In this very special series of exclusive articles for the Property Chronicle, Australian property legend Norman Harker reflects on his extraordinary 50-year life in real estate. He will pull no punches partly because, as he freely admits, Norman has a limited life expectancy of five years from December 2018 due to a diagnosed terminal blood cancer, which he has cheerfully accepted in preference to (in his words) “kicking the bucket without notice”. We are honoured he has chosen us to publish these brilliant, funny and incisive reflections of a lifetime in property.

Chapter 6: My second task as a valuer, evolution and a variety of red books

I wasn’t given time to recover from that first job in ladies’ underwear. Next came a job valuing the assets of a company selling furniture.

“Off you go, Rover!”

“You what?”

“You know what to do now. This is yours. Let me know when you’ve SNAFU’d it!”

“SNAFU?”

“Situation Normal Another Foul Up – or variations thereof! It’s from Second World War soldiers.”

“I wasn’t in that war. And what’s with calling me ‘Rover’?”

“Make up your mind! You objected to ‘Norman’ last week.”

But I trotted off, like a good dog, and went through the process I’d been led through step by step before.

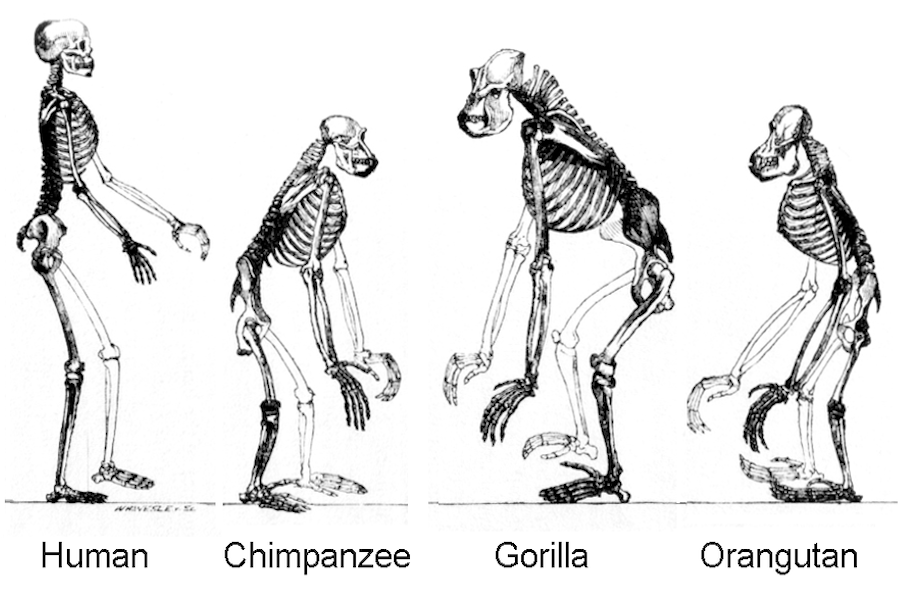

We were part of a group of ‘young bloods’ in London that were evolving valuation reporting standards.

Evolution: ‘Hi ho, hi ho, it’s off to work we go’… and me, off to my second valuation task

We lived in the Dark Ages. It was before the pill! We had no ‘Practice Standards’ – my firm just believed that our reports were our reputation. They should be of the highest quality both physically and content-wise. They were also, like the pill, our protection.

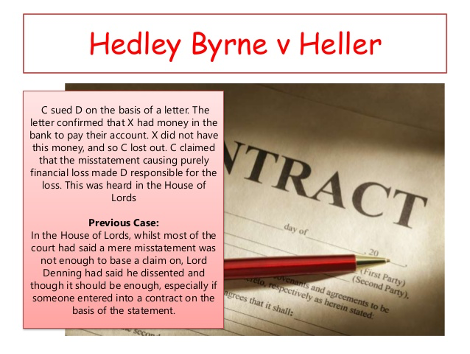

At college when doing contract and tort, I’d wet myself reading about the many ways of committing negligence acts. I didn’t want to add to that collection of cases. “Tell them what you’ve done! Tell them why! You’ve then taken due care! If you turn out to be wrong, you’re not culpable.”

This is what worried us: it’s worse than snails in ginger beer…

Our reports were contained in black leather binders emblazoned with the client’s name in gold. Our firm’s name was discreetly at the bottom of the spine. Those were a present to the client – we wanted something that would stand out in their boardrooms, directors’ offices, or wastepaper bins.

We used top-quality Old Turkish Mill paper. I suspect it was made from pulverised Turkish bread bound together with the hair and droppings of goats.

Old Turkish Mill report paper recipe: pitta bread, goat hair, and some type of glue

That paper was a … Well, it kept jamming up our photocopier. That photocopier was 2m x 1m x 1m and printed a one-sided copy every two seconds. It cost something like £20,000 then. It was more temperamental than my dog with a new bone. There were huge costs for new lightbulbs, drums and other thingamabobs, goo-flips, and widgets.

Checking was a nightmare. We used stuff called ‘Snopake’ to paint over mistakes and allowed typing over it. I recall inventing the fast method of checking all figures in a report – add up every single figure, all 500 or more, wherever or whatever they were. If the total was the same, then each one had to be correct, with almost 0 chance of compensating errors. Two of us had to get the same answer!

We used foolscap, not A4. It stood out and we got more of our scintillating material on one page.

Our reports were emblazoned with the client’s name in gold – something that would stand out in their boardrooms, offices, or wastepaper bins

Over the years individual reports were extended, to comprise a photograph of the property, an extract from the government plan, and a street traders plan, followed by verbiage under the key valuation impacting situation, description, dimensions, areas, general condition, planning, title, tenure, valuation. Contents under each head was continually expanding.

We gave areas and dimensions in both our Great British and that upstart foreign system. No one liked metric then in UK. It had been introduced by the man who wore his hat sideways, was always scratching his stomach, and met his Waterloo at Waterloo.

Professional photographs were expensive. We equipped ourselves with professional cameras, tripods, and wide-angled perpendicular erection-correction lenses. We didn’t know how good our shots weren’t until the film was developed. Ex-colleagues will remember the photo of the Brighton department store and the lady walking past. The perpendicular correction of one building was reversed and made it look like a rocket about to be launched.

Our reports would be rubbish now – but the reports of at least one major firm at that time were no more than a two-page badly typed letter. They were the best source of our clients.

There was another Red Book before ‘the Red Book’, and it was given away in millions. But somehow, I couldn’t find a lot that was relevant and had problems with reading Mandarin.

Before ‘the Red Book’, this guy also wrote one

Our preface letter substituted for ‘the Red Book’ and contained all sorts of definitions, limitations, reservations, and provisos. When the RICS issued their Red Book, we ordered immediate compliance.

My only problem, which exists to this day, was that it was all copyright protected. Any quote from it whatsoever should be cleared by the RICS. The same applies to the 2020 International Valuation Standards. Take a look! It’s right at the front just after the title page.

If anyone reads my life story, the RICS and the IVSC are going to be getting a lot of mail asking for permission to quote from their Practice Standards. Now, that’s not my fault, is it?

Image credits: Guillaume Paumier (pitta bread); Ge Xiaoguang (Chairman Mao).