Capital markets in the region experienced another weak month in October, following a lacklustre September. Uncertainties from the US presidential election, protracted US fiscal stimulus talks and a resurgence in infection numbers in Europe contributed to the bearish sentiment.

Closer to home, Thailand’s stocks fell on mounting anti-government protests, which if protracted are likely to derail an economic recovery – its key equities benchmark tumbled to the lowest level in more than six months. The GPR/APREA total return gauges for the kingdom’s listed real estate and REITs contracted by double digits to clock the biggest fall among regional markets.

The GPR/APREA Listed Real Estate Composite Index posted negative returns in October, underperforming the region’s equities market, which were supported by stocks in the heavily-weighted tech sector, as well as bonds. China’s property stocks, a regional heavyweight, contracted as property firms continued to face mounting pressure to meet the government’s new debt-ratio caps. Stocks in Indonesia, however, bucked the regional trend to clock the largest gains on optimism that labour market reforms could bolster growth. Sentiment in the Philippines also revived in the wake of slowing infection cases.

REITs

Total returns for Asia-Pacific REITs similarly contracted in October. Taiwan and China-linked REITs were the only markets that stayed in positive territory. Sector indices were negative across the board with retail the hardest-hit, while industrial REITs contracted the least.

During the month, the CapitaLand Commercial Trust and CapitaLand Mall Trust merger was finalised to form a new entity – CapitaLand Integrated Commercial Trust.

REITs in Singapore have picked up the pace in acquisitions, spurred on by low interest rates and higher debt capacity under revised gearing limits allowed by the central bank to emerge strongly from the lockdown-induced slowdown in the first half of the year. Market reports indicate that S-REITs have announced S$7.3bn in acquisitions, compared with about S$1.4bn in the first half of the year. This could put acquisitions activity at pre-pandemic levels, as REITs remain focused on long-term potential, taking advantage of any pricing dislocations to seal attractive entry opportunities.

The region’s REIT markets continued to see an uptick in activity, with significant fundraising activities undertaken. ASX-listed Home Consortium Limited is seeking A$300m for the proposed IPO of its spin-off, Home Co Daily Needs REIT. Logistics giant ESR also announced plans to debut a Korean REIT in December, targeting a ₩375.3bn equity sale comprising a logistics portfolio in the country’s largest cities of Seoul and Busan.

Outlook

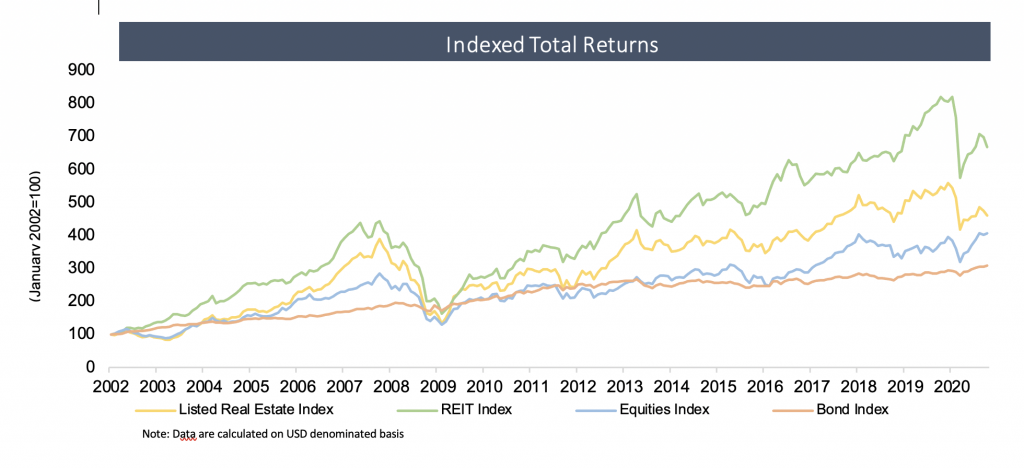

While both the GPR/APREA Listed Real Estate and REIT indices shrank for the second consecutive month in October, signs are pointing to an inflexion in the fourth quarter. Regional stock markets have reacted positively to a Biden victory while encouraging results from a number of vaccines under development boosted sentiment. The region’s property markets could yet finish the year on a strong footing.

October 2020 total returns

| GPR/APREA listed real estate | GPR/APREA REITS | MSCI Asia-Pacific equities | JPM Asia-Pacific govt bonds | |

| Oct 2020 | -3.1% | -4.2% | 1.0% | 1.1% |

| 1 yr | -16.0% | -18.4% | 8.0% | 6.4% |

| 3 yrs | -0.7% | 4.2% | 3.5% | 4.4% |

| 5 yrs | 4.2% | 6.3% | 7.9% | 4.4% |

| 10 yrs | 4.8% | 7.3% | 5.7% | 3.0% |