Signs of slowdown, and some scepticism that AI capex will generate enough returns anytime soon

- A change to the zeitgeist, and it’s definitely gloomy

- healthcare makes all the jobs, and construction too, but probably not for much longer

- even sell-siders are worrying “is AI capex head over skis?”

- rest-assured, though, capex as a share of revenue tells a different story

There is a palpable vibe-shift amongst the commentariat that is decidedly a bit bearish.

‘Unambiguous slowdown’

Others have noticed that the job market isn’t so hot, and they are beginning to wonder where growth might come from next.

Or rather, because they confused “catch up” with strength, and catch-up is now basically done, experts are starting to wonder whether some of the rosier forecasts for earnings growth are, well, a bit too rosy.

A 10% correction? Don’t mind if I do!

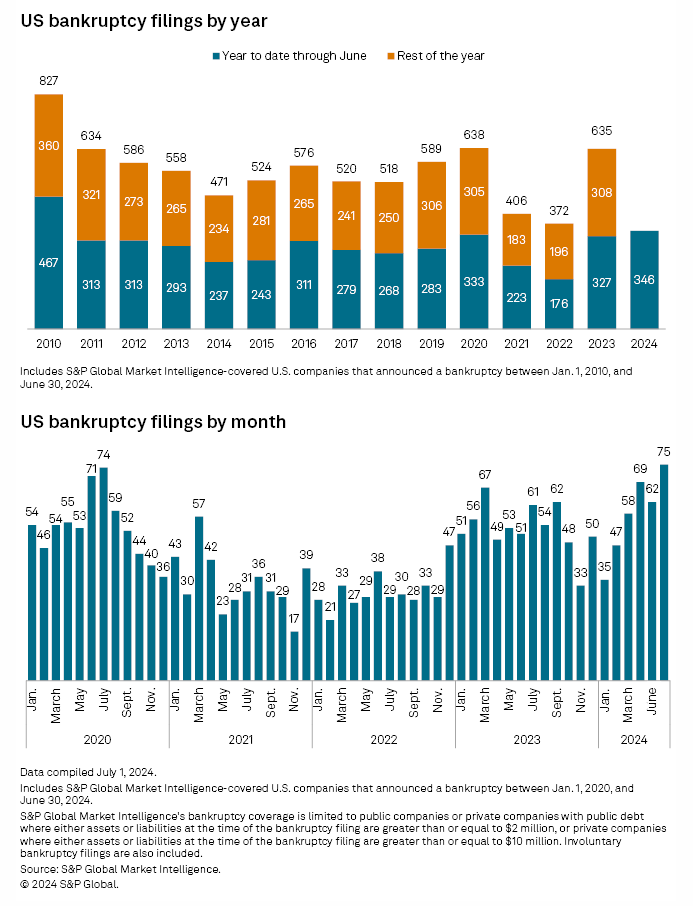

Agh, the bankruptcies are coming!

June had the highest number of bankruptcies in any single month since the very beginning of the pandemic.

Some commentators are even speculating about a “middling” or “stagnation” outcome, where things are not so bad that would justify expansion-mode from the Fed, but not so good that the good times will otherwise roll.

Others still are wondering if it’s apparently the case that healthcare makes all the jobs, then what else is going to make some jobs?

Construction employment has been pretty resilient, as well, but with residential and commercial construction starts falling into the abyss, does it mean that construction employment is likely to follow?

I mean, probably, but maybe data center construction will fill the void?

You already know what Random Walk thinks.

As of now, healthcare makes all the jobs, and extend and pretend cannot go on forever. If there’s something more exciting on the horizon, a great industrial overhaul perhaps, Random Walk is on high alert for signs of game.

AI Capex ‘head over skies’

Unfortunately, data centers, etc. haven’t escaped the sentiment-shift, either.

Some folks are even beginning to raise doubts about the intensity of AI capex.

Not just any folks, but generally bullish sell-siders like Goldman Sachs, and Barclays. What kind of blasphemy is this?!

This kind, apparently.

Barclays’ Ross Sandler says the numbers don’t add up:

“Will the frenzied spending on artificial intelligence drive major revenue boosts for internet companies — or are those big spenders getting ahead of their skis?

“That’s a key question for investors these days, according to Barclays analyst Ross Sandler, who noted Tuesday that the math doesn’t appear to add up. Wall Street expectations are for roughly $60 billion in incremental capital expenditures on AI but just $20 billion in incremental cloud revenue for 2026 . . . Based on our preliminary work here, the consensus estimate for hyperscaler AI capex in 2026 is enough to support the existing internet plus 12,000 new ChatGPT-scale AI products,” he wrote. But Wall Street is worried about whether there will actually be anywhere close to that many AI applications that can generate revenue, according to Sandler.

“From his standpoint, Sandler sees the potential for “lots of new services that will bring some of this bull case to light, but probably not 12,000 of them.” – Marketwatch

The math is the math and the math don’t lie.

Hyperscalers will not continue to plow billions into Nvidia if they are generating a fraction of that in incremental revenue.

Goldman also published a long report “too much spend, too little benefit?” that included some skepticism that AI is in any position to solve a $1T problem (any time soon), despite the $1T in capital investment.

To summarize the skeptics, AI is barely helpful outside of a few (diminishing) efficiency gains in coding, or customer service, and it isn’t anywhere close to creating labor obsolescence and/or efficiency that more optimistic forecasts assume. Even where it is helpful, the costs are high enough such that the juice ain’t worth the squeeze.3

“Models are 2x better!” That’s great, but what does it mean to be 2x better at customer service chatbotting?

AI is a probability machine—it looks like reasoning (because it sounds so human), but it is not, in fact, reasoning. AI doesn’t “know” anything (yet). People seem to understand that “inference” is the next frontier, presumably because a “firehose of statistically commonplace text” isn’t going to cut it, but inference isn’t here yet. For now, AI isn’t all that useful.

As (the most bearish) Jim Covello observed:

“Currently, AI has shown the most promise in making existing processes—like coding—more efficient, although estimates of even these efficiency improvements have declined, and the cost of utilizing the technology to solve tasks is much higher than existing methods. For example, we’ve found that AI can update historical data in our company models more quickly than doing so manually, but at six times the cost.“

That dog won’t hunt for long, and Covello points out that even if GPUs do get cheaper, we’re going to need far more of them to power the sorts of workflows that will actually be worth paying for.

And besides, there is no reason to assume that things just get cheaper and/or more efficient—either compute or the energy required to make it work—or that it will happen quickly enough to justify meaningful returns on all this spending, any time soon.

So say the bears.

Actually, that doesn’t seem so bad at all

Anyways, whether this is right or wrong, the point is the bears are out (again) all of a sudden.

Random Walk personally hasn’t seen anything new or different that would change my view of the world, but the most interesting tidbit I learned in all of this, is actually pretty reassuring.

Yup, Random Walk read the bear cases and came away more reassured than before.

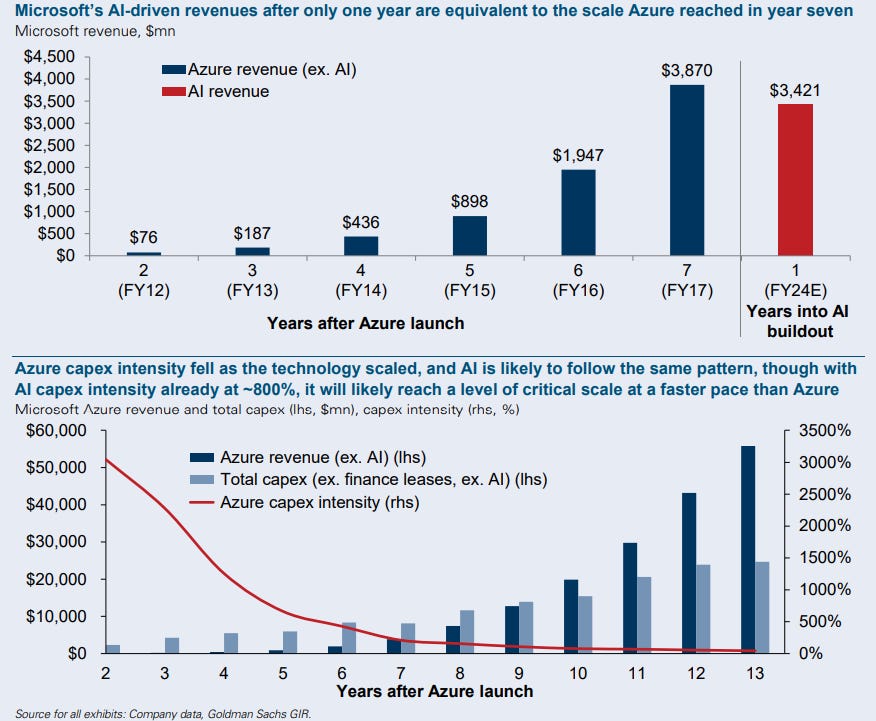

The Goldman bulls pointed out, that yes, Capex is high, but it was pretty high with cloud architecture too.

Microsoft has already generated about as much AI-revenue in year 1, as Azure did in year 7.

Was cloud more of a known-thing when Microsoft started investing in Azure? Yes, yes it was, but still, it was a lot of investment without anything to show for it, for a while.

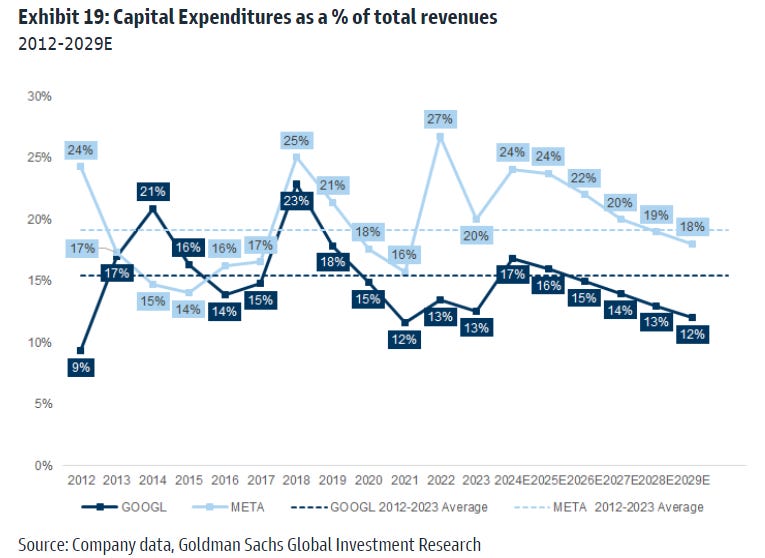

Even more happily, as a percent of overall revenue, hyperscaler capex just isn’t that remarkable:

For both Meta and Google, Capex as a share of revenue is within range of the 10 year average.

So, companies are definitely spending big on AI, but these are also very big companies, with a lot to spend. They also have considerably more track record at big tech Capex, then say some of the late 90s ‘upstarts,’ who had quite so much egg on their face, when the Dotcom Bubble burst.

Does that mean there won’t be egg-on-face?

No, it does not mean that, but (a) we already knew that was a genuine concern; and (b) now we have at least some reason to think it will be about as bad as blockchain or metaverse egg-on-face, which is hardly an extinction event.

The bigger issue, of course, is that AI is the Capital Cycle, Now.

Absent AI capex (and related ‘Picks and Shovels’ earnings growth) there isn’t a whole lot else going on.

There’s a lot of paper wealth—retirement wealth especially—that’s riding pretty much entirely on the sustainability of that earnings growth (i.e. some meaningful return on all that investment), which in turn, rides on the commercial success of ‘generative AI,’ past the current ‘testing phase.’

It’s getting a little nerve-wracking that we haven’t seen more use cases (forget the superapp, for the moment), but it’s still early.

This article was originally published in The Random Walk and is republished here with permission.