In this very special series of exclusive articles for the Property Chronicle, Australian property legend Norman Harker reflects on his extraordinary 50-year life in real estate. He will pull no punches partly because, as he freely admits, Norman has a limited life expectancy of five years from December 2018 due to a diagnosed terminal blood cancer, which he has cheerfully accepted in preference to (in his words) “kicking the bucket without notice”. We are honoured he has chosen us to publish these brilliant, funny and incisive reflections of a lifetime in property.

Chapter 16 left you bored over why I became a lecherer in valuation in the Department of Land Economy, University of Aberdeen, Scotland – founded 1494 – floundered, 1985. In 1494 The Mayflower was possibly still growing and Australia wasn’t even on the maps.

1494: Aberdeen, The Mayflower still growing, Australia not on maps

My own family possibly came from the village of Harker, northeast of Carlisle on the border between England and Scotland. One ancestor, a tad bored with raping, looting and pillaging and being raped, looted and pillaged in return, went south and founded the great Harker dynasty.

‘Canny’ is often interpreted as ‘mean’ in English but Canny really means ‘wise investors’

It was a move to an ancestral battleground. However, I soon found the Scots to be warmhearted, friendly and embarrassingly generous. ‘Canny’ is often interpreted as ‘mean’ in English, but canny really means ‘wise investors’. It has nothing to do with their spirit of generosity. Scots Pension Funds have long been among the best performing.

Their antagonism towards the English is only evidenced if the English adopt a belief of superiority over the Scots. Being English by birth, I don’t believe that superiority – I know the English are superior. (Norman now ducks for cover under his Shetland wool blanket.)

Emigrants from England passed this trait of nationalistic superiority on to their colonies such as USA, Canada, Australia, New Zealand and elsewhere. One of the more disastrous English colonialist introductions. The disasters rank higher even than rabbits in Australia, cotton farming in Tennessee or attitude to the French and their language in Canada.

Now I’ve succeeded in upsetting 99% of the world’s population by that digression, I’ll continue – with more effort, I’ll get to 100%.

The Department believed there was something in the water, because all of the staff had produced babies after joining.

In November 1985, I merely looked at my glass of water and said, “There really must be something in this water!” Congratulations all round on the anticipated birth of my son, Robert, in March 1986. My wife and I had left ‘counting chickens’ until late because of a history of early miscarriages. My great friend Nanda also proved the water theory.

“There really must be something in this water!”

Why did Aberdeen take the lead in the UK in valuation? It was a team effort!

- Mark Shucksmith taught me how to use financial calculators and I translated that onto computers.

- Nanda was incredibly patient in getting a real dumbo to actually understand financial maths.

- Greg Lloyd and I ‘performed a double act’ presenting unscripted diametrically opposed political views on the same real estate issue that amused and forced students to think.

- Jeremy Rowan-Robinson and I educated one another on impact of law on valuation.

- Maureen Reid was the sole administrator and kept us all in check.

- Professor Alistair MacLeary was the leader who put it all together by, effectively, determining appointments and letting us get on with it.

- Suffering students educated me.

- After Nanda and my appointment, Alistair MacLeary made the unusual decision to give the practical units to the mathematics guru (Nanda) and the theoretical ones to the practice expert (me). Nanda and I would always have got on well because of a mutual love of cricket, but Alistair forced day-to-day liaison.

- We did not suffer from non-academic administrators getting in the way of education. If we thought something was important it went into lectures straight away.

After I left Aberdeen, when Sri Lanka won the cricket World Cup, Dr Norman Hutcheson, an old student of Nanda and mine, and now a professor, tells us Nanda wasn’t seen for three days.

I took to education (NOT teaching) like a duck takes to water.

My understanding of financial maths was helped by weekly intensive study on night-train journeys back to the south of England to visit my wife, who was too pregnant to be involved with ‘setting up shop’ in Scotland.

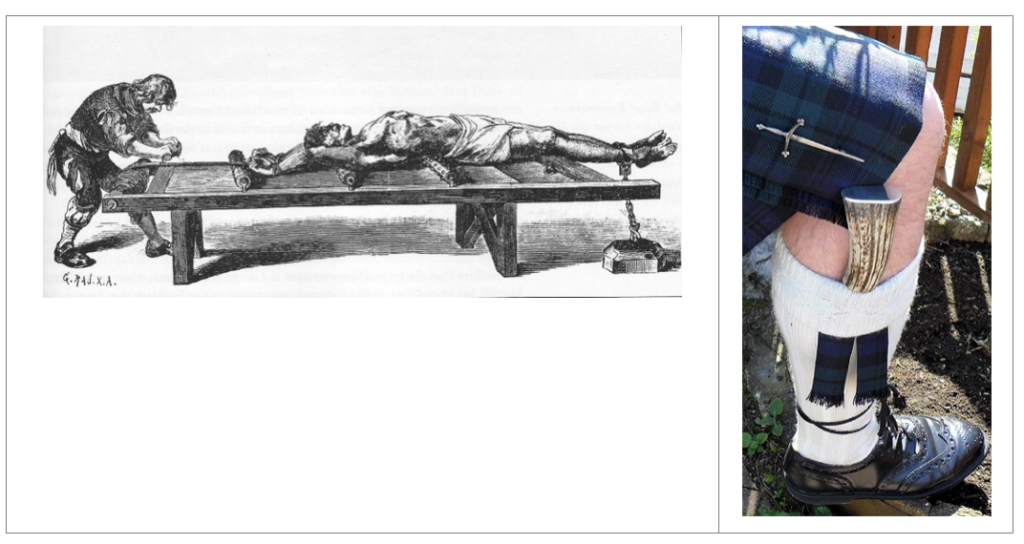

No work was done on one return journey that coincided with the annual soccer match between England and Scotland at Wembley. I joined the pre-match preparation on the Friday and post-match post-mortem on the Sunday, and was awarded the accolade of being ‘nae bad for (—) Sassenach!’ The alternative to joining in was being torn limb from limb (one limb at a time) followed by decapitation with their sgian dubh.

One limb at a time preferred to English method, the Scots sgian dubh

I integrated financial calculator DCF and formula solutions into the valuation subjects. We were well in advance of all other universities in the UK who still used tables. We researched problems faced by practising valuers. Nanda, me and an honours student, Simon Rogers, solved and published the solution to a 50-60-year-old UK valuation problem. Boring! But the end result was a simple solution of great utility to practising valuers.

Simon was employed by the major firm Savills, London. An independent parallel with my career is that at Savills, Simon, in increasingly senior roles, has extended his calculator expertise to all Excel matters. Another old student, Alistair Hughes, was the sole Aberdeen graduate amongst 30 took on by Jones Lang Lasalle in London. With his exceptional financial calculator abilities he rose to the top and is now a board member of the largest UK REIT, The British Land Company – Honorary Life President, Sir John Ritblat, my first boss.

I left Aberdeen for Australia with a conviction, of the non-criminal variety, that academics needed to infiltrate their ‘truths’ into the property profession rather than ‘preach’ what is right or write technical papers in journals that few valuers read or find useful in their day-to-day practice.