Regional property stocks reversed two consecutive months of falls in November as successful trials of vaccines in development raised hopes for an end to the pandemic. As a Joe Biden victory bred expectations of a more stable geopolitical environment, the world’s largest trade pact was also inked in November. Fifteen Asia-Pacific economies including those in the ASEAN bloc, Australia, China, Japan, South Korea and New Zealand committed to the Regional Comprehensive Economic Partnership, underscoring the significant role the accord could play in post-pandemic recovery efforts.

The proceedings underpinned a rotation towards recovery plays as investors took positions in riskier stocks, heightening exposure to cyclicals, retail and tourism-related sectors, all of which had borne the brunt of the pandemic as fundamentals dived. However, REITs continued to trail Asia Pacific equities, which gained 10.2% in November.

Listed real estate

The GPR/APREA Listed Real Estate Composite returned 11.4%, outperforming the region’s equities market. Property stocks across most of the region, particularly those in emerging south-east Asia, rose. Thailand shrugged off continued civil unrest to post the region’s largest returns; those in Australia gained on easing lockdowns in the state of Victoria. Hong Kong and China also rode higher on upbeat data signalling continued recovery in the world’s second-largest economy, with consumer spending picking up steadily and industrial output rising faster than expected in October. The country’s central bank had in November pumped more liquidity into the financial system to maintain momentum.

REITs

Asia-Pacific REITs, as tracked by the GPR/APREA Composite REIT Index, closed 9.7% higher. Similarly, the rebound was led by the sectors that had been hit the hardest by the pandemic. Retail REITs clocked the highest gains, followed by those in hospitality, as both sectors are likely to benefit the most from the rollout of a vaccine. Office REITs also rose on the back of a rotation to economically sensitive stocks. Industrial REITs were notably left out of the rally.

Across much of the region’s bourses, REIT stocks posted double-digit gains. Thailand’s component stocks led the way, with its retail and hospitality REITs rebounding on a surge of optimism as the kingdom reopened its borders to all tourists through a 60-day travel visa. Easing lockdowns also lifted retail REITs in Australia.

Meanwhile, listings are set to deepen the region’s youngest REIT market, as developers in the Philippines gear up to spin off their assets on the country’s bourse. DoubleDragon Properties Corp is planning a sale of shares of its REIT – DDMP REIT Inc. – after filing an application with the stock exchange commission to raise up to PHP14.7bn in what could be the country’s second REIT. On the regulatory front, Hong Kong will adopt proposals to allow more flexibility in investments, following the conclusion of a consultation exercise to enhance its REIT code. Governments in the region are looking at REITs as a key economic revitalisation tool.

Outlook

Sustained recovery beyond the industrial sector remains a prerequisite for a revival to pre-pandemic highs. While retail and hospitality will continue to retrace their pre-pandemic highs, the path is likely to remain uneven without clarity on a full return to normalcy. As euphoria over the progress of vaccine trials is gradually priced in, further direction will, in the interim, be focused on shorter-term dynamics as investors remain skittish over the near-term outlook. Still, we expect the wave of vaccine-related optimism to remain sustained into December. The broadening recovery into riskier assets so far is signalling investors’ belief that, if anything, the outlook is at least brighter. A stimulus deal in the US, currently stymied by political wrangling, and better-than-expected third-quarter GDP growth figures in the region, are sentiment drivers and could still shore up markets.

November 2020 total returns

| GPR/APREA listed real estate | GPR/APREA REITS | MSCI Asia-Pacific equities | JPM Asia-Pacific gov’t bonds | |

| Nov 2020 | 11.4% | 9.7% | 10.2% | 2.6% |

| 1 yr | -5.1% | -9.4% | 18.5% | 9.6% |

| 3 yrs | 2.5% | 5.9% | 6.4% | 4.8% |

| 5 yrs | 7.0% | 8.6% | 10.4% | 5.2% |

| 10 yrs | 6.2% | 8.5% | 6.8% | 3.5% |

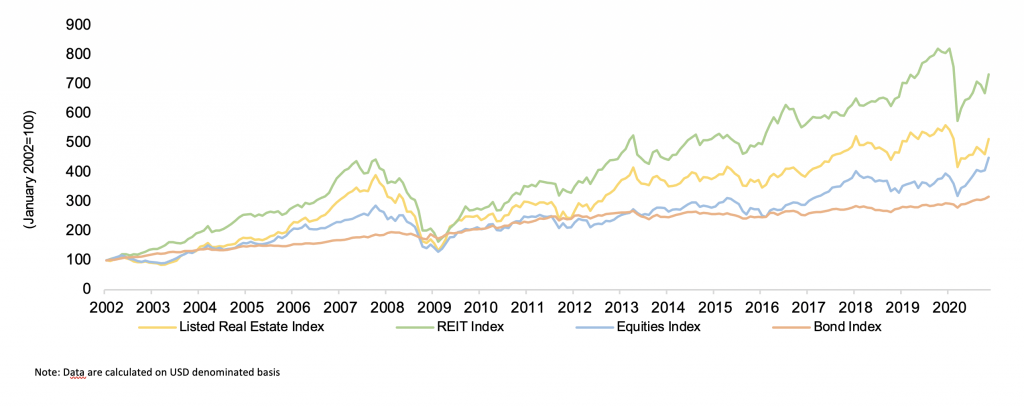

Indexed total returns