Originally published October 2022.

How it could elevate role of Vietnam and robotics in global supply chain

China’s population reached 1.45 billion in 2022 and is forecast to plateau around these levels early next decade, according to the UN projections. Thereafter, China will join the bulk of the developed world in population decline, which poses headwinds and tailwinds for global real asset demand.

Beneath China’s headline population trend is the working-age population decline. In nominal terms, this age cohort will peak around 843 million this year. However, as a percentage of the population, this age cohort peaked six years ago – from 59.5% in 2016 to 58.2% in 2022 – and UN forecasts this slump will continue below 50% in 2050.

In this article series, which examines the impact of global demographic trends on real asset demand, we explore the demographic trends in two of our most significant markets in the Asia Pacific region, China and Australia.

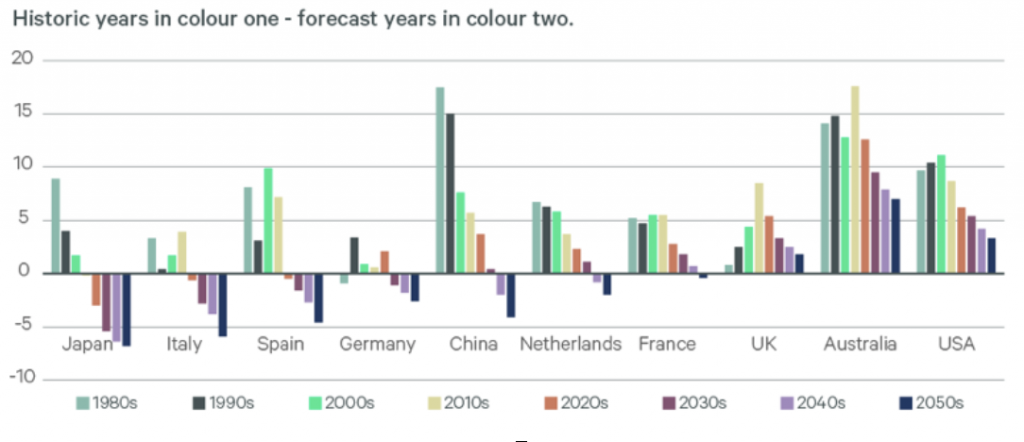

Population growth by decade, % per decade

China’s shrinking working-age population: causes and consequences

There are two major drivers of China’s shrinking working-age population. First, China’s one-child policy – from 1980 until 2015 – has pushed birth rates into a steady decline and below the replacement fertility rate. The policy’s rescission has failed to reverse the trend, due to rising incomes and expensive childcare. Consequently, a declining 0–19-year-old age cohort has fed into a smaller tertiary education cohort. However, China’s burgeoning middle-class and the prestige of overseas education has seen a steady rise in Chinese students studying abroad, supporting the student housing sector. But by the end of the current decade, the 20–24-year-old age cohort is forecast to decline by 21% – the sharpest decade fall in China’s history.

Second, longer life expectancies. The proportion of China’s population aged 65 has started to accelerate sharply over the past decade – from 7% in 2002; 8% in 2012; to 13% in 2022 and a projected 18% in 2032. By contrast, the over-80s age cohort has remained stable over the past two decades, with around 15% of retirees over 80. But that is forecast to rise to 20% over the next 15 years and to peak at 45%.

Demographics influence on China’s economic outlook and property demand

The pace and scale of China’s mass industrialisation and urbanisation since the 1970s is a phenomenal achievement unmatched in human history. This progress has elevated China from a low-income country to a middle-income country, but not yet a high-income country. In fact, China’s declining working-age population risks cementing structural constraints (eg, deteriorating productivity and returns on investment).

Some of these constraints are evident in CBRE IM’s five-year macro forecasts: decelerating GDP growth, compared to smaller Asia Pacific markets, such as Malaysia and Vietnam, where growth rates are still high. Chinese policymakers can mitigate these demographic impacts by reorienting the economy away from heavy industry and low-value jobs towards higher value-add manufacturing and service-sector jobs. Another option is to pivot the economy from labour toward advanced robotics.

While China’s demographic challenges are shared by the Western world, the nation’s role in the world economy as supplier of cheap manufacturing labour, and potential pivot for its economy, has global implications. For example, international manufacturers will have to identify alternative South East Asian labour sources, transition toward advanced robotics or some combination of the two.

Impact on real assets

The impact of China’s demographics on real asset demand includes a mix of headwinds and tailwinds related to capital flow, macro environment and real asset sector trends.

First, the provision, and financing, of senior living and nursing care. Chinese retail investors will need to save more for longer retirements, which will increase capital flow into overseas markets. Investment-grade real assets will be a beneficiary of this expected trend, exerting net downward pressure on yields.

Second, the working-age population decline will reduce availability and increase global labour supply cost, reversing the deflationary impulse trend out of China from the 1990s. In part, China can be replaced by other low-cost labour sources (eg, Vietnam, Malaysia, Thailand, etc), combined with a rapid increase in automation. This scenario would see China transition to neutral or even an inflation exporter, which would increase competition for index-linked real asset cashflows.

Third, real asset sector impacts. In student housing, the sharp decline in the student age cohort could reduce Chinese student demand for student housing from the late 2020s. In logistics, advanced robotics may help sustain Chinese production, supporting global logistics demand. In addition, global urbanisation trends may also support logistics demand, despite declining populations. However, if China loses production market share to other South East Asian countries, logistics demand to service international supply chains may create opportunities in emerging Asian markets, notably Vietnam.

Australia

Australia’s population is yet to peak. In the tertiary education cohort, a seven-year decline is expected to conclude in 2023, followed by strong population growth in the late 2020s, according to UN forecasts.

Australia’s economy will also grapple with the social impacts of an ageing population due to longer life expectancy. The working-age cohort, as a proportion of the population, peaked in the 2000s and 2010s at 53%. It has been declining since 2019 and forecast to fall below 50% in the early 2030s. Early retires represented 80% of the all retirees in the 1980s, this has now fallen to around 74%, and is forecast to continue to fall. That said, the proportion of retirees that are over 80 will remain lower than in most other major markets.

Arguably the most significant Australian demographic story is Melbourne, which is forecast to eclipse Sydney’s population in 2027, according to the Australian Government Centre for Population, despite the recent curbs on inward migration due to the pandemic.

Economy and impact on real assets

Australia demographics benefit from population growth, inward migration and strong urbanisation trends. However, the rapid growth is not without problems, particularly in limited affordable housing supply. Investors seeking a ‘young’ developed market with growing population centres that need servicing by real assets will find Sydney and Melbourne attractive, particularly a need for residential and student housing. Elsewhere, the opportunity in later living and nursing care provision is limited.

In the final article of our demographics’ series, we will explore the trends in the eurozone, the UK and the US.