Commercial real estate is priced to produce superior risk-adjusted returns compared with investments in both fixed income and public equities in coming years. This article will present two different frameworks to assess and validate this claim.

Framework #1: Mean reversion of returns

Asset class returns are volatile but tend to be mean-reverting over sufficiently long time-horizons. Two of its most important implications are: 1) investors should hold diversified portfolios to reduce portfolio volatility; and 2) investors should regularly rebalance their portfolios back to their target asset allocation, a form of programmatic contrarianism.

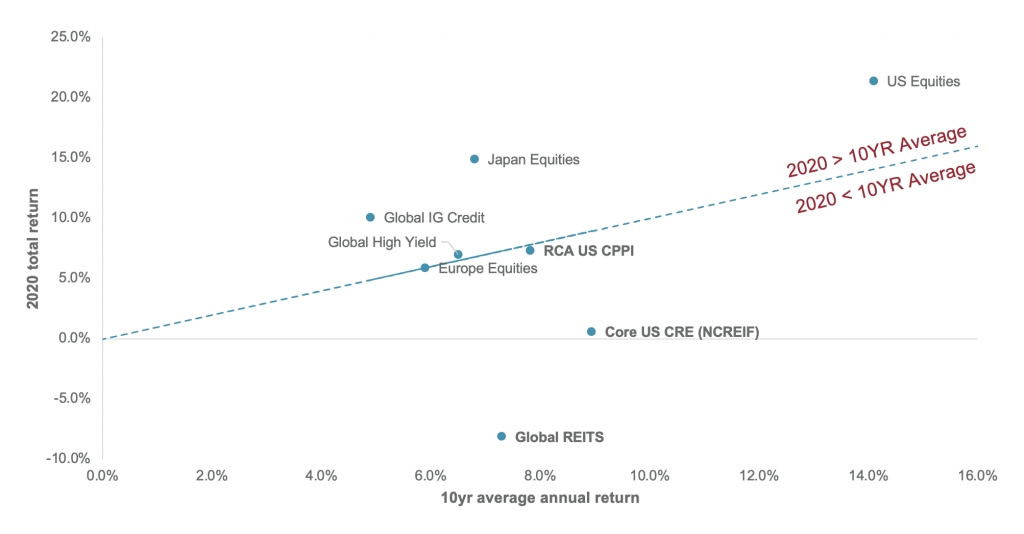

In 2020, the top-performing asset classes were US equities, Japanese equities and global investment grade corporate credit. These investments not only outperformed other asset classes but were also significantly higher than their own ten-year average total returns.

By contrast, global REITs were the worst-performing asset both compared with investment alternatives and with their own long-term returns, followed by core US real estate as reflected by NCREIF’s National Property Index (NPI). Given that downgrades in appraised values tend to lag changes in market conditions, 2020 performance was likely worse than the most recent figures suggest. The same is true of the all-property RCA CPPI index, which showed prices increasing in line with the ten-year average: the value is inflated by the lack of trades for all but the most resilient properties. The upshot is that in the years ahead, returns for the first group of assets are likely to slow down while commercial real estate returns accelerate.

Cross-asset returns: 2020 versus ten-year average (%)

The exception to this argument comes in cases of secular changes to industries, asset classes, etc. that structurally alter values and returns. This is the argument for the space elevator (perhaps literally one day soon) for many technology sector companies, and is also a risk under which the commercial real estate market, particularly dense urban centres and retail, and offices more generally, have laboured in the last year.

My view is that dense urban centres will retain their cultural and economic primacy after covid-19. Similarly, I see little reason to believe that the factors supporting experiential retail will not reassert themselves while the crisis rips the band-aid off already failing malls and department stores. As for offices, increased remote work will create a drag on demand for office space relative to pre-covid-19 (see Global Office Impact Study). However, the office will remain a core technology hub for the knowledge economy and for collaborative and interactive work both within and among firms.

It seems far more likely that reality could surprise to the upside for real estate as opposed to equities and credit

In other words, I both believe that there are significant long-term impacts and yet I am still optimistic relative to many investors, particularly those who are not focused on real estate predominantly. Said differently, commercial real estate today is priced for significant structural changes with risk skewed to the downside plus an additional uncertainty premium. By contrast, US equities, particularly growth equities, and investment grade credit are priced to perfection. Taken together, it seems far more likely that reality could surprise to the upside for real estate as opposed to equities and credit. This in turn reinforces the argument for mean reversion and thus outperformance in commercial real estate.

Framework #2: Value and risk

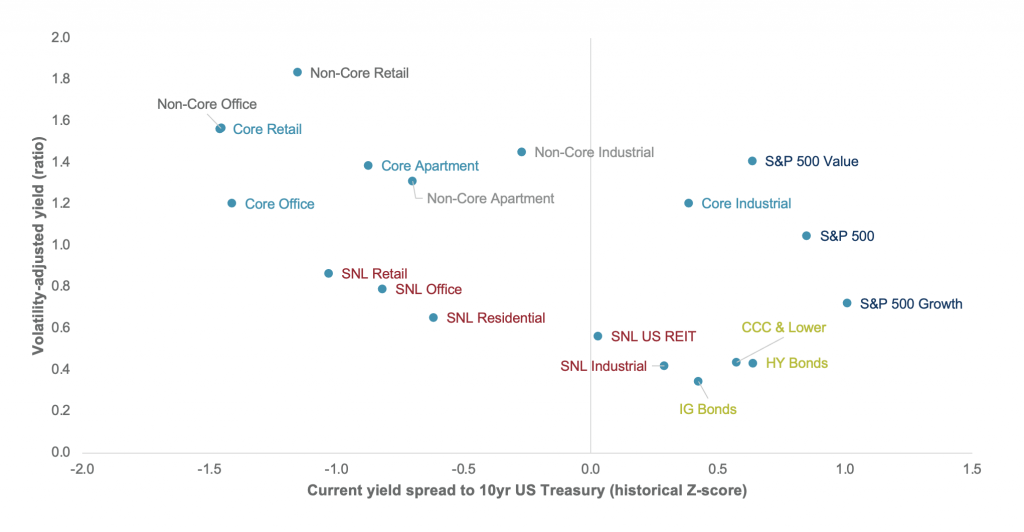

I started this article by claiming that commercial real estate is priced to produce superior risk-adjusted returns. In order to assess this statement, we need to look at current market pricing from two different perspectives: 1) what are current risk premiums (i.e. the current yield relative to ten-year Treasury) and how do they compare to historical risk premiums for various investment alternatives; and 2) how valuations compare on a risk-adjusted basis?

To do this, we looked at private commercial real estate transaction cap rates, public equity forward earnings yields, REIT funds from operations (FFO) yields and fixed income effective yields over the last twenty years (or as available), collecting data from a variety of sources. What we find is that large-cap US equities and corporate debt are all in varying degrees trading well above long-term average valuations, even after adjusting for lower interest rates. This is particularly true for growth equities.

By contrast, private and public commercial real estate across the major property types are trading at risk premiums well below long-term averages, while providing investors with similar or greater risk-adjusted yields. In other words, real estate investments, particularly in the private markets, offer investors higher risk-adjusted current yield while also being undervalued relative to history, suggesting greater potential for capital appreciation. Another corollary of this is that real estate valuations are less likely to be impacted by changes in interest rates compared with other assets.

Cross asset risk-adjusted yield versus value

Note: Core refers to properties that are either class A or built/renovated within the last ten years, were 88% occupied or greater at time of sale and were not purchased for the purpose of renovation or redevelopment. Non-core includes all other transactions. Includes pricing data from refinancing transactions.

Within real estate, non-core offices and retail are the most undervalued and offer the greatest risk-adjusted yield. While it is certainly the case that these product segments face headwinds, the pricing suggests the potential for deep value investments. Core offices, apartments and non-core industrial are each undervalued relative to history, significantly in the case of core offices while offering similar risk-adjusted yields as core industrial and the S&P 500 value and overall indices, both of which are more richly valued. None of these results are particularly shocking, and indeed, they tend to reinforce the strong investor demand for multi-family and industrial property, as well as the reluctance on the part of core offices holders to sell into the present market.

Concluding thoughts

Current market pricing represents both a tactical and a strategic opportunity for multi-asset class investors, suggesting that they should maintain or increase their commercial real estate allocations through a combination of public market and private strategies. Our view is that capital will continue to flow into commercial real estate due to a combination of: 1) opportunistic capital allocation; 2) growth of institutionally managed wealth globally; and 3) the massive amount of liquidity injected into global markets by monetary policy-makers. These capital flows will drive the commercial real estate valuation reflation, offsetting much of the downward pressure on prices due to weaker operating performance over the next several years.