The correct use of language may not appear to be a priority in our straitened circumstances, but the misuse of technical terms has a capacity to spread confusion and misunderstanding. This, in turn, leads to poor decision-making and financial loss. One of the popular descriptions of the crisis that engulfed us in 2007-09 is the Great Recession, but it was nothing of the sort. Recession is the name we give to the negative phase of a trade or business cycle. This is to be distinguished from a depression, which is the technical description of the negative phase of a credit cycle. Depressions and recessions are as different as migraines and headaches. The challenge before us, once more, is to stave off a depression.

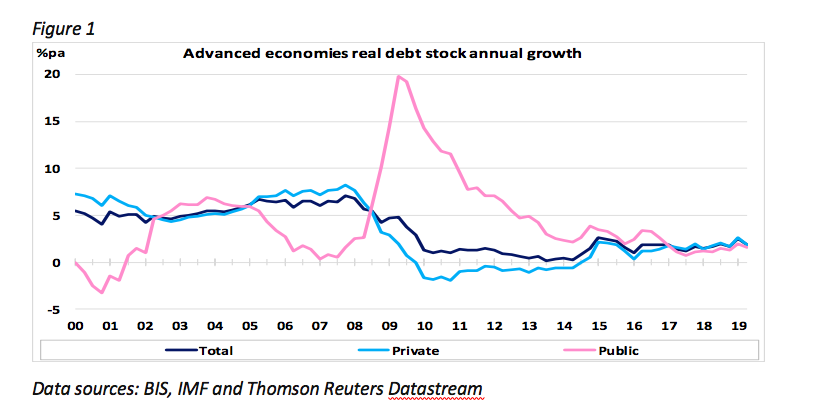

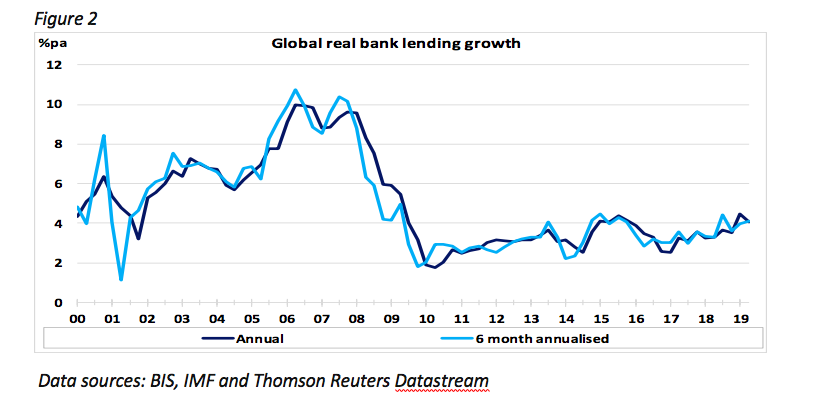

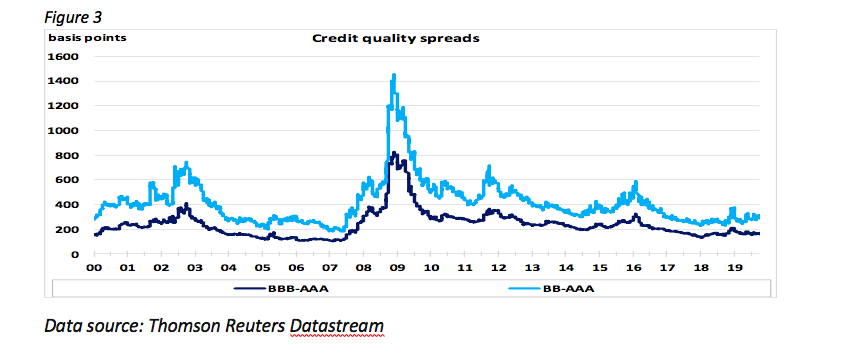

Make no mistake, from a global macro-financial perspective, the defining characteristics of 2007-09 were the collapse of credit growth (figures 1 and 2) and the explosion of credit spreads (figure 3). Only when the US Federal Reserve and other central banks expanded their own balance sheets and offered them as collateral to private sector banks, was the crisis contained. We face the same dual threat today, with the additional twist that the non-financial corporate sector has feasted on cheap loans and debt issues over the past 7 years and is now leveraged up the eyeballs.

At times like these, the Keynesians gravitate to their perpetual narrative of deficient demand and the need for government stimulus; monetarists, camped forever on the wrong side of the balance sheet, obsess about the growth of bank deposits. Yet, for at least the past 30 years, it is credit that makes the world go around. Politicians and central bankers are running in all directions to ‘do whatever it takes’, but if we fail to protect the credit system, we are heading into depression territory. After slashing interest rates, injecting liquidity and expanding its balance sheet, the US Federal Reserve finally turned its attention to the corporate bond market.

Alongside the provision of essentially open-ended QE, on 23 March the Fed announced the provision of finance to investment grade companies through two facilities, the Primary Market Corporate Credit Facility and the Secondary Market Corporate Credit Facility. The Fed will finance a special purpose vehicle to facilitate the PMCCF loans. Significantly, the SMCCF involves the outright purchase of investment grade corporate bonds by the Fed in the secondary market. Effectively, the central bank has taken upon itself a new role, that of lender of last resort to investment grade companies. By implication, firms that are sub-investment grade, or expected to join these ranks very shortly, will be cast into the outer darkness “where there will be weeping and gnashing of teeth”.

It remains to be seen whether this bold attempt to throw a force field of protection over the corporate sector will prevent the escalation of bond defaults. As investors seek to exit from BBB-rated debt of companies that are clearly impacted by the shutdown of economic activity, the Fed could find itself overwhelmed by the burden of selling. How much single-name debt would the Fed be willing to stomach? In a cruel twist, the rating agencies are downgrading companies in their droves, with Ford becoming the largest-ever fallen angel, taking US$96bn of debt into the unprotected abyss.

A failure of the credit system is also a failure of the payment system: a single defaulting borrower transmits pain to its network of counterparties, some of whom may fail also. Covid-19 can be considered as a cull of the zombie firms – and households – whose grasp on viability was already hanging by a slender thread of access to affordable credit. To shutter their businesses, even for a few weeks, leaves them vulnerable to a liquidity crisis that quickly mutates into a bankruptcy event.

It has been our view for quite some time that a global corporate credit crisis was imminent. We are about to discover how much debt has been infected and how much economic capacity will be lost as the infection spreads. It is a positive that the Fed has finally recognised that the credit system is under threat. They may be shocked to discover the scale of support that will be required to mitigate a destructive default cycle.