Following on from ‘

28 Days Later‘, this report looks back at the 2017 Bordeaux

en primeur campaign, which came to a close at the end of June. For reasons which will become apparent as you read, this article of recommendations is somewhat shorter than I imagined it would be…

If you want the really short version, then the message can be summarised in a single line: 2017 is a vintage for consumers happy to wait a few years for a bit of bargain hunting, and not one for investments or en primeur purchases. And if a second one-liner is permitted: Buy the blancs – 2017 is a stunning vintage for white Bordeaux.

The Own Goal

Sadly, this latest en primeur campaign will be remembered as a disappointment; not because of the wines, but because of the prices. The 2017 wines are generally good, and in a relatively classic Bordeaux style (I.e. with refreshing acidity, not too alcoholic and with aromas of fresh fruit rather than baked). The en primeur release prices, on the other hand, are not good; widely seen as a continuation of the unjustifiably high prices for which top-end Bordeaux is earned a bad reputation.

The campaign started with a zip of energy, created by an early release and a sensible price, from Chateau Palmer. But that initial energy was not sustained beyond week one. As the chateaux released their prices over the next six weeks, each one thudded home disappointedly, like one more nail in the en primeur coffin. A handful of chateaux showed courage, and were praised for it, dropping their 2017 price by a significant percentage compared with 2016 (generally considered a finer vintage, and therefore worthy of the higher prices). But the majority reduced by just ten percent – certainly not enough to put prices at level where buying en primeur offers any sure benefit. Hopes of top-end Bordeaux showing a return to sensible pricing are now very low indeed (maybe even six feet under). Despite that, next April, the UK wine trade will take a deep collective breath, and gather hope once again. It is not dissimilar to the hope held by English football fans as each World Cup comes around…maybe this time?!

In my previous article, I made a few recommendations for purchase. These were, of course, based on how the wines tasted, rather than what they cost (prices had not been announced yet), and in the blind hope that release prices would actually be sensible this year. Happily, most of the recommendations remain relevant even now.

Shining White

I sampled a wide range of white

Bordeaux blancs from 2017, and was impressed from the first to the last. The first had something of a responsibility to be impressive, being Chateau Margaux’s Pavillon Blanc, which costs £148 GBP per bottle at en primeur prices. Among the more accessible blancs from are chateaux

Olivier (c.£23),

Bouscaut (c.£25) and

Malartic-Lagraviere (c.£42).

Three Lions

One of my recommendations in the last article was to buy anything with ‘

Leoville’ in the name. This was aimed specifically at the trio of second growths in the village of Saint-Julien: Leoville Poyferre (c.£55), Leoville Barton (c.£55) and Leoville Las Cases (c.£150). These three estates were once one, named simply ‘Leoville’. The (stone) lion referred to in the name now sits proudly astride the gates, and on the label, of Leoville Las Cases. These three wines are worth a look in 2017; all three wines are of very high quality, and all three saw a respectable price reduction of 18%.

The Leoville Lion

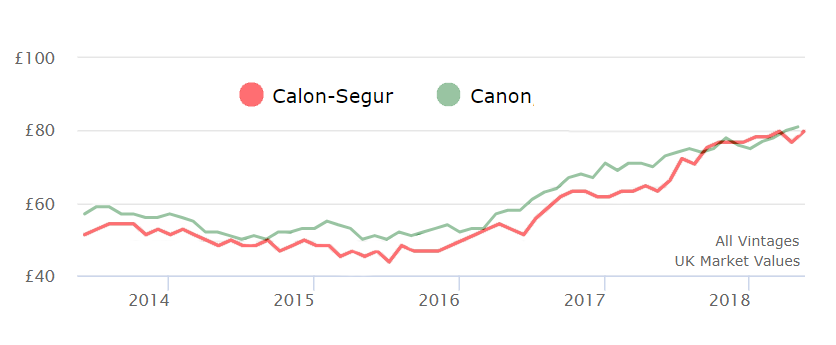

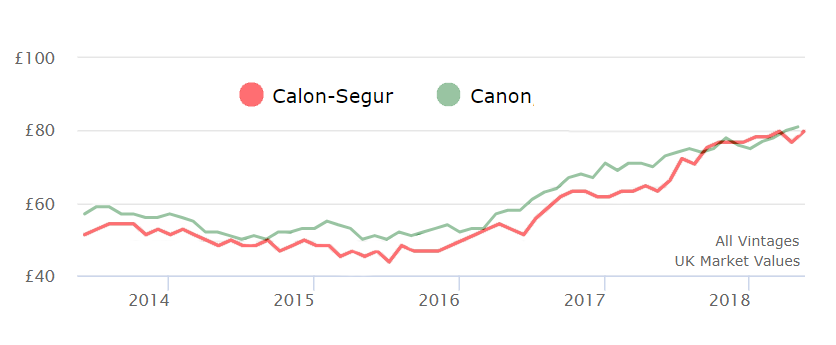

Calon and Canon

If you can actually get hold of en primeur stock of Chateau Calon-Segur or Chateau Canon, then do so. These two wines have been consistently rising up the ranks of quality and price in recent years, and show now sign of stopping this year. En primeur stocks of both were hoovered up within minutes of release, but it seems that some merchants still have stock to offer. Check Wine-Searcher.com for

Canon 2017 (c.£69) and

Calon-Segur 2017 (c.£64).

Calon-Segur & Canon: Rising Stars

Wild Card Soutard

An unexpected addition to the list, but one which clearly deserves to be here, is

Chateau Soutard (c.£37). For a younger-drinking wine at relatively accessible price, this is a good buy. In 2017, frost-damaged Cabernet vines forced the Soutard winemaking team to boost the wine’s Merlot component to a juicy 90%. The result wine is excellent; and on a par with many Saint-Emilion wines which cost several times as much.

As per the introductory line, this article is shorter than I had hoped, due to the lack of value-based recommendations I can offer. So if you think it’s all over….it is now.

Jonathan Reeve is our guest contributor from Wine Owners (www.wineowners.com), the fine wine collection management and investment platform based here in London. Jonathan came to Wine Owners in January, after eight years at the world's largest wine website and search engine, Wine-Searcher.com, where he wrote a 5000-page wine encyclopedia and went on to manage the company's market data channel. His academic background is in Linguistics (BA, Durham) and the Scrabble-worthy "Lexicography & Lexical Computing" (MSc, Information Technology Research Institute). When not poring over wine investment charts, or writing wine-related content, Jonathan can be found working on the website at WineOwners.com.