Is this the digital worlds last frontier?

“We are all now connected by the internet, like neurons in a giant brain” –Stephen Hawking

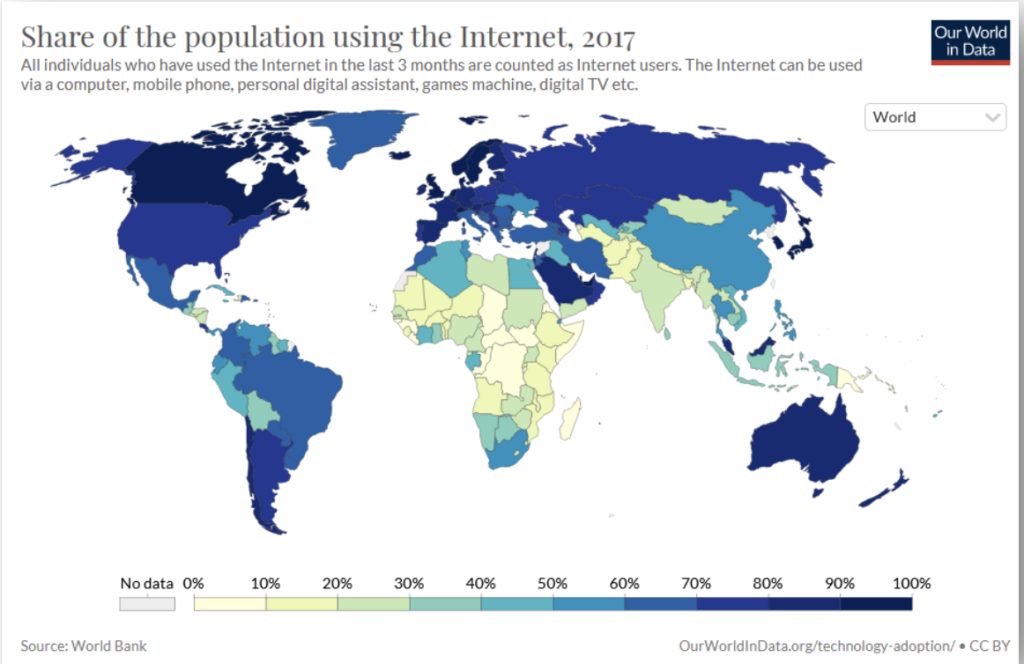

Looking at a map depicting global internet user penetration verifies this thought, but also leaves an important and impactful fact unmentioned: the significant gap between African countries, in particular sub-Saharan Africa, and the rest of the world.

On average, internet user penetration in sub-Saharan Africa stands at 24%, with some markets undercutting that average significantly, like Malawi, at only 17.8%.

The obstacles

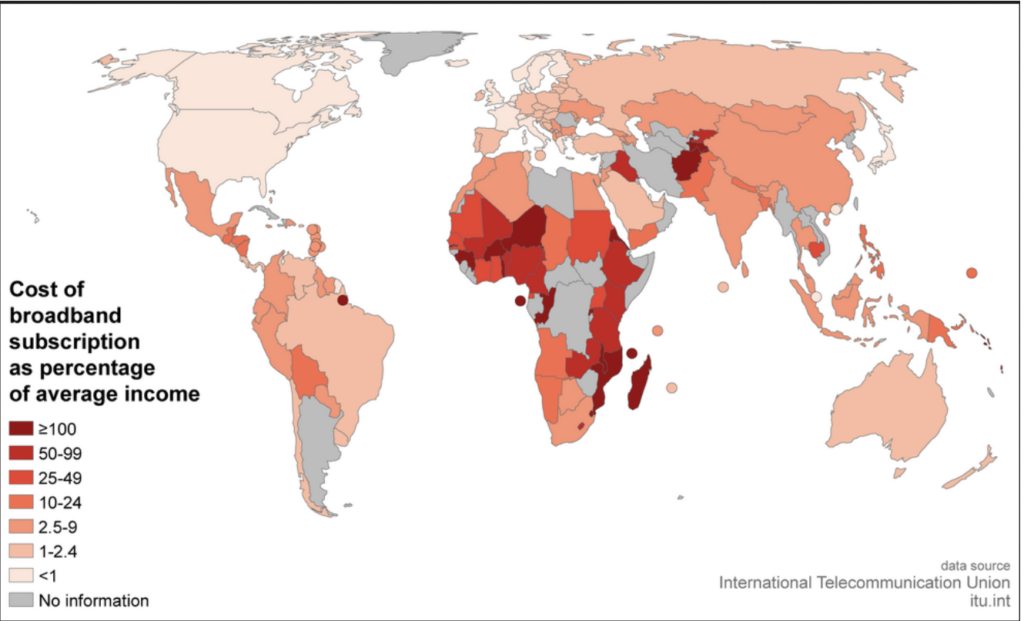

Major hurdles to overcome that issue include a lack of affordability driven by non-existing fixed lines network access, lack of mobile network coverage, monopolistic pricing structures and regulatory stumble stones like the unavailability of mobile network frequencies. Another, related issue is the intermittent nature of energy availability required, for instance, to power cell towers. This is being tackled by increasingly using stand-alone solar-powered installations.

The lack of broadband internet access affordability in sub-Saharan Africa is mainly driven by a combination of high internet access costs and low income levels as highlighted in the following graph.

The importance

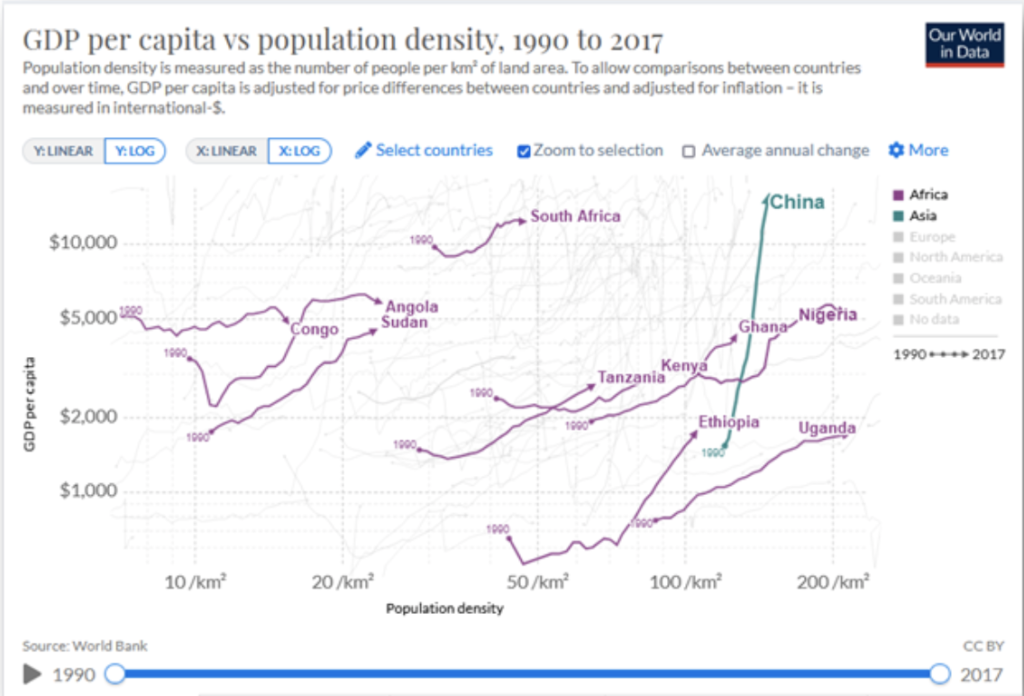

Sub-Saharan Africa is urbanising at break-neck speed. Whereas most of the regions’ countries today are majority rural, by 2050 most people will live in cities. As a result, the next 30 years will see significantly increased population densities in almost all sub-Saharan markets.

Increased proximity, enhanced connectivity, skill clustering and specialisation are some of urbanisations’ benefits which are closely related to productivity gains reflected by increased GDP per capita ratios. This is supported by the following correlation graph based on World Bank data.

Increased per capita GDP is one of the key drivers for mobile-phone subscriptions, which in turn is the major driver for increased internet user penetration. This impact is compounded by another major economic driver in sub-Saharan Africa: the demographic dividend, ie, the fact that the region’s median age will significantly diverge from the rest of the world, which is ageing rapidly.

The outlook

According to Ericsson’s June 2021 mobility report, between 2020 and 2026, sub-Saharan Africa will be the fastest-growing region globally in terms of LTE (4G) subscriptions (CAGR of 15%), bringing the region to 300m internet users. This obviously needs to be somewhat caveated due to the shift to 5G networks around the world. Over the same period, the region will see an explosion of mobile data traffic with CAGR of 38% (#2 globally).

The opportunity

Increased internet user penetration, use of cloud-based solutions and associated data volumes will require more localised infrastructure to ensure flawless data flows and speeds. Another driver for increased local data infrastructure is regulatory impacts driven by legislation aiming for more data sovereignty and personal data protection across the SSA region, similar to the EU’s GDPR rule book.

For investors, the obvious choice are data centres reflected in increased investment and fundraising activity. However, an even more interesting choice are incumbent mobile network providers, especially in the most underserved markets.

We are seeing quite a few of those investment opportunities emerge. Feel free to get in touch if you are interested to learn more.