Originally published September 2020.

Dear development financier,

Are you really, truly, aware of the risks you will be taking over the next few years with your residential loan book? You are supposed to say yes. I am supposed to say no – and demand you wise up, with the immediate purchase and aid of my new book, Broken Homes – Britain’s Housing Crisis: Faults, Factoids and Fixes. However, I suspect that anyone wise enough to be reading Property Chronicle will need no lessons from me on residual land values and how to spot the errors and omissions in development appraisals.

Even so, there are two appraisals in Broken Homes, supplied by Montagu Evans. They relate to a single imaginary site of 100ha, on which 70ha can be built. Model A produces a residual land value of £16m for erecting 1,500 units, of which 800 are private, 450 affordable and 250 build-to-rent. The private units are built 25% larger than the norm. Model B holds 2,000 normal-sized units: 700 private, 800 private rent, and 500 affordable. The residual land value pops out at £43m.

Why produce this appraisal, beyond providing an entry-level guide? Well, my co-author, Jackie Sadek, is a regeneration expert with decades of experience. She is a woman of fierce conviction, who feels “everyone deserves better” – meaning bigger homes at lower densities than are generally being built today. Jackie has bought a site in Bedfordshire on which 1,500 homes are planned. Bought after spending three years in the Cabinet Office as a senior advisor to a Cabinet minister. Her subsequent planning ‘journey’ is a mordant read.

The extra cost of ‘beauty’ is matched by the extra income from sales – that’s the short answer

Model A and B underpin the opening chapters. These examine not only the financial variances, but also the differing social impacts on occupants. Why? As Jackie puts it, “occupants are regarded, not as human beings, living 21st century lives, rather as ghosts in the machine, forced to fit, rather than form the mould. The less well-off squeezed into homes the size of 19th century back-to backs. Everyone deserves better.” Will bigger homes at lower densities result in negative land values, I hear you ask?

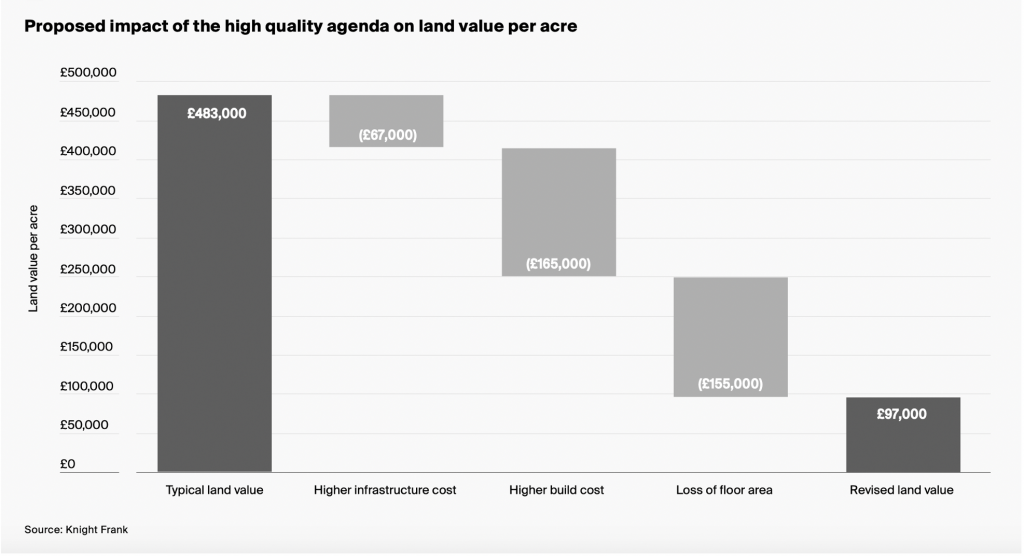

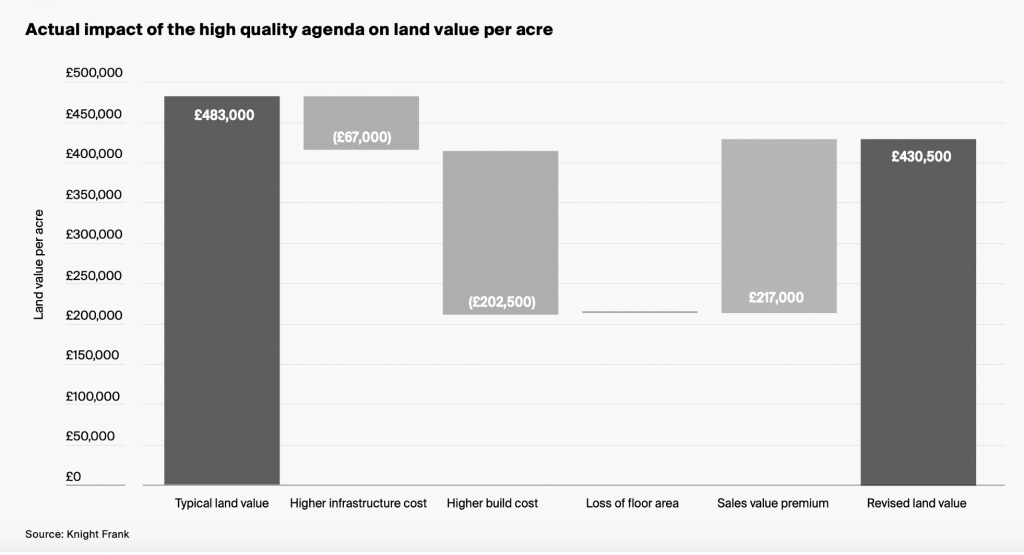

Lower, yes, as the model demonstrates. But don’t be too hasty in turning down loans to the enlightened. Finance costs of a not-to-be-sniffed at £25,000 per unit are contained in both models. The atmosphere is changing. There is talk in Whitehall of ‘beauty’. A new design quango has been set up carry the concept into planning law. (Only be scared if Jackie and I can persuade them to introduce mandatory space standards.) Don’t just rely on us. Delve into the detailed financial appraisals by Knight Frank of the ‘beauty’ movement.

The extra cost of ‘beauty’ is matched by the extra income from sales – that’s the short answer. The telling numbers for a debt investor are those on land value – what the developer feared they would be, by spending more, and the outturn. The developer feared the land value would drop from £483,000 an acre to £97,000. In reality the drop caused by spending more, but getting more back in sales, was minimal. People will pay more for ‘bigger’ and ‘better’ – a hardly surprising concept, except to those who cram in matchboxes.

I will end with some advice. Place no faith in government plans to ‘end Britain’s housing crisis’. All governments promise that. The latest is an attempt is to force councils to zone land. Take no notice of land traders who come begging for money because they believe the policy will result in more homes being build, “and that 20 acres I’ve spotted before anyone else will now be a sure thing for planning”. It might be. But the thing about forcing councils to zone lots of land is that we all know what happens when supply exceeds demand.

Easier to explain the risk by quoting from the press release on Broken Homes:

“Suggesting the state can control housing numbers is a fairy tale,” says Peter Bill, who worked for Wimpey before editing Building and then Estates Gazette. “Housebuilders control the supply valve. They twist the wheel open or shut with an eye to the economy. It’s sophistry to say ‘changing the planning system’ will magic up homes. Output is yoked to the economic cycle, not to the number of acres zoned by councils.”

Broken Homes – Britain’s Housing Crisis: Faults, Factoids and Fixes by Peter Bill and Jackie Sadek is published in October by Troubador (£20.00; 220pp) and can be ordered here.