In this very special series of exclusive articles for the Property Chronicle, Australian property legend Norman Harker reflects on his extraordinary 50-year life in real estate. He will pull no punches partly because, as he freely admits, Norman has a limited life expectancy of five years from December 2018 due to a diagnosed terminal blood cancer, which he has cheerfully accepted in preference to (in his words) “kicking the bucket without notice”. We are honoured he has chosen us to publish these brilliant, funny and incisive reflections of a lifetime in property.

Chapter 14: Aircraft carriers and yellow paint in Scotland

Note: Figures and facts are changed from the truth for simplification purposes. The essential detail is absolutely true.

To conclude boring the bejesus out of you regarding sordid rent reviews, I’ll jump ahead seven years to 1979. The Tardis better work bringing me back next month.

Two associated companies had three less than brilliant ideas:

- I should handle a rent review for them.

- They’d ignore that my probable failure would cost them.

- They’d ignore the fact that the property was in Scotland, where the legal system is completely different.

Never one to tell clients where to go, I met them, and they gave the history.

Twenty years earlier, they had decided to set up a port in Scotland not far from Stranraer, where there was a port operated by British (Low Speed) Rail. They had feared that a real competitor might set up nearby. One place close by was viable – a long pier at Cairnryan that projected at an acute angle into Loch Ryan through which fairies had to pass to get to the Irish Sea and Northern Ireland.

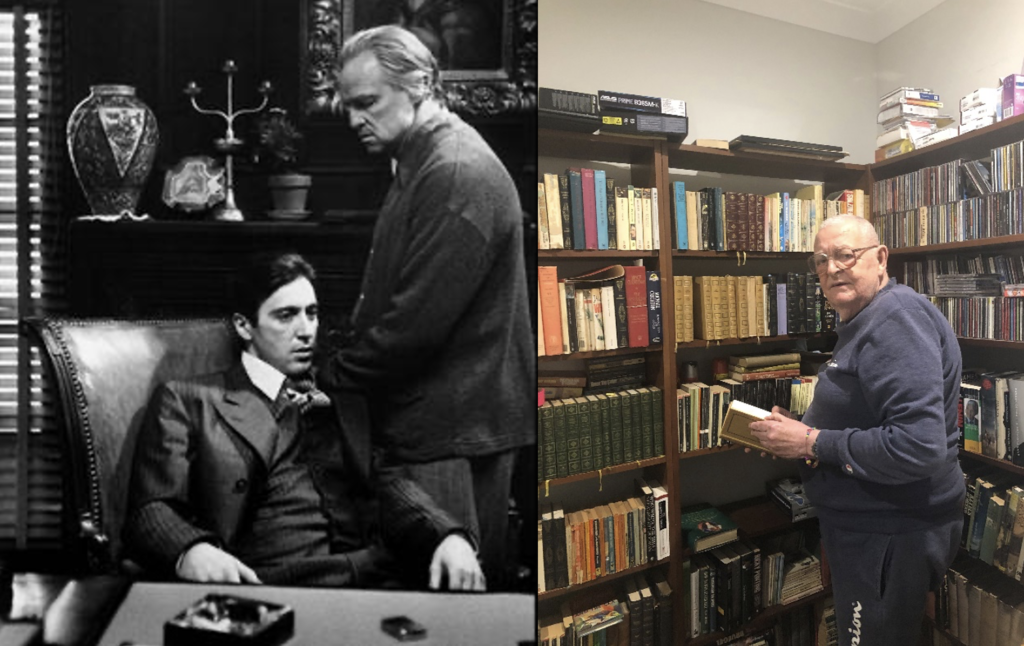

The Disunited Kingdom (left), and the Battle of Cairnryan (right):

In 1959 Cairnryan pier was used by a firm of shipbreakers. My clients had negotiated a lease for 99 years covering just the first 1,000 ft of this pier from high-water mark, plus land preventing alternative access, plus a road leading to it. The rent was £25,000 per annum, reviewed every 20 years.

“OMG!” I said. “Why didn’t you ask me to advise you back then?” They replied, “You were only 12 years old at the time!” I reluctantly conceded this point, although my olde school (Colchester Royal Grammar School) would have loved to have got rid of me.

Their problem: an increase for 20 years without review.

My problem? I asked one question. “Now that you’ve spent mega money on building your port, how much would you pay now to stop a real competitor?”

They went white as sheets and a smell pervaded the room. They left and came back confirming instructions. I said that I’d have to play the naive English idiot (in other words, act naturally) and agree three or more times the current rent, hoping that the landlords wouldn’t spot the argument.

My role

I took the BR night train to Stranraer, in order to meet Captain McKirk for breakfast – the clients’ local man. All I needed was a taxi to Cairnryan, for it to wait for two to three hours while I took notes, and for it to bring me back to Stranraer. We’d meet in the evening, because I might have questions. Would he and his better 95% join me for dinner?

The aircraft carrier Eagle (Ark Royal’s sister from an unknown father) was parked on ‘my’ bit of pier being broken up. “I’m going to paint two yellow lines down each side of ‘my’ bit of pier and tell them to […] move!”

UK no parking

Country note: In the UK, double yellow lines mean ‘no parking’.

Technical note. To break up a ship you start at the beach and cut off a chunk. Then, next high tide, you pull a bit more up the beach. Having ‘eaten’ half, they were going to float Eagle into the loch, and take it to the other side of the pier and park the famous Ark Royal where Eagle had been and then do both at once. With double yellow no-parking lines, this would be impossible.

Captain and Mrs McKirk and I met for a convivial evening. They educated me into the joys of single malt whisky and poured me on to the night train back to London (aka civilisation).

My Scots education syllabus

Legal note: Scotland has its own legal system. Angus McLaw, my clients’ lawyer, produced the following for me:

1. An injunction from our tenant company demanding that they cease parking any boats (Captain McKirk insisted I said ‘ships’) on our bit of pier – Scots commercial lease law strictly interpreted the lease – no ‘ifs’ no ‘buts’, “Do as you have agreed in writing!”

2. A writ from our company that owned the new port at Stranraer, demanding that they shouldn’t move the Eagle and risk blocking navigation of Loch Ryan or bring any other ships that blocked the navigation channel.

3. A deed varying the lease with the rent left for insertion ready for binding signature.

4. An agreement allowing ‘parking’ and use of our pier plus land plus road for the remainder of the lease with the words “on payment of” at the end left for insertion ready for binding signature.

The BBC news highlighted the famous Ark Royal leaving Plymouth to meet its unmaker. I called an urgent meeting with the landlords. I was relieved they suggested my office in London. I’d researched them. They looked vaguely familiar.

My opponents; and me

I served the injunctions and was met by the familiar smell – a precursor of success. But I dreaded them leaving my office to arrange for a horse’s head, as I gave them the two draft documents.

“What are the figures?” … “The rent will be £1 p.a. if demanded. Permission to use will be £50,000 p.a. in advance increased 5% each year for remainder of the lease. If you agree, I have authority to sign.” They agreed! I signed and exceeded my authority as an agent. I’d only been given freedom to negotiate, and the figures were only left blank to allow me to judge on the day where we would start from.

I knew the clients would be as happy as pigs in straw with any rent payment below £75,000, and the parking agreement was just a formality to get it. It pays to leave plenty of juice in the lemon when you squeeze the nether parts of practising Catholics. What I asked was peanuts to the shipbreaking contracts, though. Speed was more important than money to all concerned.

It pays to leave plenty of juice in the lemon when you squeeze the nether parts of practising Catholics

As they left, one said, “Would you consider coming to work for us?”

I phoned my clients and said I’d reached a final agreement. They said I didn’t have authority. I tried to sound apologetic. I was sorry, but we’ll make it good after they’d seen the details, which were on the way by courier. The later phone call was different – they were jumping up and down laughing, pigs in straw. They liked the advance payment.

I said, “So do I. My fee is the saving in the first year and I didn’t want you to have pay it out of pocket.”

There were no later ramifications and I had two clients plus doubtful opponents recommending me to all except ex-wives.

Image credits: Isaac Newton (Ark Royal); Michael Trolove (Minster Yard road markings); Paramount Pictures (The Godfather)