In this very special series of exclusive articles for the Property Chronicle, Australian property legend Norman Harker reflects on his extraordinary 50-year life in real estate. He will pull no punches partly because, as he freely admits, Norman has a limited life expectancy of five years from December 2018 due to a diagnosed terminal blood cancer, which he has cheerfully accepted in preference to (in his words) “kicking the bucket without notice”. We are honoured he has chosen us to publish these brilliant, funny and incisive reflections of a lifetime in property.

Chapter 12: Lease renewal and rent review – bulldust!

Before I start, I must apologise in advance to any lawyers who read this. (Lawyers might note, though, that I haven’t said that I mean the apology!)

My involvement in the development of lease renewal and rent review negotiation is an example of my infamous modification of the property/real estate adage.

- Location/situation in time – in this instance, the early 1970s.

- Location/situation in market sector – in my case, mainly retail.

- Location/situation in geographical terms – I was in London working at Conrad Ritblat & Co.

Time is prime. The best real estate locations in current or past recessions have lost large percentages of value. Next most important is market sector or sub-sector – the right one can buck the trend in such times. Finally, we get down to geographical – where the property is located situated in those times and market sectors.

Taking time (or timing) first

As with love-making, the timing must be right or it’s SNAFU (situation normal another foul up). It was the early 1970s: the lead-up to the Nixon resignation. Ann Summers opened the first marital aids shop in Oxford Street, London. Virgin Records was founded by Richard Branson – we both went on to greater things. In his case, to being an international entrepreneur. In my case, to becoming a famous many-sided idiot.

The importance of time (left) – for instance, the early 1970s (right)

The crucial aspect of time for lease renewals was the coincidence of expiries of 99-year, 33-year, 25-year and 21-year leases. Long leases rarely expired. If it was a business occupier in England, the tenant had the legal right to a new 14-year lease on the same terms but (since 1969) with rent reviews.

With a limited free market, landlords had demanded progressively shorter rent review frequencies since the Second World War, as they observed increasing values becoming the norm after 1930s deflation. The early 1970s saw the falling due of the first 33-year, 21-year, ten-year, seven-year and five-year rent reviews. (For historic reasons, the US had always gone for freeholds and short leases rather than accept long leases. Australia and other UK colonies had tended to go for short leases with options to renew.)

Next comes market sector

Some sectors or sub-sectors of markets do well in a recession. Warehousing, as I write (in March 2021) is doing well. In the early 1970s, despite no growth in the economy generally, retail rents were escalating. Vacant shops let overnight. Poorly performing tenants had a legal right to assign and were approached and bought out by new retailers desperate to get outlets. Retail was the sector, and by far the best sub-sector was high-street shops with London’s Oxford Street being the crème de la crème.

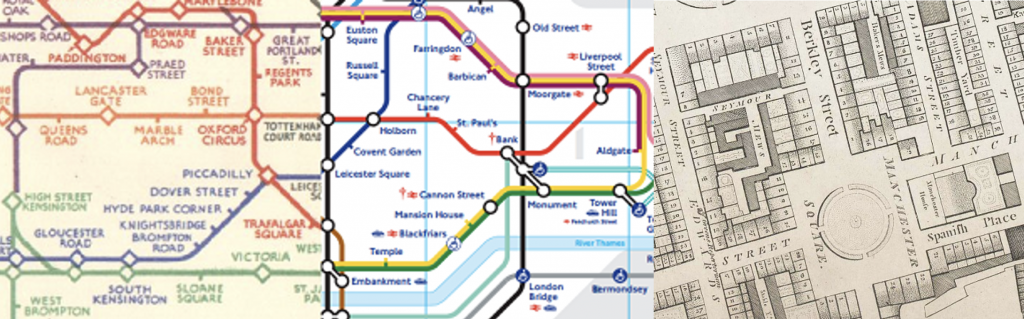

Market sector – retail (left); sub-sector – high-street shops (right)

Third comes geographical

Some areas perform better than others. Right now we are seeing Singapore and New Zealand outperforming. But within countries some areas and cities buck the general trend.

In England in the 1970s the South was more prosperous than the North, and retirement (‘cemetery’) towns on the South coast such as Bournemouth had increasing values.

I was in central London, more especially the West End, where the retail agents were concentrated around the historic founders of retail estate agency. In a geographically small country like England, retail valuation and consultancy was London-based.

We saw previously, in chapter 11, that I had managed to get my inexperienced and naive self into the offices of my employers, Conrad Ritblat & Co in 14 Manchester Square, London.

London was Britain’s answer to Mumbai, Tehran, Alexandria, Athens and Rome. But I must stop waxing lyrical and wax my cricket bat instead, as with Australia’s recent losses it might be needed.

Geographical factors (left) – and my then employer’s location (right)

That adage ‘location, location, location’ (‘situation, situation, situation’) is the biggest load of bulldust ever to be inflicted on a profession. In opinion poll ranks, it causes us property professionals to be lower than that of the oldest one! Thank goodness for lawyers and accountants – otherwise we’d be at the bottom.

Location, location, location (situation, situation, situation) is the biggest load of bulldust ever to be inflicted on a profession

At Conrad Ritblat, the responsibility for lease renewal negotiations was regarded as requiring more knowledge of the Landlord and Tenant Act and the Property Acts than knowledge of rental values. Accordingly, it was handled by the professionals rather than negotiators. In other firms, lease renewals and rent reviews were in the hands of negotiators.

Back then, before the pill, the negotiators were market-orientated and would automatically ask, “How much can I let this for?” The professional, however, would automatically say, “What does the Landlord and Tenant Act 1954, as amended by the Law of Property Act 1969, say I should do?” Or, in the case of rent reviews, would say, “What does the rent review clause say?” It became the holy writ of Conrad Ritblat’s professional team of lease renewal and rent review artists to say, “RTFA and RTFL”. Read The Fine Act and Read The Fine Lease.

But what was the biggest laugh of all? The one that made me laugh so much I wet myself? The legislation and the leases were drafted by lawyers! These lawyers knew nothing about the multidisciplinary bases of real estate valuation and appraisal. The provisions of the legislation and leases allowed the likes of me to get them spinning round in ever-decreasing circles and disappearing up their – ummm – offices?

Perhaps my most remarkable find was a book called Standard Forms and Precedents. Recall that these were prehistoric, pre-computer times. It was before copying and pasting, and lawyers, who now go to their previous drafts, Google, Facebook, and TikTok, would go to that text as a source when drafting leases.

That text became my favourite book of jokes. There were more nonsenses in that text than my dog has fleas. Which reminds me, I must get some flea powder.

The acts and the rent review clauses were my guide, and I always follow guides, especially the pretty ones.

I always say: “If the lease or legislation says that I should do the valuation standing upside down in a bucket of water, singing Advance Australia Fair, then get me a bucket!”