China’s reopening and the abandonment of stringent domestic Covid restrictions prompts thoughts on prospects for the property market in China: after the difficulties of 2022, spring is definitely in the air.

First let’s take a look at the global backdrop. MSCI data shows that global acquisitions of investment property plunged in the final quarter of 2022 when compared with the same period 12 months ago. The fourth quarter of the year, usually the busiest, was the slowest – deal volume dropped 64% to US$206.9b. The result of market stress is lower liquidity and the number of buyers and sellers active in the fourth quarter fell to the lowest level since the middle of the pandemic. So far, so gloomy.

Unsurprisingly, global headwinds have spared few markets with the result that dealmaking fell across the board and regionally Asia Pacific’s slowdown mirrored that of the Americas and EMEA. It is interesting to note that China was the region’s largest market for investment properties, despite various lockdowns attributed to its ‘Zero Covid’ policy. But even there, deal volumes fell by 50% YOY.

Shanghai was resilient in 2022 on the back of several large office deals including AIA Group’s purchase of SIIC Center for more than US$1b which made the city the biggest APAC office market edging out Tokyo.

A word on capital flows. Cross border acquisitions of commercial real estate declined by 29% in 2022, falling to US$230b from US$324b in 2021. Putting this into perspective, the 2022 level is on a par with the 2020 total and well below the 10-year average. This highlights how the uncertainty created by high inflation and rising interest rates has dampened international capital flows. The largest destinations for cross-border capital remain the major investable cities in Europe, US and the UK. Institutional investors, if minded to look at markets at all, will likely think ‘safety first’ which might mean that developing markets will take a back seat for a while.

So what next? Oxford Economics indicates that inflation likely has already peaked implying that interest rates do not have much further to rise, which would be a boon to the market. However, the period of exceptionally loose monetary policy since the Global Financial Crisis (GFC) is over and I worry that quantitative tightening will negatively impact asset markets. One saving grace might be the sheer amount of capital which has been raised by global fund managers post GFC and which affords many of them huge war chests of ‘dry powder’. Any sign of distress in property markets will attract huge interest even in these uncertain times – some large transactions in APAC in Q4 seemed to bear this out.

The yield gap is being closely watched: high inflation and rising interest rates mean that the generous gap between property and bond yields has dramatically shrunk. This impacts how property looks when set against other asset classes in a multi-asset portfolio. Expect adjustments by Chief Investment Officers as portfolios are re-balanced: this momentum will drive transactions and set real prices which is what the market needs to trade at long-term deal liquidity.

All of which brings me to property sectors: if investment returns cannot be driven by yield compression then what counts a lot for investors is resilience of income returns, and occupancy, at the property sector level. Which sectors look interesting? According to MSCI, investment in the three “beds” sectors (apartment, hotel and seniors housing & care) held up much better in APAC in 2022 than traditional commercial sectors. Which is all well and good but it must be remembered that those sectors are not large – they accounted for only 15% of total volume of income properties transactions in 2022. Commercial transactions dominated volumes in 2022 and some big deals were concluded in markets such as Japan where interest rates remain relatively low and solid investment opportunities attract strong interest almost irrespective of wider market conditions.

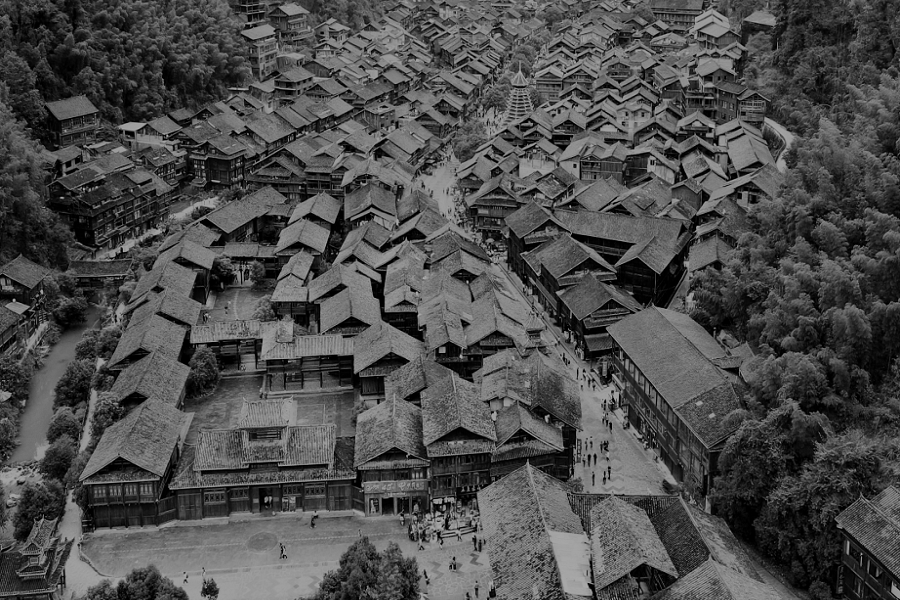

The sector picture for China is mixed. Retail property prices have fallen, perhaps unsurprisingly given the impact of the pandemic. However, the multifamily market has maintained a steady stream of deals and global investors continued to take aim at China’s logistics sector, making it the biggest industrial target for the year.

Cross-border investment in APAC fell by one-fifth in 2022, a large part of the decline attributable to China where offshore acquisitions has slowed to a trickle by the middle of the year. MSCI reports that by the third quarter, over one-half of China’s investment volume was driven by the corporate sector. The fourth quarter saw a turning point with the return of regional investors from Singapore and Hong Kong and the conclusion of significant deals in China securing this as the top trade route for the year.

On a city basis, Shanghai has maintained a third-place ranking in a regional Metro league table for all sectors, behind Seoul in second place and top-ranked Tokyo. On the basis of office deals only, Shanghai pipped Tokyo for first place, which is remarkable in the difficult circumstances of 2022. China’s other Tier 1 cities fared less well. Beijing remained one of the top ten Metros but volumes were down 57% and both Guangzhou and Shenzhen were down by a third.

Whatever one’s view of volumes in 2022, it hardly needs to be said that on a global basis US$1.1tr of income property transactions points to a lively and resilient market just ahead of activity levels seen in 2019 and 2108. Yes, 2022 is markedly down on 2021 but nothing like the reduced volume seen in 2020. So there is plenty of room to be positive albeit in a very different trading environment to that experienced pre-Covid. Let’s be optimistic: canny investors and fund managers will find plenty of global opportunity in 2023. China remains a key market to monitor for opportunities.