A global economy at a standstill, populations confined and hospitals overcrowded are the consequences of an unprecedented health crisis. A rescue plan is needed and recovery measures are crucial. The health and economic situations have imposed crisis management, leading to supply-chain disruptions. Companies must be saved or face the consequences. Policymakers still remember the great financial crisis pain and this is why emergency measures have been deployed to ensure the continuity of the economy; tax relief is being offered and longer payment terms are granted. But above all, credits are granted. The decision-makers have tried to deploy all possible means to soften the effects of this pandemic by pursuing a soft landing.

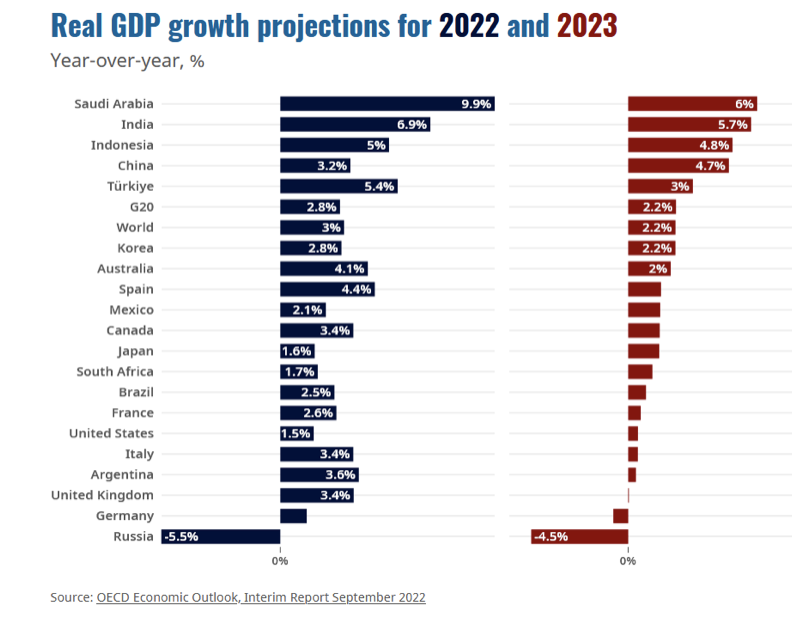

The global economy has been hit hard and when signs of a recovery start to appear, geopolitical turbulence has emerged, and companies are suffering the consequences. All the facilities granted during the crisis must be settled. Banks, the state and suppliers are the main creditors of any company. In addition to bank debt, companies can benefit from supplier debts. The major problem with this type of debt is that it links economic actors who are also linked by the operating cycle. We can therefore assume that the risk of default is twofold. In the event of a bankruptcy, the supplier will lose its receivables and its customer. A chain of bankruptcies can be triggered and a whole sector of activity can collapse. Indeed, depending on the sector of activity, a domino effect can be observed when a major player in the market goes bankrupt. However, this effect is less visible with tax and social security debts. Presumably, the state can provide a welcome boost by granting relief from tax and social security debts. But the insolvency of companies leads to a decrease in tax revenues. Between 2019 and 2020, the tax authorities of the OECD countries have suffered a loss of € 620bn and tax arrears of € 200bn (OECD 2022, Tax Administration 2022). As a result of this decline, a decrease in the levels of state investments and social benefits can be observed. Thus, the consequences will be wider and will affect all economic actors, including households. As a result, consumption, which could play the role of a precursor to an economic recovery, is in hibernation, as the following graph shows:

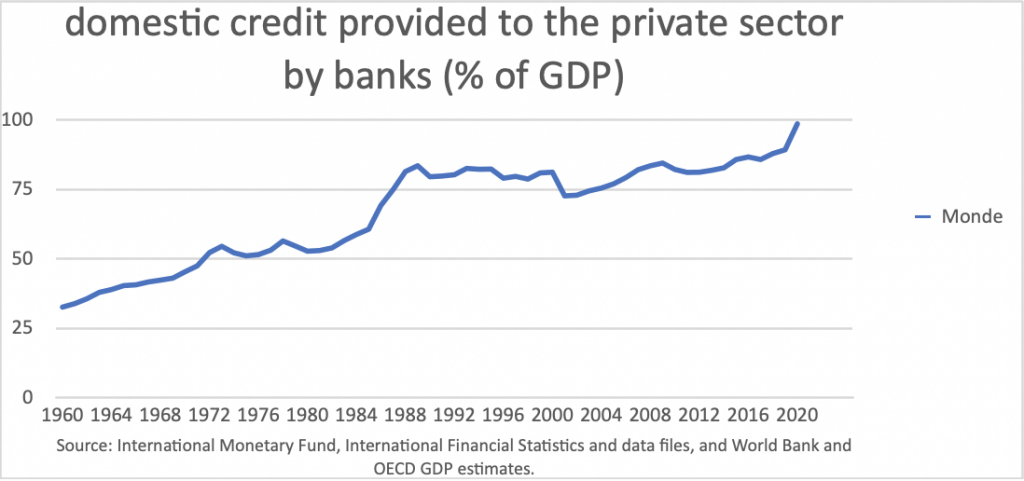

Regarding bank loans, we see a record level of credit granted to companies in 2020, reaching 98.58% of GDP worldwide.

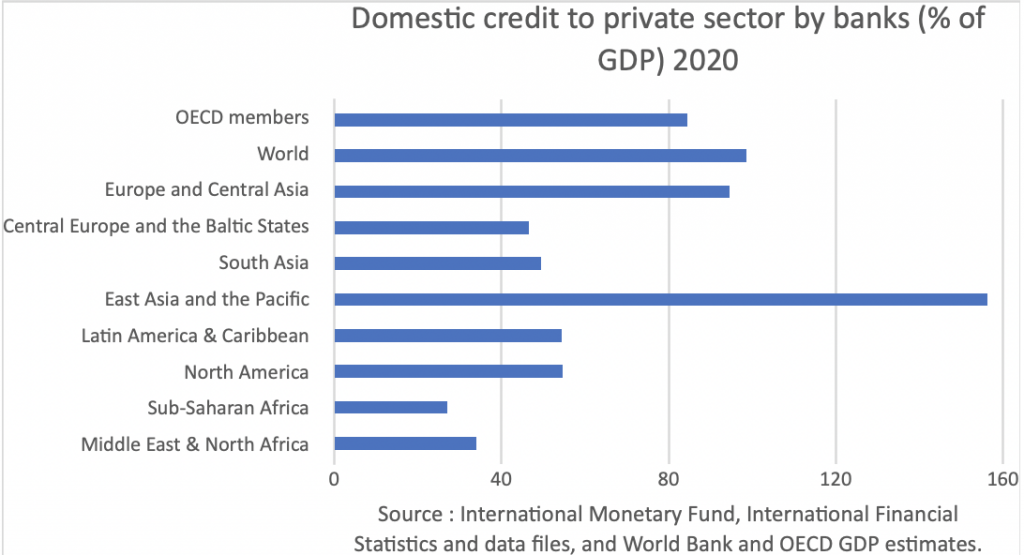

This level of indebtedness varies from region to region, but the trend is the same.

The consequences of these debt levels are multiple. Companies face additional expenses. Financial charges will affect investors’ profits. Debt ratios and cash-flow capacities will be weakened. The risks of such a situation can be felt over time with a decrease in the attractiveness of investments and an increase in overall risk.

The risks are not limited to investors, but also to other providers of funds. For example, creditors themselves, by extending credit to weak companies, can expect the latter to become insolvent. Creditors must be cautious in allocating funds and try to reduce the moral hazard associated with the funds granted. Some countries, such as France, have supported debt as an emergency measure, by guaranteeing credits granted to companies in difficulty. The previous period is no better than the recent one, because each one corresponds to a different crisis. It is true that we are almost past the health crisis. However, we are now facing another global crisis in the energy sector, which is interrupting the global supply chain and dramatically increasing production costs. As a result, companies are finding themselves unable to meet their commitments.

Declining profits due to a slowing economy, compounded by loan repayments, can lead to lower levels of self-financing for new projects.

Indeed, the banks, alerted by the increased risk, will refuse to grant more loans and thus will abandon the companies in front of their needs for a future revival. We are stuck between companies unable to repay current loans due to lack of means and banks that no longer provide these means due to lack of profits.

To conclude, we must admit the importance of loans to revive the economy and get through all crises. Bank loans play a real precursor role in maintaining economic development, but it is a double-edged sword because it is necessary to avoid finding ourselves in situations of overindebtedness. It is a delicate balance to be found between granting debts to avoid the collapse of companies and maintaining economic growth and rationing debts to avoid creditor bankruptcies. The current situation is alarming, given the fragile global economic and geopolitical situation. Will creditors agree to lend more in the hope of saving everything? Or will they stop at the risk of losing everything? The barrier is very thin, especially within the rate hikes…