Why timber buildings may be key in limiting climate change.

Originally published September 2021.

The latest Intergovernmental Panel on Climate Change (IPCC) Report makes for grim reading. It finds that climate change is here, it is accelerating and left unchecked the implications for humanity will be serious. In the fight to curtail the worst impacts of rising temperatures, real estate has a critical role to play given its significant contribution towards greenhouse gas emissions.

The operation of buildings is important, but it is real estate construction and demolition which is most damaging from an environmental perspective. Indeed, if concrete were a country it would account for 8% of annual global emissions, making it the world’s third largest carbon emitter after China and the USA according to Chatham House think tank.

With population growth, demographic change, building redundancy and urbanisation driving demand for new sustainable and efficient buildings, it is unrealistic to stop new construction entirely. A more pragmatic approach is needed which enables construction and reduces the impact of end-of-life demolition in a way which also helps the planet. One potential solution which could achieve this is the use of timber buildings.

Carbon negative potential

On the face of it, cutting down trees to help alleviate climate change may seem counter-intuitive, but the logic is sound. Trees absorb carbon as they grow and this is permanently captured when timber is used to construct new buildings. Sourcing trees from sustainably managed woodland means that new fast-growing trees are cultivated to replace those chopped down, thereby reducing carbon from the atmosphere even further. Not only does this negate the need to use polluting concrete, but it also sucks out additional carbon from the atmosphere; done correctly it is carbon negative.

Timber buildings are nothing new. The Horyuji Temple, a timber building in Japan, has been standing strong through earthquakes, fires and typhoons for over 1,400 years. Durability is no issue. Despite timber’s long tenure in construction, techniques are evolving rapidly with innovations such as glue and cross-laminated timber allowing taller and more versatile designs. Long building life cycles push out the need for demolition and when that time comes, timber can more readily be reused or disposed of in environmentally sympathetic ways.

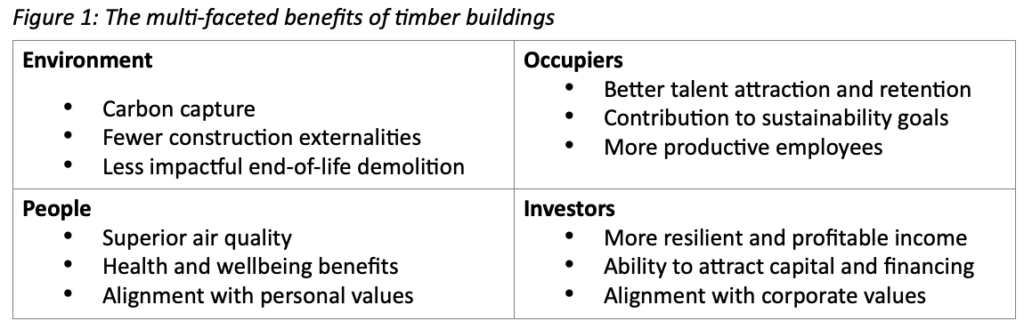

Given that wooden buildings are much lighter than their concrete or steel counterparts, their foundations need not be as deep. This brings further construction benefits due to lesser noise pollution, dust, fewer lorry journeys and an overall faster timetable due to prefabricated construction techniques. As a result, timber buildings address both environmental and financial concerns at the same time as achieving a quicker and cheaper build.

Wide-ranging benefits

Timber buildings deliver significant additional benefits over and above their role in mitigating climate change. Wood is more aesthetically pleasing than concrete. Timber buildings emit fewer volatile organic compounds (VOCs) – chemical toxins – which deliver better internal air quality, a metric that occupiers are increasingly using to select property. It supports a range of health and wellbeing benefits for human users, according to Dasos Capital. This helps occupiers of timber buildings attract and retain talent and enhances worker productivity.

Rising numbers of public and private entities are committing to net-zero goals. Based on a recent survey of 400 global corporate occupiers by Knight Frank, 82% believe that sustainability considerations will be a key influence on their portfolio strategy over the next three years. It is likely that occupier demand will gravitate strongly towards timber buildings in the short to medium term.

Significant performance driver

Timber buildings can therefore help occupiers secure and utilise talent on top of their environmental benefits. Because of this, they are likely to have higher occupancy rates compared to conventional property and secure rental premiums through competitive occupier demand. This implies more robust and profitable income streams for investors.

Given the sustainability agenda is increasingly being pursued by investors too, timber buildings have better prospects of attracting capital investment and preferential financing rates which will support valuations. Thus, there is no trade-off between sustainable real estate and high-performing real estate. In this case they are one and the same. All stakeholders win – the planet, the investor, the occupier and their staff.

The time is now

Modern timber buildings are at a nascent stage representing a tiny proportion of the market, as are the dedicated investment vehicles seeking to support them. The alignment of interests in the triple bottom line – people, planet, profile – means that timber buildings will constitute a far larger proportion of the market in the years to come. This is especially true as timber construction techniques evolve to increase design possibilities and lower costs even further.

Forward-looking investors who act now are likely to harness the greatest benefits. First movers can secure quality stock at scale ahead of the wider market, maximising returns and also the environmental benefits. Considering the IPCC’s latest findings, and mitigating the worst impacts of climate change, there is no time to spare.