If asked to separate forecasting consistency from obstinacy, my reply is categorical. Consistency is sticking to an economic prediction based on fundamentals; an outlook one must persist with, until & unless something occurs to markedly alter matters. By stark contrast, obstinance is persisting with a forecast that was never properly rationalised, or, if it had been, found itself overtaken by events undermining the assertion as first presented.

With the above in mind, the onset of COVID meant that what was “confidently” anticipated in late ‘19 for the year ahead had to be entirely reassessed. Exiting lockdowns & entering ‘22, as we know, the invasion of Ukraine forced all forecasters into another wholesale detour. Revisions for all the monetary & real variables economists endowed with extensive education & experience, are supposed to best anticipate.

Here we are then with the backdrop of recent ‘unexpected’ shocks & indeed those which have struck time immemorial. And yet, we persist with the time-honoured annual pantomime inviting forecasting folly. The profession has a ritual this time of year of presenting economic predictions for the Neo Xrono, even though we know 1/1 has absolutely no magical transformative quality, certainly not in economics or finance. Therefore, the sensible forecasting strategy is simply to extrapolate into next, on the trajectory we end this year. This timeless temporal factor accepted; we have to allow for two very different shock factors.

One obvious economic displacer is “a left field” exogenous hit; Newton’s 1st Law if you will. We have, that is, to accept that in any particular 24hrs in ‘24 (& yes including 1/1) something shocking, bad or good, could happen. To be clear, whilst virologists & strategists could respectively ‘claim’ to have seen the dramatic consequences of COVID-19 & Ukraine ‘coming’, honest economists did not. In short, ‘24 could experience shocks not possibly foreseen by any other than a modern-day Prometheus.

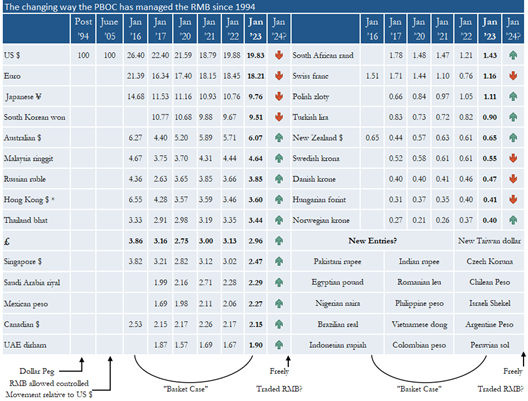

The above accepted, the NY could easily witness events that “good economic sense” should see coming. Of such looming shocks, already non-zero probabilities must only increase with each passing day; think Bayesian not Poisson, temporal process. With all such stochastic-ness in mind, let me close with this prediction. In six of the past eight years, China’s CFETS has altered the manner in which it manages the yuan (see Table attached). In ’16, it ended its long-standing exclusive peg to the US$; replacing this with a 12-strong basket. 5 times since, this basket has been reweighted & expanded (now 24 strong). Remarkably, to NO fanfare, all these changes have been announced in late Dec; going LIVE on 1/1. To my mind, another big NY basket change is upon us; one so dramatic in nature it could make all LONG $ strategies costly BASKET cases.