In this very special series of exclusive articles for the Property Chronicle, Australian property legend Norman Harker reflects on his extraordinary 50-year life in real estate. He will pull no punches partly because, as he freely admits, Norman has a limited life expectancy of five years from December 2018 due to a diagnosed terminal blood cancer, which he has cheerfully accepted in preference to (in his words) “kicking the bucket without notice”. We are honoured he has chosen us to publish these brilliant, funny and incisive reflections of a lifetime in property.

Chapter 13: War, Planet of the Apes style – valuers’ and appraisers’ version

Important notes: Facts, figures, dates, and details have been changed to protect the guilty. See the brief concluding serious note on ethical dilemmas involved.

I’d wanted the role of Harlton Cheston in the film, but I was rejected, and I still can’t see why.

What’s he got that I haven’t got?

First skirmish

You may not recall Chapter 5, but opponent number one had been stocked and shunned when Obnoxious Norman walked out of an interview after five minutes saying he wouldn’t want a job there.

My client now had a 99-year lease of an entire well-located building with reviews at 36 and 72 years. To explain, I’ll use round figures – I never did like skinny women (Dolly Parton could have had me if she’d played her cards right).

Current rent £25,000 (set 36 years before). They didn’t want the accommodation. Market rent of £400,000 a year – ouch! A repairing obligation was going to cost £200,000. A letter quoted £450,000 a year. Summary: (expletive deleted)!!

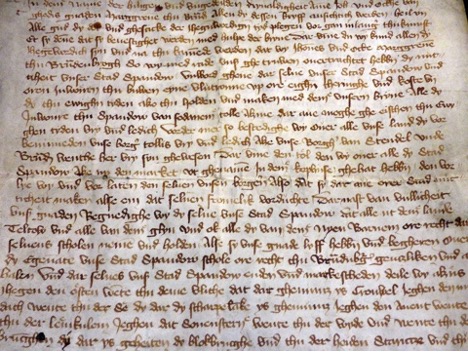

Having nothing better to do, I’d RTFLd (read the fine lease) on receiving instructions and before meeting with my client. Being old, it was printed on beautiful parchment

Read the fine lease

In the absence of agreement, the landlord had to ask the chartered chappies’ president to appoint an expert to determine the rent. This request was due no later than a date that was two weeks after my first meeting with the client.

The magic words ‘time being of the essence’ were used. I advised on interpretation, ethics and ramifications and got the client’s authority to proceed – the opponent had also, in his inimitable style, got right up my client’s nose and into his sinuses.

The magic words ‘time being of the essence’ were used

I arranged a meeting at the opponent’s office the following week. By total coincidence, it was the same room I’d been interviewed in three or four years before! His response to my ‘low ball’ suggestion of £75,000 was, “Mr Harker! You should go on the stage!” But I noted the opponent’s very thin file – with obviously no copy of the bulky parchment lease in it. I said I’d take the client’s instructions and come back next week (which would be after the required notice date).

“Mr Harker! You should go on the stage!”

I returned the next week and said, “Before we start, can I see a copy of the notice you sent to the president of the RICS?” Opponent was mortally injured, having lost his client’s right to any increase in rent for 36 years!

End result? Client received £400,000 for surrendering the lease (after taxes, legal costs and my fees). We had another regular client, who recommended us to all, except his ex-wife.

The opponent was lucky! The case didn’t get to court with him ‘on the stage’ or referred to regarding damages for negligence.

Second skirmish

Rent review involving a firm led by second, even nastier opponent. He never listened to or understood my review clause arguments on the impact on the rental of a highly restrictive permitted use.

The case went to arbitration.

The second enemy

I presented the case and gave evidence with my client by my side. The opposition’s ‘evidence’ was a handful of marketing details of similar properties being marketed by his firm and others at the review date. Not one piece of evidence was admissible, apart from the opponent’s personal opinion.

The opponent claimed £16,500. I looked at each detail, kept pulling back earlier ones, and the table was covered in a chaos of papers. The arbitrator smiled at the chaos I was causing. We adjourned for 30 minutes. I got confirmed the instructions that I had recommended. Agree £16,500 as modern lease rental despite our opinion that it was £15,000. The opponent had also ‘cooked’ his evidence!

I presented my proof in two folders – the ten-page argued proof in one folder and the indexed, sequential, easily opened flat, index-carded and certified evidence in the second. The opponent, arbitrator, my client and I had separate copies.

I started by saying, “My instructions are that I must agree the market rental submission of the landlord.” The arbitrator was startled! So was my opponent!

I paused to allow all to become pregnant.

Pregnant paws

“But that isn’t the rental defined by the rent review clause. With the lease restriction on permitted use, there shouldn’t be any increase. There is no market for that use at present. Accordingly, the defined rent is below current rent and should stay the same because this is an ‘upwards only’ review.”

The arbitrator sat back as he realised what I had done. He, the arbitrator, was trapped! £16,500 – he’d accepted the opponent. Just £1 less – he’d accepted my argument. Either way, there would be an error on the face of the record that could be appealed to get a precedent.

Further submissions were asked for. I went first. My purposely short submission snapped my opponent’s temper like a violin string being over-tightened. I said something like, “You have been presented with totally [pause] irrelevant [pause] arguments. There appears to be no admissible evidence apart from personal opinion!” Talk about a red rag to a bull!

My purposely short submission snapped my opponent’s temper like a violin string being over-tightened

He launched a vicious attack on my age, experience and capabilities, upon my firm, and upon my senior partner using an insulting word for his Jewish religion. During the attack on my capabilities, the arbitrator interrupted and said, “I think you can leave me to determine that.” We’d won!

The arbitrator awarded the existing rent. There was no appeal. We didn’t have a precedent, but we had a respected arbitrator’s award to show whenever needed.

In a later chapter, I will cover how my latent feelings on my opponent’s intolerance were satisfied. “Up with this I will not put,” as Winston Churchill said.

“Up with this I will not put”

Serious note. Profoundly serious and arguable ethical issues here. My view in these two cases was that all arguments and ramifications should be put to the client to the best of one’s abilities and to let the client decide. There were many cases where it was not in the client’s interest. Note also that the law and background vary over time and between different countries.

Image credits: Tim Buss (Winston Churchill statue); Rennett Stowe (bonobo).