In this very special series of exclusive articles for The Property Chronicle, Australian property legend Norman Harker reflects on his extraordinary 50-year life in real estate. He will pull no punches, partly because, as he freely admits, Norman has a limited life expectancy of five years from December 2018 due to a diagnosed terminal blood cancer, which he has cheerfully accepted in preference to (in his words) “kicking the bucket without notice”. We are honoured he has chosen us to publish these brilliant, funny and incisive reflections of a lifetime in property.

After some compulsory attempts at humour there will be a more serious interlude as a break from the usual mode of this series.

I arrived in Australia at a permutation of the three letters U W and S. UWS (University of Western Sydney), which begat WSU, which will begat? SWU?.

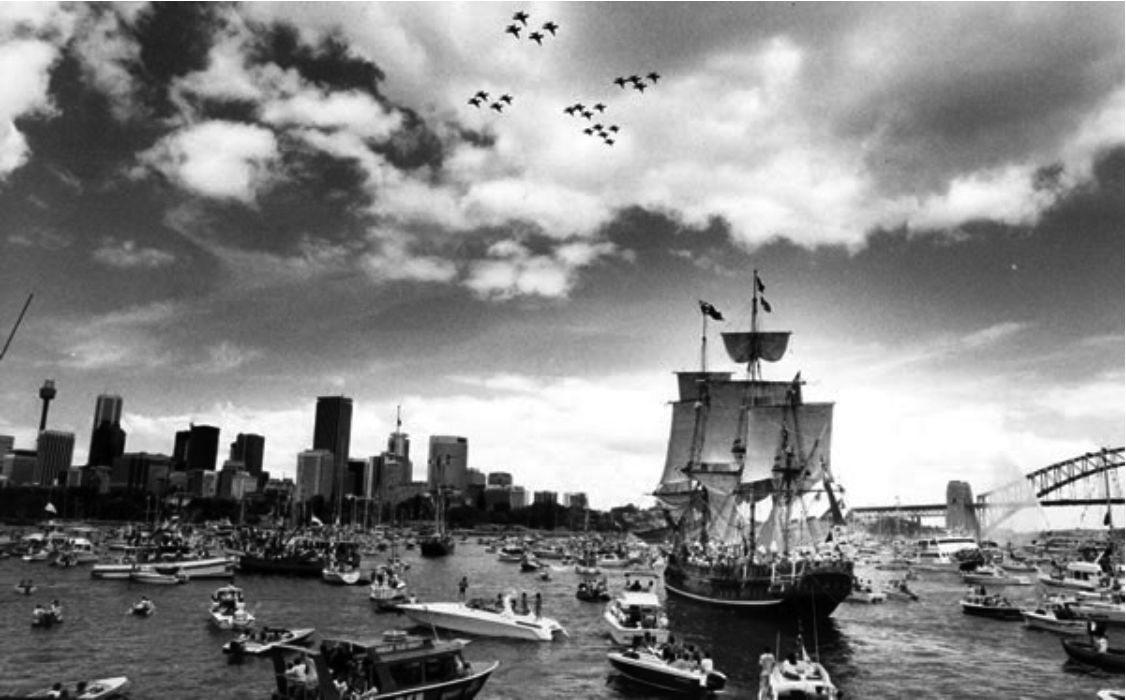

It was the beginning of October 1987 and being next to the RAAF base, the university laid on frequent Harrier and Falcon jet fly-pasts in celebration of my arrival.

I learned later it was the RAAF practising for the 26 Jan1988 bicentennial celebration of Britain founding a new place to send its convicts. That was after those Americans, completely illegally, declared they didn’t like George III and eventually chose their own George called Washington. I suppose they were right in preferring their George, whose great-grandfather, after all, did come from England rather than George III, whose great-grandfather was a (—) foreigner. I was plain Norman I of England and Australia.

Britain’s George III, USA’s George I, Norman I of England and Australia

Now for the more serious interlude, although some of it I wish it were a joke.

Professor Alan Millington lead us during the evolutions/revolution in university property valuation education. He is famous for Introduction to Property Valuation, first published in 1975. This has been translated into dozens of different languages. Subsequently he published Property Development. Both are seminal texts.

I joined as a Senior Lecturer and left 24 years later as a Senior Lecturer. This could well be a classic example of the Peter Principle, that people rise to their level of incompetence. I say ‘could’ because in my case I made decisions to:

a. Stay doing what I enjoyed doing, rather than be promoted to a level that required me to do tasks I wasn’t suited for, and

b. Refusal to follow the university’s developing model rather than the traditional model of a university which I express by:

i. Rationale – excellence

ii. Objectives – excellence in education, research, and publication

iii. Goals – appropriately measurable relevance to the discipline of valuation and the wider community.

With Professor Millington, we had a world leader in many areas. Fifteen students to each member of academic staff. The student :’real’ academic staff ratio is a key to high quality university level education. It needn’t be in a large university, but can be a boutique university or campus like Stanford, California.

Professor Alan Millington’s Seminal Texts.

Under Professor Millington, but less and less after he left and the Balrogs took over:

- Individual lecturers determined how and what was taught and varied it from year to year based on their experiences and changes in the professional discipline and technology. The property market environment changes daily, and we reflected that by changes as and when necessary.

- Every lecturer had their own style and quality opinions. No one style or opinion is best or we would have found it by now! No attempt was made to force all into a standard template.

“Students were expected to read widely for a degree”

- Students were expected to read widely for a degree and were not constrained by the limits of the lecturers’ notes and limited reading materials.

- We developed entire programmes at short notice addressed to the needs of the property profession. A post-graduate programme was planned and implemented for presentation in Sydney CBD, convenient to all interested professionals. Professor Graeme Newell and I designed the programme. Professor Newell was the unsurpassable master at getting the required paperwork through the ever-increasing obstacle course that Balrog administrators devised.

- Units that contributed to an award were described in brief broad terms. At unit level, it was left to the academic to determine content, modes of delivery, assessment and grading. Academics were trusted to set meaningful and appropriate levels of assessment and grade appropriately.

- We designed and implemented with the Australian Property Institute a world-leading Continuing Professional Development (CPD) programme. This was thanks to initial federal government sponsorship and to the leadership of Gail Sanders at the API and Professor Newell at UWS and numerous supporting individuals in private practice.

- After the initial CPD development my contributions were on my shoestring budget for the hardware and software I needed to produce the materials for participants. UWS couldn’t keep up with software or hardware to match what industry needed.

- Mode of assessment depended upon what was taught. In most valuation subjects the appropriate mode of assessment is for each individual or small group of two or three to value a real property to real world standards. Grading bars should rise progressively from year 1 undergraduate to post-doctoral research. In defence of my view on variable assessment, I merely opine that different levels from real estate sales trainee to post-doctoral researcher would be expected to answer differently the question, “What is market value?”

- Interaction and feedback was personal, continuous and prompt, and nonone’s office door was closed unless, exceptionally, a private matter, hopefully not ‘political’, was being discussed.

- Research was based on the lecturer’s interest rather than being aimed at promotion.

- Publication mode was similarly left to the lecturer. I believed my function as a property valuation academic was:-

- Publication in the form of up-to-the-minute lecture and tutorial notes,

- Developing post-graduate materials for mid-career property professionals or graduates of other disciplines seeking property exposure or qualification, and

- Infiltration of the property profession with relevant CPD programmes.

That approach went down like a lead brick with my seniors and caused no end of personal sacrifices. But it has never been a matter of regret.

“That approach went down like a lead brick”

In summary, we developed a world-leading programme with a model relationship between the university and the property industry. That model relationship and the high standards of the Australian property profession were fostered by the close relationship between the university and the Australian Property Institute, which led the world in the development of appropriate continuing professional development programmes.

Take overs of the university courses by administrators who have never practised in the property industry and the similar takeover of the API by administrators with no experience as practising valuers is the challenge we now face. I term this the battle against the Balrogs.

The concluding episodes in this series will detail some of the details of those battles with the Balrogs.