The report is divided into the following sections:

1) A summary of November performance

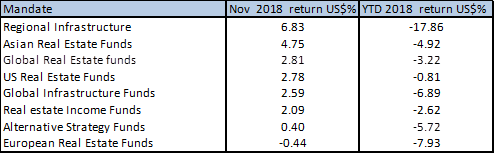

As can be seen from the table below, (which is ranked by average November 2018 returns for each main mandate) the last month was positive for most mandates, although average YTD returns remain negative.

2) Fund Flows

November saw outflows across all mandates, most notably for Income Funds and active Global real estate funds.

3) Focus: Risk metrics for funds

This month we take another look at the various risk metrics that can be used for real estate and infrastructure funds, and reprise the work that we first published in March 2013 on the various metrics available and their definitions. In summary we would suggest that the traditional measures such as the Sharpe ratio and the Information ratio are most appropriate and commonly used for dedicated real estate securities funds but market perception of “risk” now encompasses an appreciation of maximum drawdown as well as maximum and minimum monthly returns as appropriate measures.

Having established the principles and uses of each in the theory, we then look at their practical applications and establish:

1) How they have moved over time, and

2) How they vary between mandates

4) Detailed performance statistics by mandate for November 2018

This month we look at the data for November 2018. For each mandate we show: the dispersion of returns by Fund AUM, aggregate performance by size, active vs passive performance, Benchmark Index returns, and the best performing active funds above an AuM threshold for each mandate. For consistency, all returns are rebased in US$.

Finally, it is important to note that there are no recommendations or investment advice contained in this publication, and that it is not intended for retail investors. This report represents only a very small summary of the outputs of our database, and the bespoke research and advisory service work we undertake for clients. For further details of our work please contact us.