Office condos have always occupied an odd place in the commercial real estate world. With few exceptions, corporate tenants generally don’t want to own their office space—they prefer the flexibility of leasing and generally have better things to do with their cash. Real estate investors, on the other hand, are more than happy to collect monthly lease payments while owning the underling real estate asset. So, historically, office condos have been a rounding error in the commercial real estate market.

But with the office market entering its fifth year of cataclysm, desperate times call for desperate measures. And some owners—particularly those holding the most distressed Class B and C product—are increasingly considering chopping assets up and bringing them to market as office condos.

Today’s letter will dive deep into the office condo opportunity with interviews with several operators on the front lines and breakdowns of recent office condo deals.

What is an Office Condo, Anyway?

An office condo is pretty much just what it sounds like: an office unit that has been subdivided and sold as a condominium. It’s pretty much like a residential condo but for office space, and office condo offerings operate under the same legal framework as residential condos. This means that anyone looking to create a new office condo needs to file plans with the state, a process that—at least in New York—can take up to a year.

Of note: many commercial buildings will use a “condo” legal structure to separate distinct parts of the building—for instance, to break off the ground-floor retail portion as a retail condo that can be sold separately to a retail-focused investor. That’s not what we’re focused on here, nor are the rare special-purpose office condo transactions such as Wells Fargo’s mega-purchase at Hudson Yards. For this article, we’ll concentrate on office condos as a potential answer for owners (or, increasingly, lenders) stuck holding Class B and C office space.

The Office Condo Market

In general, traditional office tenants—Fortune 1000s, tech startups, law firms, and the like—are not buying office condos. But that doesn’t mean there isn’t demand. To better understand the office condo market, we spoke with Michael Rudder, Principal of Rudder Property Group, a New York-based firm specializing in office condo sales.

Rudder got his start in the office condo market after stumbling into it while working for legendary real estate investor Francis Greenburger of Time Equities. Greenburger owned 125 Maiden Lane in New York’s Financial District, an emptying office asset in a neighborhood full of them in the wake of September 11th. Greenburger had originally planned to convert 125 Maiden Lane to apartments, following in the footsteps of several successful conversions in the immediate vicinity. But in 2006, Greenburger gave Rudder six months to attempt an office condo conversion instead.

“We had interest from several nonprofits who wanted to buy, not lease, office space in the building,” explained Rudder. “So he gave me six months to see if an office condo plan could be a success; if not, we would convert to residential. And we had a huge success.”

“The Governor of New York purchased 160,000 square feet. All these non-profits were buying. And they were buying at $385, $400 per square foot at a time when whole buildings were selling for $200 per square foot,” said Rudder. After completing several other office condo conversions for Greenburger, Rudder broke off on his own in 2010 to start Rudder Property Group.

No one in the office condo market—including Rudder, its champion in New York—pretends it is a large market. “Office condos make up about 2% of the office market in New York,” noted Rudder. “It’s about 10 million square feet citywide, which is around 110 buildings.” The office condo model is no more common elsewhere in the US, although it does play a more meaningful role overseas, particularly in the developing world.

In general, office condo demand is driven by a few types of buyers:

- Immigrants. “In today’s market, most [office condo] buyers are businesses whose principals were born abroad,” says Rudder. He attributes this to a cultural preference toward stability and ownership—after all, office condos are far more common in other countries.

- Nonprofits. Taxes are a significant portion of office asset operating expenses, particularly in a place like New York. But nonprofits don’t pay taxes—even property taxes. So if they own, rather than lease, their office space, a nonprofit won’t have to pay property taxes and can achieve substantially lower costs.

- Businesses with Complicated Equipment. For some businesses—particularly in the medical field—moving equipment can be cumbersome and extremely expensive, which can give landlords power over them in lease renewal negotiations. In addition, medical practices often have stable and predictable needs for space, making office condos a good option.

With niche demand and limited supply, the office condo market is thin. “There’s like under a million square feet for sale citywide,” said Rudder. “For most size ranges—5,000 square feet, 10,000 square feet, 50,000 square feet—there are fewer than five options on the market at any given time.” As we’ll find out, this can make office condo sales slow-going.

It’s worth noting that many office condo buyers can unlock relatively inexpensive financing through the SBA. “If you’re a business with reasonable creditworthiness and you’re taking owner-occupied space, you’re probably eligible for 90 to 100% financing through the SBA,” added Rudder. “People think about these SBA loans as small and onerous, but in reality they can go up to $10 million.”

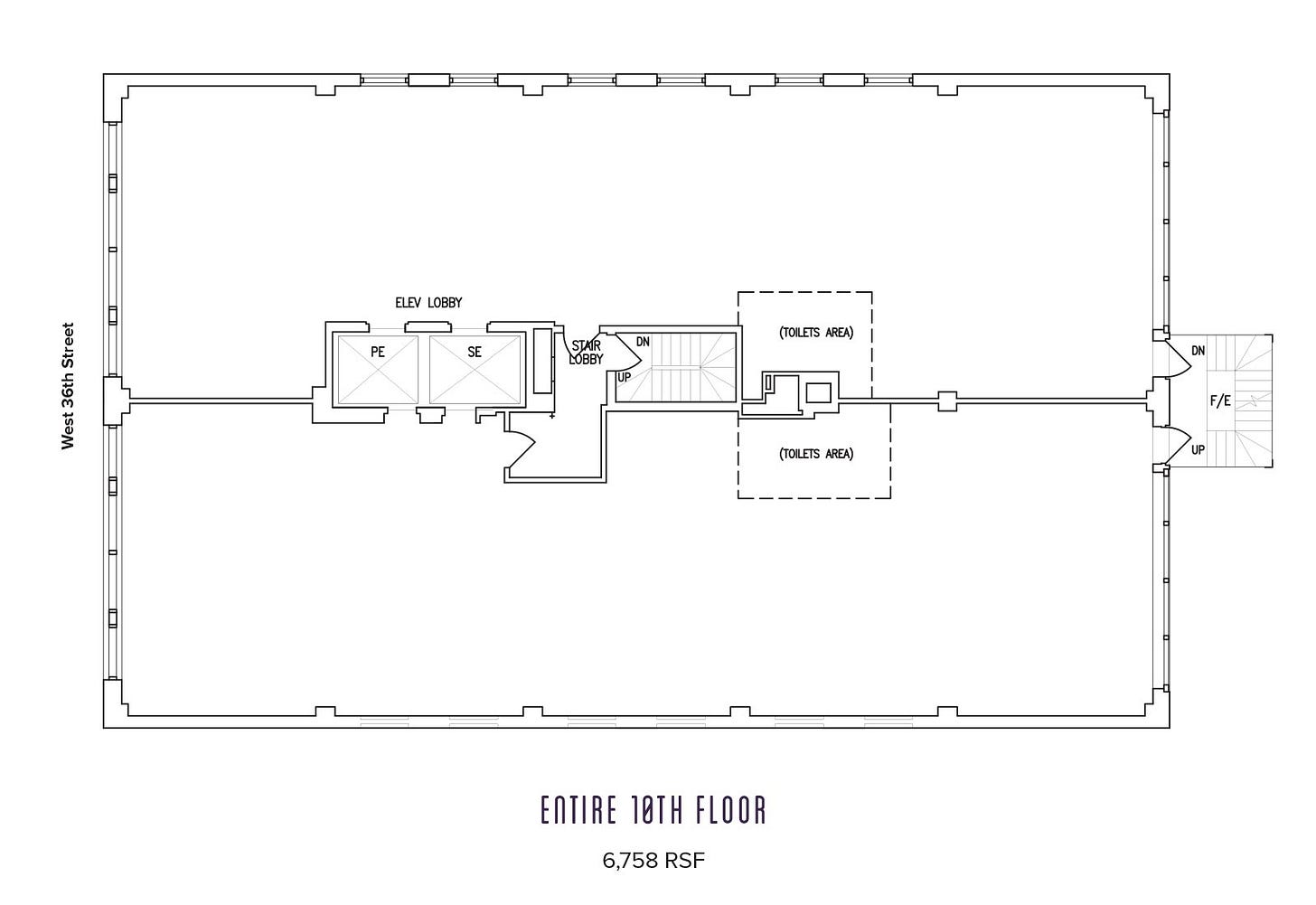

“As an example, we sold one office condo to a New York-based South Korean entrepreneur who has factories and offices in both South Korea and Vietnam” said Rudder. “He purchased a 15,000 sf office condo at 35 W 36th Street, where he plans to build a TV studio to record for QVC. He will also use the space for warehouse, distribution, and showroom—bringing the loft building back to its original intended use.”

“We also sold an 11,000 SF floor at 545 W 45th Street to CreoDent, a firm that makes the porcelain used in dental veneers. They aren’t dentists themselves; rather, they supply materials that dentists use to create these popular ‘fake teeth.’ CreoDent uses its space for manufacturing as well as for a training center to demonstrate how to use their product.”

An Office Condo Deal

Abie Hidary of Hidrock Properties knows the New York office condo market. He’s the owner and developer behind one of the city’s most recent office condo conversions at 35 W 36th Street.

Hidary initially filed the condo conversion plan in 2019 shortly before the pandemic hit. “We had initial interest at $900 per square foot,” he shared. “As the pandemic was playing out, we dropped prices and ended up near $650 per foot, which is still much more than our basis and more than we would’ve gotten had we sold the building outright to one buyer.” The building sold out in 2022 with the exception of one floor which remains under a long-term lease to an end-user tenant.

As a 12-story, 80,000 square foot building, there are a few factors that made 35 W 36th work particularly well for office condo conversion. One, it has relatively small floor plates—6,700 square feet each—which Hidrock further subdivided into two suites of approximately 3,300 square feet each. “There are a lot of buyers for spaces that small,” explained Hidary. “And the building has a center-core, with elevators and stairwells in the middle, so two units on each side each felt like a full floor presence. You press 3E or 3W on the elevator, and it opens into your space and feels like you have a full floor. You don’t have to worry about neighbors, hallways, and bathrooms.”

While 35 W 36th was a relative win for Hidrock, office condo conversions aren’t always such positive stories in today’s market. 32 W 39th Street—a mere 5 minute walk from Hidrock’s property on 36th—is currently slogging through office condo sales while under court-appointed receivership. Initially filed as an office condo conversion by Aron Rosenberg’s Rose & Berg Realty in 2022, rising rates and slow sales forced the asset into foreclosure where it remains to date. For W 39th Street, sales are coming in around $400 per square foot—exceptional for Maiden Lane in 2006 but not great for West 39th Street in 2025.

The White Knight?

Despite 35 W 36th’s success, Hidary doesn’t see office condos as a savior of the Class B/C office market writ large. “The supply and demand works in NYC. There’s a little bit of demand and a little bit of space. It matches up.”

Hidary also emphasized that 35 W 36th had certain traits that made it work well as an office condo—specifically, small floor plates and the ability to create smaller “suites” with a far larger pool of likely buyers. “You have to look at the demand, the type of users [for office condos],” he explained. “One of our buildings had 12,000 square foot floor plates. There are far fewer buyers at that size.” While Hidrock exited most of their New York office properties prior to the pandemic, 35 W 36th was their only condo conversion—the company’s other properties were sold to single buyers.

In the event of outright foreclosure, lenders are also likely to struggle with the office condo model. “Most [Lenders] don’t want to own and operate,” explains Hidary. “If they take title, they’ll want to sell very quickly. And it takes time to go through the condo process and to prepare the building physically and to go ahead and sell it. Most lenders won’t want to go through that.”

Despite those challenges, Rudder increasingly comes across lenders exploring the condo route. “Most of our calls used to be from owners, but now it’s lenders who have office buildings and want to see if there’s some valuable component of it that could be sold off,” said Rudder. “Maybe it’s the retail portion, maybe it’s the billboard signage, maybe it’s an occupied portion of the building that has income and good tenancy.”

“There are big blocks of vacant [office] space out there that might have no value, or maybe $100 or $150 per square foot. Outside of a few private investor groups from Great Neck, no one’s bidding on them. If you’re the owner, what are you going to do? Some are choosing to convert to condo and sell off the vacant portions to end users at what is historically a really cheap price—but it’s enough to allow the owner to pay down debt and live to see another day.”

Hidary does have some recommendations for office owners or investors considering a conversion. “You have to prepare the building and the space. You can’t just sell it as-is. The lobby has to look nice, the elevators have to work, and the other occupants have to be happy.”

Despite the challenges, Hidary does recommend the condo conversion route for certain owners. “If you have a similar building [to 35 W 36th], it’s a great strategy.”

There is no magic answer to the office space glut. As owners capitulate to the new reality—whether voluntarily or through foreclosure—a variety of new uses and strategies will emerge. Some buildings will be converted to apartments. Some will become home to schools and community spaces. Others will remain office space and simply rented out at a lower price. And some will get chopped up and sold off to end users as office condos—the Chittagong shipyards end to office buildings that no longer make sense in today’s rental market.

Meanwhile, Abie Hidary and his company have moved on to greener pastures and left the New York office market behind in favor of retail in the Sunbelt.

“Vacancy is at historic lows, rents are rising, and tenants are strong and expanding.”

This article was originally published in Thesis Driven and is republished here with permission.