The report is divided into the following sections:

1) A summary of 2018 performance

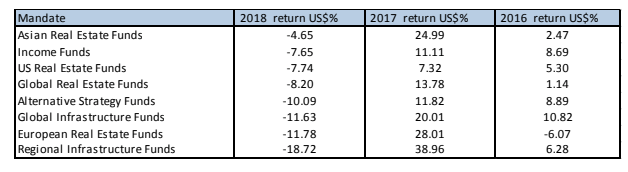

The table below, shows the average 2018 performance per mandate, and is ranked by 2018 returns with 2017 and 2016 figures for comparison. As can be seen no individual mandate generated positive returns, although this is in the context of negative calendar returns for virtually all asset classes.

2) Focus : Annual Performance Review (p4)

This month we look at the 2018 performance of our different fund mandates in the context of:

i) The last 5 years absolute performance

A poor year for all funds with last year’s star two performers (Regional Infrastructure and Europe) impacted the most. In fact European funds have always been amongst the best/worst performers in alternate years, lending some credence to a regional rotation strategy

ii) The 5 year relative performance of real estate vs infrastructure

Global real estate and infrastructure funds have had moderately contrasting annual returns which suggests a reasonable level of diversification could be achieved by combining them in a” real asset “grouping

iii) Whether fund size had an impact on performance

With the exception of Regional Infrastructure there was no evidence of small funds outperforming larger funds in 2018, in fact the reverse was true

iv) The 5 year risk and return profile of real estate, infrastructure, and income funds

Regional Infrastructure has the highest return profile, with a commensurately higher volatility. Interestingly in this period Income based funds have generated higher returns with a similar level of volatility to Global RE and Infrastructure, despite the headwinds of a rising interest rate environment

3) Detailed performance statistics by mandate for 2018 (p7)

This month we look at the data for 2018. For each mandate we show: the dispersion of returns by Fund AUM, aggregate performance by size, active vs passive performance, Benchmark Index returns, and the best performing active funds above an AuM threshold for each mandate. For consistency, all returns are rebased in US$.

Finally, it is important to note that there are no recommendations or investment advice contained in this publication, and that it is not intended for retail investors. This report represents only a very small summary of the outputs of our database, and the bespoke research and advisory service work we undertake for clients. For further details of our work please contact us.