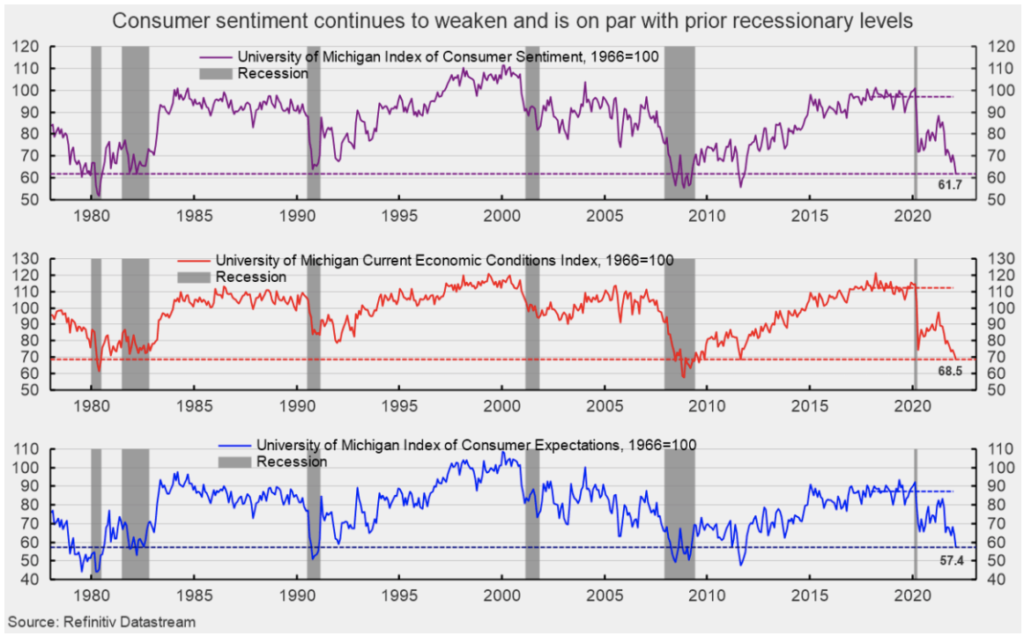

The preliminary February results from the University of Michigan Surveys of Consumers show overall consumer sentiment fell sharply in early February, hitting the lowest level since October 2011 (see top of first chart). The composite consumer sentiment decreased to 61.7 in early February, down from 67.2 in January, a drop of 8.2%. The index is now 19.7% below the year ago level and 36.5% below the 2018 – 2019 average.

The current-economic-conditions index fell to 68.5 from 72.0 in January (see the middle of the first chart). That is a 4.9% decrease and leaves the index with a 20.5% decrease from February 2021 and a 39.1% decline from the 2018 – 2019 average.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — sank 6.7 points or 10.5% for the month, dropping to 57.4 (see bottom of first chart). The index is off 18.8% from a year ago and 34.2% from its 2018 – 2019 average.

All three indexes are now below the lows seen in four of the last six recessions (see first chart).

According to the report, “The recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government’s economic policies and the least favourable long-term economic outlook in a decade.” The report goes on to add, “Importantly, the entire February decline was among households with incomes of $100,000 or more; their Sentiment Index fell by 16.1% from last month and 27.5% from last year.”

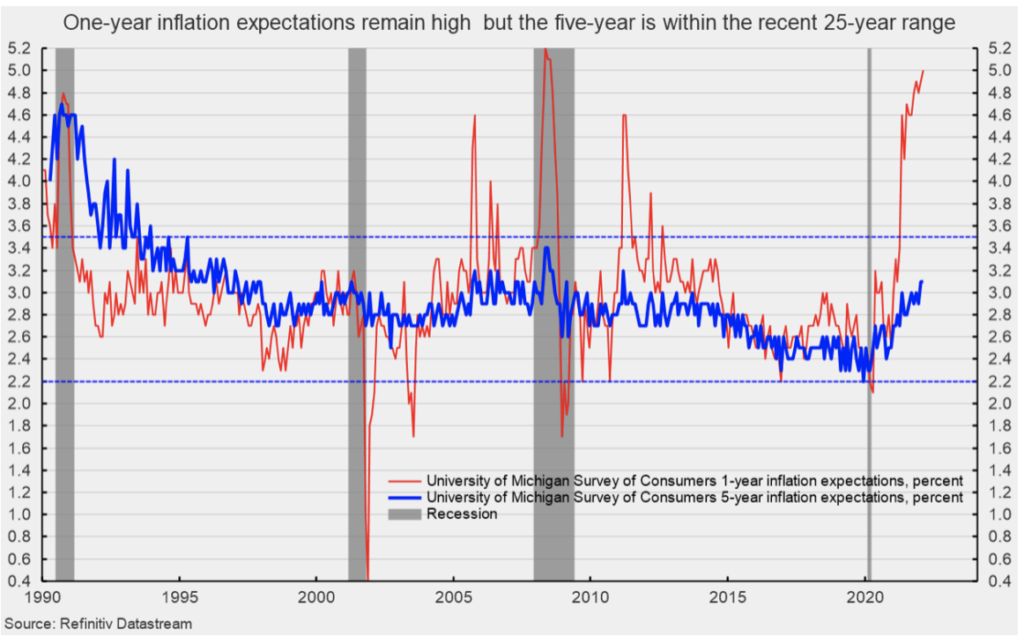

The one-year inflation expectations rose to 5.0% in early February, the highest level since hitting 5.1% in July 2008. The one-year expectations has spiked above 3.5% several times since 2005, only to fall back (see second chart). The five-year inflation expectations remained unchanged at 3.1% in early February. That result remains well within the 25-year range of 2.2% to 3.5% (see second chart).

According to the report, “The impact of higher inflation on personal finances was spontaneously cited by one-third of all consumers, with nearly half of all consumers expecting declines in their inflation-adjusted incomes during the year ahead. In addition, fewer households cited rising net household wealth since the pandemic low in May 2020, largely due to the falling likelihood of stock price increases in 2022.”

The report adds, “The recent declines have meant that the Sentiment Index now signals the onset of a sustained downturn in consumer spending. The depth of the slump, however, is subject to several caveats that have not been present in prior downturns: the impact of unspent stimulus funds, the partisan distortion of expectations, and the pandemic’s disruption of spending and work patterns.”

The substantial declines in consumer sentiment reflect the impact of higher consumer prices. The surge in prices for many consumer goods and services is largely a function of shortages of materials, a tight labour market and logistical issues that prevent supply from meeting demand. Price pressures will likely ease as production returns to normal and logistical issues are resolved, but the process may take an extended period. In the meantime, risks remain elevated with weak consumer sentiment due to rising prices, deep and growing partisan attitudes driving up hostility and intolerance among the general public and a soon-to-be-initiated Fed tightening cycle that increases the risk of a policy mistake.

Originally published by the American Institute for Economic Research and reprinted here with permission.