmic pricing.

Two questions remain for the plaintiffs to prove their price fixing cases:

- Is there any proof of rent rigidity when demand tapers off? That is, do rents not fall when demand weakens, is there evidence of artificially high rents?

- Is there any data provided by RealPage that could not be ascertained by proxies of various sorts available by researching the market?

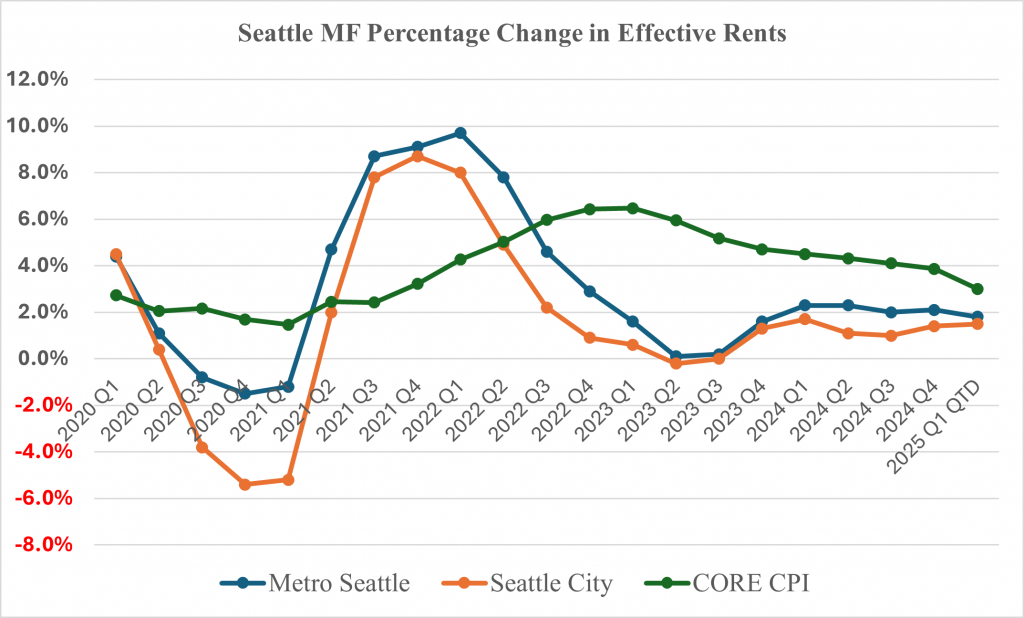

While this is not a definitive empirical study, the Seattle market, named as the most extreme user of RealPage data, has had the following pattern of changes in effective rents, using CoStar data:

Looking at both the city and metro apartment markets of Seattle, we observe a market that has sometimes seen effective rents decline and in many cases lag inflation. One might argue that this is one of the causes of inflation, but if algorithmic pricing results in collusive and monopoly type rents we would not see rents drop as fast as they do. Seattle remains a strong multifamily market but rents do decline. Sometimes they decline based on rent concessions, such as two months of free rent, and that is why effective rents are a better measure than contract rents.

One interpretation of the graph above is that in informed and competitive markets rents increase faster than in naïve less informed markets when demand is strong, but that they also decline faster when demand softens.

What is clear is that politicians focused on championing housing affordability are looking for scapegoats and ProPublica provided the fodder to bring out the underemployed lawyers, and publicity seeking politicians. Landlords are viewed as endlessly deep pocket predatory operators. It does not matter that property insurance costs have gone up faster than rents, refinancing rates are much higher, and that profit margins have narrowed or worse. A bill proposed by Peter Welch of Vermont and Amy Klobuchar of Minnesota would make it illegal for property owners to contract with companies that supply rent prices and housing supply data.

If landlords are guilty of using modern methods of data mining, then so are the airlines, Uber, all the hotel chains, most of whom have as much or more market power than even the largest landlords. There seems to be a lack of evidence that modern rent setting is a one-way street. Economists conclude that markets work best when they are allowed to compete. If anything, increased scrutiny and oversight by the government leads to less efficiency, greater risk, and possibly higher rents in the long run.