Two of our top contributors, Bill Blain and Ethan Yang, argue it out over bitcoin. Is it no more than imaginary money we’d be foolish to trust, or could it be a medium of growing substance that at the very least is telling us something important?

Beware the bitcoin BS

By Bill Blain

The current uncertainty on markets, politics, government pandemic spending programmes, and central bank QE very much suits proponents of bitcoin. Febrile markets mean bitcoin is on a roll – but it’s just another of its periodic flirtations with the financially credulous who have driven the price up 65% since September to $18,300.

After watching it for years, I confidently expect bitcoin will soar higher, attracting more and more cash from buyers who ‘understand it’ and then it will, predictably, crash again. In the meantime there will be a lot of noise and a lot of social media fake-news about how people got spectacularly rich. At the end the ‘greater fools’ will be left holding bitcoin watching the value plummet before discovering their digital wallet got hacked and is empty.

We have been here before.

Yesterday the FT asked some questions about the recurring crisis on crypto-exchanges and coin-wallets. Still, they concluded bitcoin is a maturing asset class. It quoted a billionaire hedge fund manager calling it an inflation hedge with great intellectual capital behind it. Bollchocks.

I understand what bitcoin is very well. It pretends to be more than money (money and exchangeability combined as one), but it isn’t. It’s not real like gold, it’s not guaranteed like real money. It’s something else… clever and possibly malign.

It’s not real like gold, it’s not guaranteed

like real money. It’s something else…

clever and possibly malign

Its only credential is the number of other people who believe in it. Its ability to be an instantly transferred store of value and unit of account relies on everyone who bought into it, or smells the opportunity around it, or continues to suspend any disbelief and accepts the intangible BC is a real thing. To everyone else… it makes limited sense to replace gold or money with something so intangible – they probably remember the story of the emperor’s new clothes.

And that’s the issue: there are those of us who see no real need for such a notional asset, and there are those who see great opportunities for personal enrichment by convincing people there is greater utility and wealth prospect from bitcoin than in fiat money or gold. So they talk up bitcoin and convince us gold is worth nothing (that 5,000 years of history has been overturned) and currencies are just an enormous scam governments are using to control us.

The supporters of bitcoin fall into three camps (which I will describe below). Everyone else is being pulled along for the ride. Forget whatever guff you read about how bitcoin will change the world, how it opens new windows on financial innovation, or how it is a safe store of value when governments are destroying trust in money – put it aside. Ignore such nonsense – these are all part of the insidious narrative upon which bitcoin sponsors further their cons and get-rich-quick schemes.

Approach everything you read or hear on bitcoin with great suspicion: all the proponents of BC have one common objective: to establish a wider veneer of credibility to attract in the next ‘greater fool’.

The first group are criminal. Bitcoin is the perfect untraceable token and transfer mechanism in the netherworld of the dark web and silk roads. Its anonymity makes it the preferred medium for any kind of cybercrime. You don’t have to believe in the concept or understand the complexities of distributed ledgers to accept it’s the preferred way for the underworld and shadow economy to transact. Untraceable, easy-to-launder, easy-to-transfer money – it’s the dream asset for the shadow economy.

The second group are the social theorists with a grudge. If you argue about bitcoin – as we did in our virtual office yesterday – very quickly the libertarians will emerge, pounding on about how bitcoin is immune to the vague and imagined dangers of government spending creating inflation, how it’s fighting communism and the dangers of socialist money creation. It’s the antidote to the inherent evil they perceive in government monopolies on money. Bitcoin has become a poster-child for the libertarian right’s war on ‘big’ government.

At the end of the day, bitcoin is money

to those that believe it is money.

Maybe they believe in fairies as well

And the third group are the public who’ve bought bitcoin. They crave reinforcement and praise for their financial acumen. They don’t particularly need to understand the tech or the social aspects of bitcoin. They just want to see it rise higher and higher – and you will meet them in all kinds of social situations bragging about how much they’ve made. Their ‘follow-the-leader’ success is compelling – yesterday a number of my colleagues were letting their sceptical barriers down, suggesting: “Well, maybe I will put just one percent of my assets into BC…” That’s dangerous – scepticism will turn to belief.

Money works because it is accepted. All three groups want to see bitcoin gain credibility which means wider acceptance.

Wider acceptance means greater demand. Which explains why a Citicorp analyst was on the wires this week predicting it will hit $318,000 in 2021. Greater adoption by users will inflate the value of the scarce asset. My simple maths says the demand for bitcoin would have to astronomically increase – being accepted as a credible medium of exchange by around 20 times more people than currently believe.

All the bitcoin hacks are on the wires saying the fact Paypal now accepts BC is a “tremendous” step in increased adoption, and will boost BC higher. Remember: aside from the dark web, everything you can buy with a bitcoin, you can already buy with a dollar.

I understand how distributed ledgers work, the opportunities and disruptions likely to arise across the financial markets from the perfected transfer of digital money, and the point of a digital currency for our digital age. I’m pretty sure we’ll be getting proper digital currencies from the traditional providers of monetary stock. There’s a great article on BBerg about it: It’s Better to be First on Digital Currencies: ECB Study Finds.

I’m pretty sure unregulated cryptocurrencies have a limited shelf life. Governments are unlikely to ever willingly surrender their monopolies on printing and digitising money. Someone will be the greatest fool when they are regulated out of existence.

I also understand the lustre of gold, and that makes far more sense to me than something that requires enormous amounts of power to run unfeasibly complex computer programmes to create an invisible unit of account I don’t believe in…

At the end of the day, bitcoin is money to those that believe it is money. Maybe they believe in fairies as well. Be very suspicious of the BC parasites and ticks trying to persuade you it’s better than fiat currency or gold. It’s not. At best it’s a niche for the seedier parts of the market…

Or think about it this way (my mate Ben H. came up with this analysis): Imagine a man offered to sell you a handful of invisible money for $100. You laugh. The next day he offers to sell you a handful of invisible money for $200. You say “really”. On the third day he offers to sell you a handful of invisible money for $300… and you buy because that’s the market price?

Get real.

This article by Bill Blain was originally published on his blog, The Morning Porridge.

What bitcoin is telling us

By Ethan Yang

At the time of writing, the cryptocurrency known as bitcoin has seen its value skyrocket to around $18,000 (11/19/2020 12 a.m. EST) after dropping down to around $4,840 in mid-March. This is significant because the all-time high for the cryptocurrency is $19,783 back in December 2017, only to drop down to as low as $3,122. Within the past year, the price of bitcoin has doubled, posting close to $10,000 in growth with over half that value occurring within the past month at the time of this writing.

With most of the news attention on covid-19, the presidential election, and so on, it is understandable that the meteoric rise of bitcoin may have slipped past casual observers as it did not receive the attention it received in 2017. However, what makes this rapid growth interesting is that there are a number of important circumstances that might be paving the way for bitcoin to sustain its ongoing trend.

Quantitative easing worldwide

It is undeniable that the monetary limits of fiat currency are being tested around the world as governments print trillions of dollars for stimulus packages in reaction to covid-19. The World Resources Institute writes: “In response to the massive economic contraction stemming from the coronavirus (covid-19) pandemic, some central banks – including those of the United States, European Union, Japan and other major economies – are engaging in ‘quantitative easing’ (QE) programs on an unprecedented scale.”

The United States alone has printed trillions of dollars and has far outspent what it has brought in with tax dollars, creating an unprecedented level of debt. Forbes writes: “For the first time US debt is now about equal to GDP (gross domestic product), like the sound barrier we once thought if we hit it we might explode.”

Bitcoin may serve as an alternative investment vehicle for those who are wary of an

unsustainable securities market

This level of spending and money creation has likely driven many investors to bitcoin, as it may serve as a safe haven as the value of fiat currencies like the US dollar comes into question. Furthermore, it is uncertain how the stock market, which has been the main beneficiary of quantitative easing, will react when such policies eventually subside.

Since the 2008 recession, money injections from the Federal Reserve have continued at a constant rate and the value of the S&P 500 has moved in step with spending. This creates a disconnect between financial markets and the actual productiveness of the economy. Bitcoin may serve as an alternative investment vehicle for those who are wary of an unsustainable securities market.

An article in MarketWatch explains that: “Worries that governments are printing heaps of money to paper over problems created partly by the 2008 financial crisis was at least part of the reason that bitcoins were created over a decade ago. That thinking is also the basis for this resurgence in bitcoin, crypto experts said, as the covid-19 pandemic forces governments and central banks to spend to limit the economic hit.”

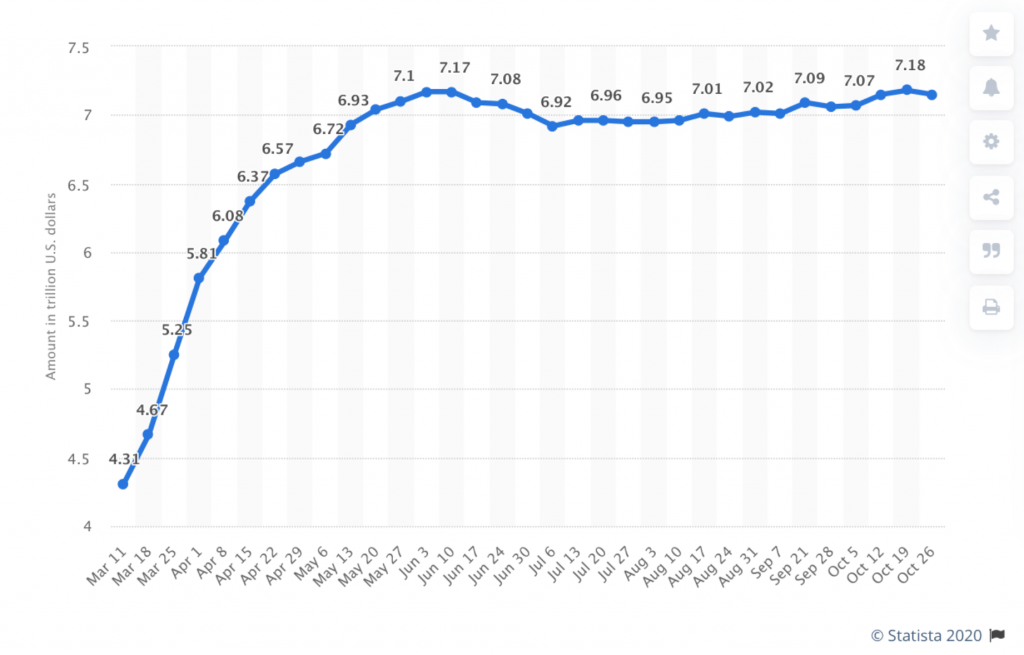

Such caution is not unfounded as the Federal Reserve’s balance sheet has ballooned to unprecedented levels in the past few months, going from $4.31trn to $7.18trn.

The monetary policies post-2008 kicked off interest in cryptocurrencies and it would not be irrational to assume that the current policies would be encouraging an accelerated timeline for the adoption of bitcoin.

Mainstream adoption of cryptocurrencies

Perhaps the most significant development that may be supporting a potential sustainable growth trend for bitcoin is the ongoing adoption of cryptocurrencies.

Market Insider reports that major companies like PayPal are making moves to incorporate cryptocurrencies into their services, when they write: “PayPal recently said that users on its platform will be able to purchase bitcoin, as well as other sister cryptos like ethereum, bitcoin cash and litecoin. PayPal’s decision last month was a further recognition of the legitimacy of digital currencies, crypto enthusiasts say. ‘Today bitcoin has gotten to a place where institutional investors, banks, and family offices are legitimately pondering involvement as a defence against currency devaluation,’ wrote Alex Mashinsky, CEO of Celsius Network, in emailed commentary. ‘This isn’t a gold rush anymore, it’s a good investment,’ he said. He predicts that bitcoin will hit $30,000 by the end of next year.”

Perhaps one of the main dangers of cryptocurrencies is the fact that at the moment they are difficult to use and are rarely accepted anywhere. A lack of mainstream adoption may have explained the rapid fall of bitcoin in 2017 as market hype diminished and investors understood that there was not much real value at the time. With the ongoing adoption of bitcoin by major firms like PayPal, the growing value of bitcoin may actually be justified.

Bitcoin is largely immune to manipulation,

which makes it ideal for those who live in countries with less reliable monetary regimes

PayPal isn’t the only company to move towards cryptocurrency. CNBC reports: “Payment company Square is buying a large block of bitcoin, an unusual use of corporate cash. Square said Thursday it bought 4,709 bitcoins, worth approximately $50m. This represents about 1% of Square’s total assets as of the end of the second quarter of 2020. ‘Square believes that cryptocurrency is an instrument of economic empowerment and provides a way for the world to participate in a global monetary system, which aligns with the company’s purpose,’ the company said in a release.”

Not only does Square’s investment in bitcoin demonstrate ongoing adoption by relevant financial tech firms, it also highlights one of the key benefits of bitcoin. This is that it provides a universal and discreet form of value that individuals all around the world can access. Bitcoin is not only easy to transfer, but it is largely immune to manipulation, which makes it ideal for those who live in countries with less reliable monetary regimes.

Even large established banks like JP Morgan are starting to experiment with cryptocurrencies as Yahoo Finance reports: “Indeed, at the DealBook Summit on Nov. 18, (Jamie) Dimon said, ‘The blockchain itself will be critical to letting people move money around the world cheaper. We will always support blockchain technology.’”

In May, JP Morgan went a step further when it began allowing customer transfers to and from Coinbase and Gemini, two US-based regulated crypto exchange sites. And Dimon on Wednesday acknowledged that some “very smart people” are investing in bitcoin these days.

This stands in contrast to his comments in 2017 on which CNBC reports: “In September 2017, about three months before bitcoin hit an all-time high of nearly $20,000 per unit and crashed shortly thereafter, Dimon dropped a bomb on the crypto world. He called bitcoin a ‘fraud’.”

Cryptocurrency and blockchain technologies seem to be demonstrating undeniable advantages that cannot be ignored for long. These technologies will likely continue to grow in use, which gives further support to the ongoing growth of bitcoin. Market Insider reports that one person in particular, billionaire Mike Novogratz, believes that bitcoin could be heading as high as $65,000.

Words of caution

With unprecedented levels of quantitative easing and debt, combined with gradual mainstream adoption, it should not be controversial to say that bitcoin might have some substance to back its meteoric revival. It is highly likely that in 2017 the world needed a couple more years to get acclimated to the idea of cryptocurrencies. It seems that for the most part they are here to stay and they will likely see further use.

With that said, that does not mean that bitcoin and cryptocurrencies, in general, are guaranteed or even likely to continue on their current growth path. Much like 2017, it is highly likely that market hype is a contributing factor to the growth of bitcoin and it remains to be seen how far investors are willing to take this bull run. It is uncertain how much, if at all, the price of bitcoin may drop or where its next peak will be. It could be at $20,000 or it could be at $65,000, or it could just keep going.

Market Insider cites billionaire investor Ray Dalio when he notes that cryptocurrencies are still far from attaining widespread adoption and that governments may pass regulations that cripple the value of bitcoin and other cryptocurrencies.

As with all investments, there are risks involved, especially when there is the potential for great reward as in the rapid rise of bitcoin. Regardless of what happens, the swift growth of bitcoin signals a number of important financial milestones as well as warning signs. Signals that not only lend some support to the cryptocurrency’s value but also provide important insight into our current state of financial affairs.

This article by Ethan Yang was originally published by the American Institute for Economic Research.