The report is divided into the following sections

A summary of Fund performance

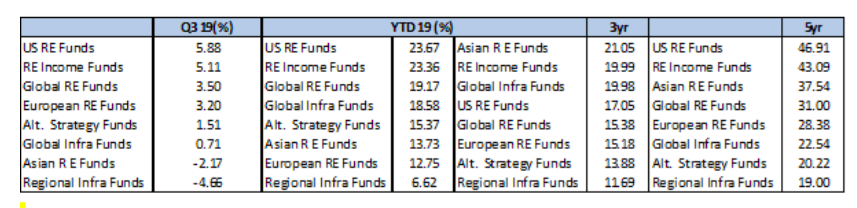

The table below shows the average Q3 2019, YTD 2019, 3 and

2. Focus : Q3 Performance Review (p3)

In this edition we look at the Q3 2019 performance of our different fund mandates and establish that:

In this period there was a broadly consistent pattern, as large funds outperformed small funds in all mandates apart from Europe and Regional Infra Funds (where we do not have large categories, only medium).

Over the period it was the medium sized regional infrastructure funds which showed the highest volatility and the large Income funds which showed the lowest volatility.

The most significant outperformance of active vs passive funds came from Asia and Income Funds, although it is worth mentioning that larger active global real estate funds outperformed passive funds. US and Global Infrastructure underperformed marginally, but the most significant underperformer was Regional Infrastructure Funds.

The best performers in Q3 were the leveraged bull strategies (>+15%) and the worst performers were the leveraged bear strategies (-16%) and Inverse Funds (-7%). Elsewhere, Residential (+10%) produced the next highest returns. It is of note that in Q3 of this year a number of “alternative” strategies again produced above average returns (as defined by the Global real estate average of c.3% in the period).

3. Detailed performance statistics by mandate for Q3 2019 (p5)

In this edition we look at the data for Q3 2019. For each mandate we show: the dispersion of returns by Fund AUM, aggregate performance by size, active vs passive performance, Benchmark Index returns, and the best performing active funds above an AuM threshold for each mandate. For consistency, all returns are rebased in US$. Finally, it is important to note that there are no recommendations or investment advice contained in this publication, and that it is not intended for retail investors. This report represents only a very small summary of the outputs of our database, and the bespoke research and advisory service work we undertake for clients. For further details of our work please contact us.