1) A summary of October performance

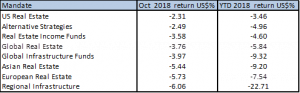

As can be seen from the table below, (which is ranked by average October 2018 returns for each main mandate) the last month again proved a difficult one, with average YTD returns now all negative.

2) Fund Flows

Key features of fund flows for October were inflows for Global Passive Funds and outflows for Global Active Funds. In terms of other main mandates in our sample, Income funds saw outflows and infrastructure funds inflows (for the first month this year).

3) Focus: Alternative Strategies

This month we take a look at the Alternative Strategies (as distinct from traditional long only regional mandates). We look at the divergence of risk and return performance available in absolute terms, and relative to traditional mandates. The question we are seeking answer is whether the different strategies have produced materially different risk and return profiles to a standard mandate. Our findings are as follows:

- The returns for standard mandate real estate funds over the 3 year period are 6% to 15% and the maximum drawdown % ranges from -14% to -17%. For Alternative strategies (excluding Inverse and Leverage Funds) the 3 year returns are -3% to 18% and the maximum drawdowns are -10% to -31%.

- Over the 5 year period returns for standard real estate funds are 13% to 27% and the maximum drawdown -17% to -23%. For Alternative Strategies returns are 11% to 53% and the maximum drawdown -15% to -31%.

- This excludes Leveraged and Inverse strategies which extend the dispersion even further. We therefore conclude that these alternative strategies are indeed producing differentiated risk and return profiles and could usefully complement a core global real estate securities exposure. We are currently undertaking some research in timing strategies for blending these Core and Alternative strategies.

4) Detailed performance statistics by mandate for Q3 2018

This month we look at the data for October 2018. For each mandate we show: the dispersion of returns by Fund AUM, aggregate performance by size, active vs passive performance, Benchmark Index returns, and the best performing active funds above an AuM threshold for each mandate. For consistency, all returns are rebased in US$.

Finally, it is important to note that there are no recommendations or investment advice contained in this publication, and that it is not intended for retail investors. This report represents only a very small summary of the outputs of our database, and the bespoke research and advisory service work we undertake for clients. For further details of our work please contact us.