Do conventional bonds still deserve a place in portfolios?

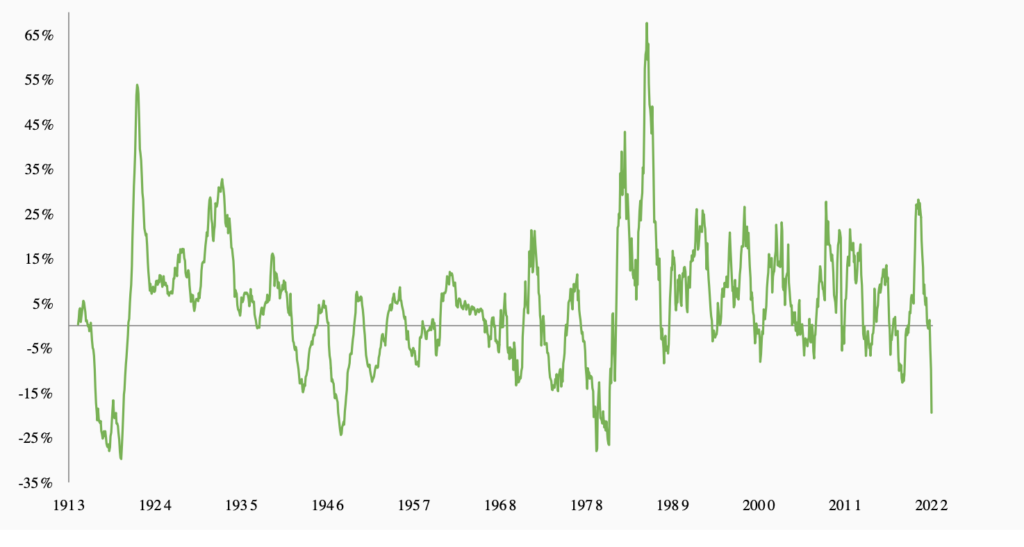

Total return on 10-year US Treasuries, adjusted for US CPI inflation %

What was the real return on the US 10-year bond over the past two years? Flat? Down a little?

Wrong – down a lot. The bedrock of the balanced portfolio has delivered a real return of -20% over the past two years (Bloomberg).

That’s the worst inflation-adjusted performance since 1981 (Bloomberg and Ruffer calculations).

Traditional balanced portfolios rely on equities and bonds fulfilling their roles – equities for good times, bonds to cushion the bad. But after a torrid three months for markets, investors are being forced to tear up the rulebook.

One rule is that bonds diversify and protect portfolios. This chart shows the historical real returns generated by a 10-year US government bond. For their owners, these investments have delivered return-free risk, as opposed to the preferable vice versa they thought they were buying.

Unsurprisingly, investors are beginning to shun their bond allocation in favour of ‘alternatives’. Often in the form of private equity, property and infrastructure. The question now is are these the right replacements for increasingly fragile bond allocations?

In recent years such assets have delivered consistent, inflation protected cashflows. But that was when inflation was low and predictable. Will they really continue to deliver when inflation is high and threatening a cost-of-living crisis? Will governments allow infrastructure and similar projects to raise prices by up to 10% or more?

Such ‘alternative’ assets are also often at risk from deteriorating economic conditions (more like equities than bonds). Meanwhile the widespread, and perhaps excessive, use of borrowing to boost returns leaves them vulnerable to rising interest rates.

Similarly, equities – even after a considerable setback – remain at historically high valuations and could struggle in the face of rising discount rates, even if profits remain buoyant. As the past decade has shown, stocks like low and stable inflation and with US CPI closing in on 8% (US Bureau of Labor Statistics) the reality is anything but.

We believe we are at the beginning of a new investment regime. One quite different to, and more challenging than, the last.

What are we doing in the portfolio?

We look to inflation-linked bonds as a key defence in a world of deepening negative real yields – where inflation consistently exceeds interest rates – using options to offset their duration risk. Other powerful derivative strategies, dynamically managed, can provide convex payoffs in market falls. Exposure to gold and other commodities could also be part of a diversified solution. Meanwhile we all need to rediscover the art of stock-picking, balancing bravery and caution to own equities which can capture opportunities in an increasingly volatile environment. The result is a portfolio that works differently and can act as an alternative to alternatives.

Most of all though, and in light of recent events, it’s necessary to be humble in the face of uncertainty. Building a portfolio first to survive, and second to thrive.

Originally published by Ruffer and reprinted here with permission.