China is huge: 1.4 billion people live in a country covering 3.68 million sq mi, with over 850 million people living in cities. Half of this urban population resides in roughly 130 metropolises with more than a million inhabitants. Thirty metropolises alone have more inhabitants than Berlin. In fact, Shanghai itself has almost seven times more inhabitants than Berlin and Shanghai’s population has grown by three-and-a-half ‘Berlins’ since 2000. What is more, Shanghai’s development is rather a rule than an exception. The number of inhabitants in the 400 or so Chinese cities, for which data is available in the UN’s World Urbanization Prospects, has increased by thirteen-fold on average since 1970, with some remarkable outliers: the population in the city of Dongguan has risen by a factor of almost 60 during this period and in Shenzhen by a factor of 350. According to current forecasts, such as those by the United Nations, the development is expected to slow down, but not to end soon.

With this in mind, China raises an incredible number of serious questions and presents plenty of business opportunities for real estate professionals. Of course, entering China creates many challenges for European investors, but ignoring such a dynamic and such a big market might carry more risk for global real estate professionals than starting to learn about it. This has been the guiding principle, ever since I started to do research on China’s real estate markets 15 years ago, and also for co-editing the book Understanding China’s real estate markets, which was released earlier this year. It is true that China’s markets, and by implication its real estate markets, are subject to a large number of stringent rules, which also underlie frequent change.

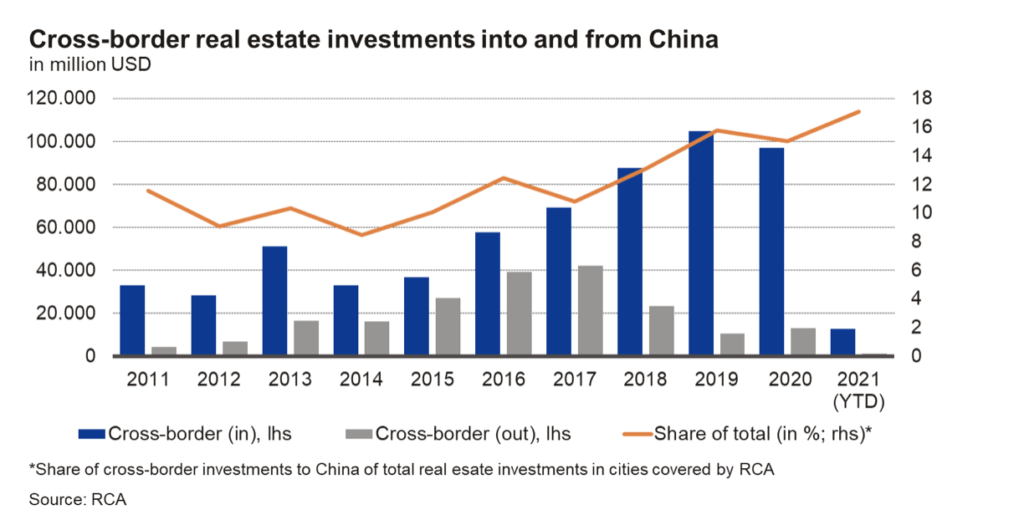

In fact, cross-border real estate transactions continue to play a major role in China, albeit more for institutional than private capital. Analysts from RCA have reported an increasing proportion of cross-border investments across all real estate transactions and this might even be underestimating the overall volume of cross-border transactions. It is precisely because the regulatory framework for real estate transactions in China is liable to rapid change that constant analyses are necessary.

It is worth keeping an eye on developments in Chinese real estate markets due to at least the following five reasons. First, the Chinese economy is too large and too tightly integrated into the international division of labour for sharp swings in any overvalued submarket to remain a solely Chinese problem. Also, the massive decline in real estate investment leaving China since 2017 may have brought some unpleasant surprises for one or two Western market players if it remains unanalysed. Second, US and European engineers, suppliers, architects, urban planners, construction process managers, investment consultants and financial service providers still stand to benefit from the dynamics of the Chinese real estate markets even if the cross-border investment business were about to shrink. Consequently, there are many indirect ways to profit from this trend. Third, there are capital market products that are linked directly (eg, as REITs) or indirectly (see, for example, the service providers mentioned above) to real estate market activity in China.

Fourth, real estate is people’s business. This truism also applies to China – perhaps even more than in Europe or the US. Personal relationships are not built overnight. Anyone looking to prepare for a time when the industry opens up again – even if planning is by no means certain – needs to start building relationships early. Fifth, when 1.4 billion people set out to build prosperity for themselves through economic activity, a great many ideas emerge which can add value compared to other markets. Our children use TikTok, we may already order goods from Alibaba and many retail stores allow you to pay with AliPay. As real estate professionals, we should be open-minded enough to see what we can learn from Chinese architects, urban planners, asset managers and investors. Some things can certainly be implemented in Europe and the US.

The fifth point above applies especially to academic research and education. In a recent article in the Journal of Property Investment and Finance, Graeme Newell called for Asian property markets to be given more attention in academic publications. While not referring exclusively to China, he also includes China. To illustrate this gap in research, I have been taking a closer look at publications in a selection of leading real estate journals (Real Estate Economics, The Journal of Real Estate Finance and Economics, Journal of Property Investment and Finance, Journal of Real Estate Research and the Pacific Rim Property Research Journal). Of the 507 papers published in these journals since 2018, less than 4% were related to China, even though almost 9% had at least one co-author from a Chinese university. Even if we add the articles on Hong Kong or conducted by researchers from Hong Kong, the proportion is significantly lower than China’s share of the world economy. For example, according to World Bank data, this proportion (including Hong Kong) amounts to almost 17% measured in US dollars.

Table 1: China in real estate research

| Authors from Chinese universities | Articles referencing China | |

| Total/proportion (excluding HK) | 44/8.7% | 20/3.9% |

| Total/proportion (including HK) | 54/10.7% | 23/4.5% |

Source: own calculation based on details provided in the journals.

Our edited volume on the Chinese real estate market seeks to make a small contribution not only to fill this gap in academic education and research, but to give new impetus to the five good reasons mentioned above for real estate professionals to get involved in the Chinese real estate markets. The authors within the book highlight macroeconomic and regional economic developments, characterise the key legal and fiscal frameworks, describe the improved data landscape, analyse the financing and investment markets, and outline developments for individual asset classes. These are certainly small steps on a long journey, but it might engage more professionals, analysts and academics to familiarise with the Chinese real estate markets. Each journey is more interesting and enjoyable when undertaken in company.

Further reading

Newell, G. (2021). ‘The need for more research on the Asian real estate markets’ in Journal of Property Investment and Finance 39 (1), p. 3-8.

Wang, B, Just T (2021). Understanding China’s real estate markets. Development, Finance, and Investment, Springer, Cham.

Tobias Just is co-editor of Understanding China’s Real Estate Markets: Development, Finance, and Investment (Springer, 2021, hardcover), which offers an overview of all relevant aspects of doing business in China’s real estate markets.