To be clear, and to contradict the popular narrative in the West, China does not have a property crisis.

Rather, it has deliberately engineered a collapse of the property developer sector which, having achieved its key role of enabling large scale urbanisation, had over-extended itself into speculation.

The Chinese authorities gave fair warning back in the summer of 2021 that they were going to limit credit to the developers. But many people, including a lot of western investors who were heavily exposed to the equities and particularly the offshore debt, seemingly chose to ignore the message. Over the last three years, the authorities have effectively delivered a controlled demolition of the developers that left the property market intact but with western investors screaming about a crisis, as both bonds and equities fell to trade at less than 10 cents on the dollar.

The latest developments, including a relaxation of borrowing limits and encouragement of local governments to buy up excess inventory and convert it to social housing, are being presented by the (sadly increasingly sinophobic) western media as a combination of a “stimulus” and an attempt to avert a full blown collapse of the housing market, when in fact it is neither of these.

Instead, it is better thought of as stage three of the controlled demolition of the Chinese property developer bubble. Stage one was the withdrawal of credit, and the statement that houses are for living in, not speculation. Stage two was ensuring that the apartments that had been bought with downpayments were completed. Stage three is now to clear the excess inventory.

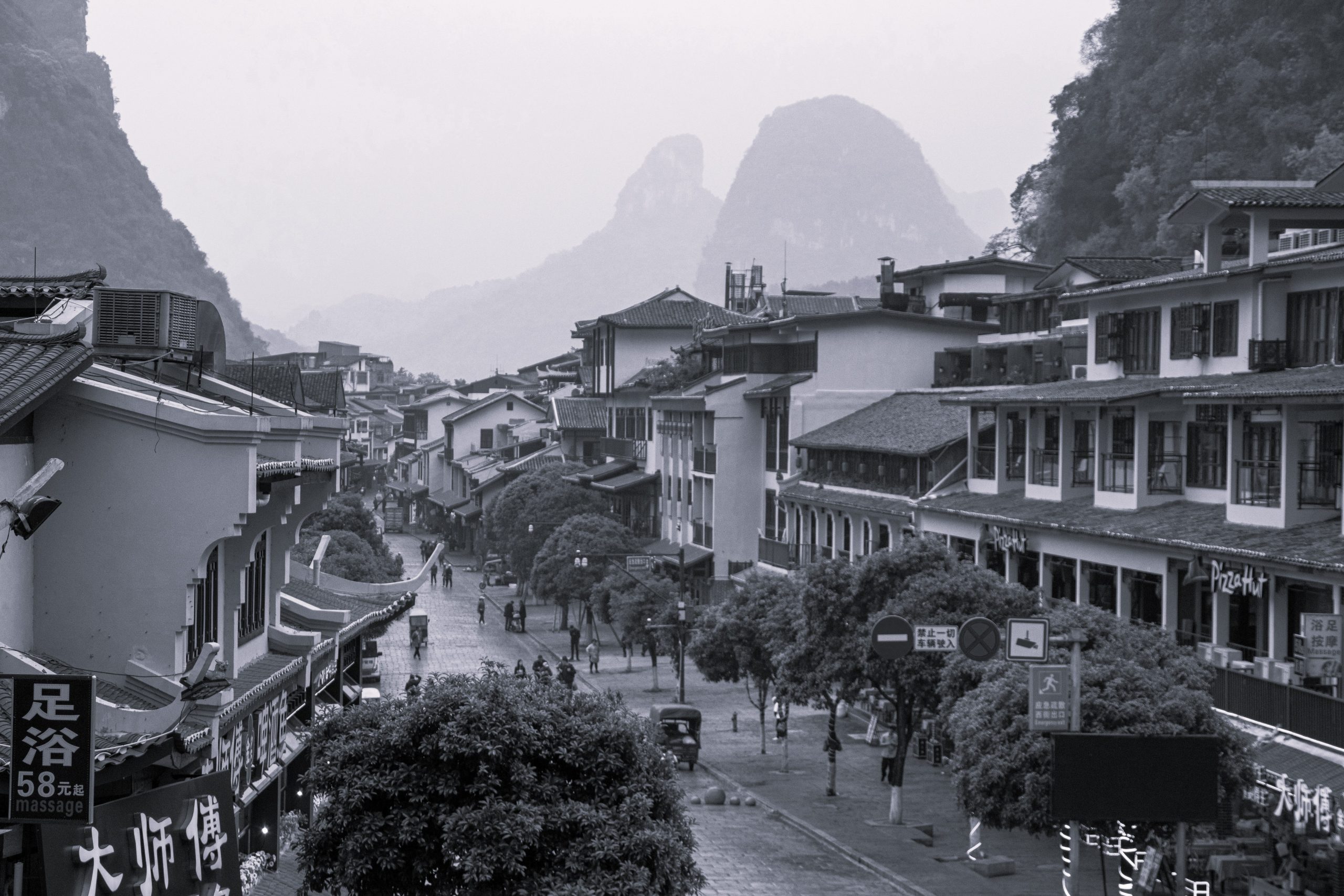

The starting point is to recognise that the property boom in China was part of a deliberate policy to facilitate the National New Type Urbanisation plan, which aimed to allow 100 million people to move to the cities by 2020. China has the highest home ownership rates in the world, at 96%, but in moving huge numbers of people from the countryside to the cities, China was obviously keenly aware of the issues faced in other developing countries of townships and favellas. Its solution was to control migration through the existing household registration – or Hukou – system and to allow local authorities to sell land to private property developers, who would then deliver the required housing in the right places

In this, the policy can be viewed as highly successful. With urbanisation moving from 52% in 2012 to 64% in 2022, that meant that in a country of 1.4 billion people, that’s been around 150 million people who need housing over a decade, on top of natural household formation of around four million a year. A huge task, but largely successful, as over the last decade, Chinese developers completed around 76 million new apartments.

At the same time, by allowing local government to sell land, China funded the necessary infrastructure development around that housing without recourse to central government. Another important point is that local governments are not like the local governments in the west; many are the size of a European Country and they also borrowed for development, which is where the misplaced “panic” about local government financing comes from. But the result is that the necessary roads, motorways and Central Business Districts got built too, along with 40,000km of high speed railway. So did 75 more airports, 5000 more schools and 15,000 more hospitals.

However, by August 2021 the development model – using customer deposits to fund working capital – had gone beyond funding even the next stage of development, it was using deposits to buy land for the development after that! As such it was in danger of crashing, so they decided to deliberately deflate the bubble rather than letting it burst.

Thus, and in contrast to most of the commentary in the west, the latest proposals are not to be seen as a stimulus package, nor are they designed to help the developers. Both of these are to put a western lens on the situation, where politicians bail out “too big to fail” companies and/or manipulate the housing market to stimulate consumption. Rather, the Chinese authorities are in the next stage of letting the air out of the bubble, which is to clear the excess inventory.

Source: Bank of England

Estimates of the size of the inventory vary, with some saying it may be around 5 billion square metres—thus the dramatic headlines. However, this seems implausible to us. With apartments now averaging 40 sq. m per head, this means average apartment size is 120-150 sq. m, which in turn implies inventory of approximately 30 million apartments, or the last four years’ worth of building. Other suggestions are lower, with the government themselves putting the inventory at around 750 sq. m, which is three to five million apartments. Still a huge number, but then everything in China is a huge number.

The important perspective is that, economically, this is not necessarily a bad thing, unless you work in construction, or own property development stocks. And even then, while the property developers employed 2.5 million people, this is out of a total of 62 million construction sector jobs, an even bigger number. Thus, while economics by anecdote can paint a bleak picture, in reality the developer sector is relatively small, at around 4% of total construction sector jobs.

Every economy sees waves of over-building and subsequent price clearance and China is no different. China’s government is providing funding to make sure this happens; not to prop up property developers, or to stimulate a pre-election boom, but to efficiently allocate resources. Individuals get to buy homes more cheaply and local governments get to buy unsold inventory and turn them into social housing at a large discount.

By contrast, in the west, we let investment banks borrow money for (almost) free and buy up the stock to make billions in profits. Unless you are a speculator in the bonds and equities of property developers it’s difficult to see why our way is “better”.