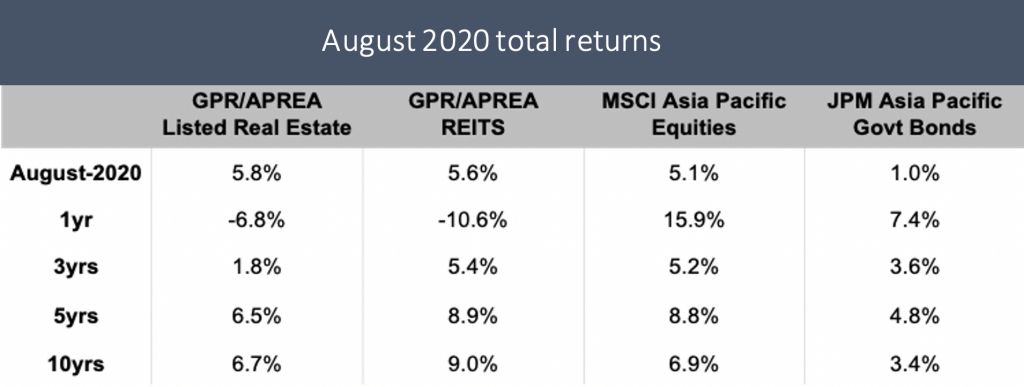

Asia Pacific’s real estate focused stocks outperformed in August, edging ahead of the wider market. This was led by the wider GPR/APREA Composite Listed Real Estate Index, which returned 5.8%, powered mainly by the Australian and Japanese markets. This more than offset the stall on China’s stocks, which remained largely flat after enjoying a strong rally up to July.

The property market has been a major driver in China’s economic recovery, with home sales and investment growing at a robust pace in recent months after coronavirus lockdowns were lifted. While home prices in the region’s largest economy, as tracked by the nation’s statistical body, eked out a 0.6% rise in August from a month earlier, sentiment was stalled by tightening measures aimed at promoting a sustainable market.

Chinese authorities took a step to rein in debt growth, issuing new guidelines on bond issuance, as a strong housing market recovery prompted caution. June’s home prices, which rose at their fastest pace in ten months, have already prompted fresh housing curbs.

Asia Pacific REITs recorded their fifth consecutive monthly gain with the GPR/APREA Composite REIT Index returning 5.6% in August, beating equities for just the second time this year. The gains were broad-based as nearly all markets across Asia Pacific turned in positive price performance. The region’s REIT stocks were led by the heavily weighted Australian market, which returned over 7.0%.

Industrial REITs, a clear outperformer so far this year, however, recorded a slight dip in August. REITs with industrial assets have mostly been resilient in the wake of the pandemic, as retail and hospitality REITs bore the brunt of the fallout from the pandemic fallout. Hotel, retail and office focused REITs, which had been the most vulnerable to social distancing measures, were some of the best-performing sectors in August.

Rotational dynamics were clearly in play as investors bought ahead into a broadening economic recovery in the region, in search of higher yield. This was echoed in Japan, where hospitality REITs led the rally, followed by retail and office.

In hopes of more to come, Japan’s first reciprocal green-lane arrangement for essential travel between Japan and Singapore shored up sentiment. Retail-focused REITs in Australia also outperformed as sentiment got a boost from the expected rebound in consumption. The latest retail trade figures released by the Australian Bureau of Statistics had showed retail turnover climbing 3.2% in July.

The worst may also be over for office REITs as restrictions ease across the region. Vacancy, while moving up, has not spiked as occupiers in the region have been conservative on space requirements, especially in high-cost cities. The adoption of telework is also expected to be lower. The office will remain the region’s default workplace, as culturally it is more accepted; connectivity is an additional concern in the emerging economies.

The securitisation of real estate in the region continues to gain ground. The Indian and Philippines stock markets debuted new REITs, with the latter welcoming its first in the country. This month, India’s latest listing, Mindspace Business Park REIT, which debuted strongly, was included in GPR/APREA’s real estate indices. Meanwhile, Singapore’s status as a listing venue for cross-border REITs received another boost as South Korea’s AIP Asset Management and Japan’s Tokyu Land announced plans for a REIT listing in Singapore as soon as this year. The offering, backed by Australian commercial properties, could raise about S$400m.

While some bumps are expected, gains registered by Asia Pacific REITs are expected to remain sustained, as policy support and monetary conditions remain conducive. Central banks in the region have continued to reiterate a lower-for-longer outlook. For the rest of the year, the region’s REIT space in the region is likely to be shaped by ongoing M&A activity as well as the creation of Chinese REITs. A continued economic recovery as well as an earlier-than-expected vaccine will remain strong sentiment drivers.