There is barely a facet of life that has been unaffected by the coronavirus pandemic. One of its most visible impacts has been on the use of real estate – shops and pubs have shut, offices stand empty and housing market activity has slowed to a trickle. Whilst a short-term hit to real estate performance is inevitable, the long-term story is more nuanced. Performance will depend on how well aligned an asset, a location and a portfolio is to the structural changes that the pandemic will generate or hasten. To preserve and enhance value, investors must identify the themes which are changing real estate demand and allocate accordingly.

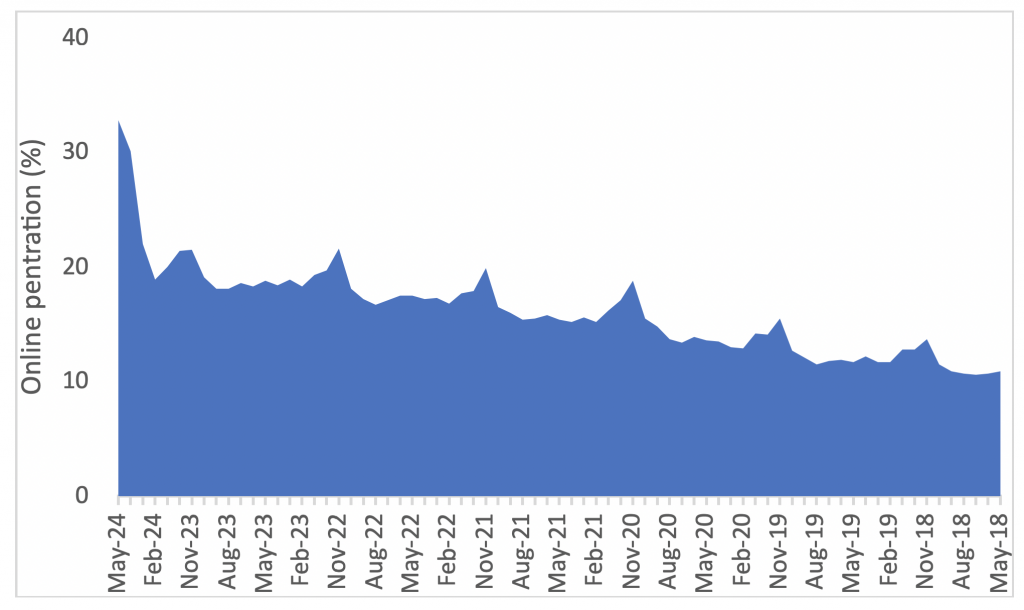

Let’s take retail to illustrate the dramatic impact of fast-moving structural change on real estate. The pandemic has prompted an explosive consumer shift from physical to online shopping (see Chart 1). This shift was underway before COVID-19 struck but it has been accelerated from perhaps five to ten years to a matter of months. Historically high online penetration rates may not hold when normality resumes, but they will settle permanently at much higher rates. This has major implications for retail and logistics real estate.

Chart 1: E-commerce explosion: UK online retail penetration rate

Source: Mayfair Capital / ONS (July 2020)

Given their inability to trade from physical stores, retail businesses have been under immense pressure. Some have failed. Others have reined in expansion plans or announced permanent store closures. TM Lewin, for example, was acquired a private equity firm and will now become an online only seller. Online retailers have benefited, with the likes of Ocado and Amazon registering booming sales. Multi-modal retailers who have an online platform on top of their physical stores have also fared better.

At a high level, this is bad news for holders of retail assets. Just 35.5% of retail rents were collected at the June quarter end according to Remit Consulting. Most retail tenancies are currently subject to rent concessions, holidays or renegotiations. Retail vacancy is rising and investors face sitting on an illiquid asset which is losing value. Intu is the highest profile landlord casualty, others may follow. It is good news for holders of quality logistics and warehousing stock. Occupier demand is strong, with Q2 logistics take-up reaching its highest level ever recorded according to CBRE. The share price performance of warehouse-focused REITs has been similarly strong. Given the direction of travel was visible before the pandemic, investors who had already gone under-weight retail and over-weight logistics will be sleeping easer.

The retail story is nuanced though. Many retailers on discount retail warehouse parks, for example, have continued to trade during the pandemic and occupiers have captured bumper trade as a result. Many supermarkets double-up as “click and collect” points or local dispatch hubs for home deliveries and have preserved their value much better than other retail segments. The pandemic has been a boon for local retailers. Some 59% of shoppers have visited their local high street more frequently during the lockdown according to Deliotte. Many will continue to support local businesses once the pandemic fades.

Investors who avoid the retail sector due to the overall adverse impact of the pandemic on it may thus be missing out on value. This could be especially true once the real estate market becomes active again as there could be many sellers, and few buyers, of retail assets. This may create mispricing. To be clear, I am not advocating that investors dive head-first into retail. Rather, I am suggesting that within the retail sector there are winners and losers, which means there is value to be had by investing based on future occupational demand.

The same nuanced, structural change-based story is playing out across and within every single real estate sector. Parts of every sector are at risk of rapid value loss. Other parts are positioned well to capture sustained, long-term occupational demand which will lead to rental value growth, secure income streams and value accretion. This makes a generic investment strategy approach weak and a forensic, targeted, thematically based strategy strong. Investors that adopt the latter should expect resilient long-term performance.