Recently I was reading an article by LBX Investments explaining that “autonomous vehicles are expected to eventually have a transformative impact on our economy, our society, and numerous industries, including commercial real estate and by extension, retail.”

Whenever I hear someone talking about automated-driving technology, up until now, I have never made the connection between the impact to commercial real estate. My first impression has always been that driver-less cars are light years away and the technology has no impact to my REIT research.

However, I recently met with Stephen Bersey, senior technology analyst at MUFG Securities and he explained that the data that is utilized for autonomous vehicles will have an extraordinary impact to the data center REITs. He explained that the “average person generates around 650 MB of data a day, through use of PCs, mobile phones, and wearables, but by 2020 projections show that the average person will generate 1.5GB of data a day”.

Of course, I have no background in technology, so Bersey explained to me that “in an autonomous car, we have to factor in cameras, radar, sonar, GPS and LIDAR components as essential to this new way of driving as are piston rings and engine blocks. This means that each autonomous car will be generating around 4,000 GB (4 terabytes) of data a day”. That’s over 2500 times the amount of data that the average person generates today!

I began thinking about the technology behind the autonomous vehicle and the impacts. According to LBX Investments, “major corporations such as Alphabet (Waymo), Uber, GM, and Mercedes are investing hundreds of billions of dollars in self-driving technology and logging millions of miles in test drives”.

While this seems convincing, based on this corporate commitment, that we could soon be driving around like the Jetson’s, LBX believes full ‘Level 5’ automation, with no human involvement or usage restrictions, is, at best, more than a decade away from widespread implementation.

Most of the technology currently under development is defined as ‘Level 4,’ or high automation. As these technologies hit the open market over the next several years, they will gradually force real estate owners to contemplate changes to traffic patterns and consumer behaviors that could be quite meaningful.

For example, the potential elimination of billions of square feet in parking space, which could be repurposed to more profitable uses, is an oft-cited impact of the technology. With respect to shopping centers, some of the open questions retailers will need to consider include determining how automated vehicles will impact their supply chain decisions, in-store shopping experiences, and site selection.

LBX explained that “while automated vehicles may certainly become as mundane as cell phones and airplanes someday, the next 10-15 years are likely to be more of a period of experimentation and learning than widespread AV implementation. Landlords have plenty of time to react.”

Upon closer inspection on this topic, we believe that the blueprint for the technology is already being utilized as infrastructure is already being implemented to serve 5G network customers. In order to serve this growing demand (autonomous vehicles generate 2500 times more data per day than the average person today), cell tower and infrastructure REITs are expanding to serve customer needs.

By the end of 2018 AT&T plans to be the first to bring both a standards-based mobile 5% network and mobile 5G device to its customers. The company plans to bring mobile 5G to 12 cities this year, reaching at least 19 cities in early 2019. Also, Verizon and Samsung announced the world’s first successful data transmission using 800MHz bandwidth of 28GHz frequency, resulting in a maximum throughput of close to 4Gbps.

How to Play It? After researching the automated technology subject matter, I am convinced that the driver-less car with have a significant impact on communications REITs (cell tower, fiber, and data center). Think about it?

If you drive an automated car in 10 years, the amount of data that you generate will be over 2500 times the data utilized today (with your cell phone and computer). It’s almost impossible to forecast and quantify the impact to REIT earnings in 10 or 15 years, but it’s obvious that the demand for data is insatiable and that’s why we are enhancing exposure to these communications-focused companies.

Cell Tower REITs

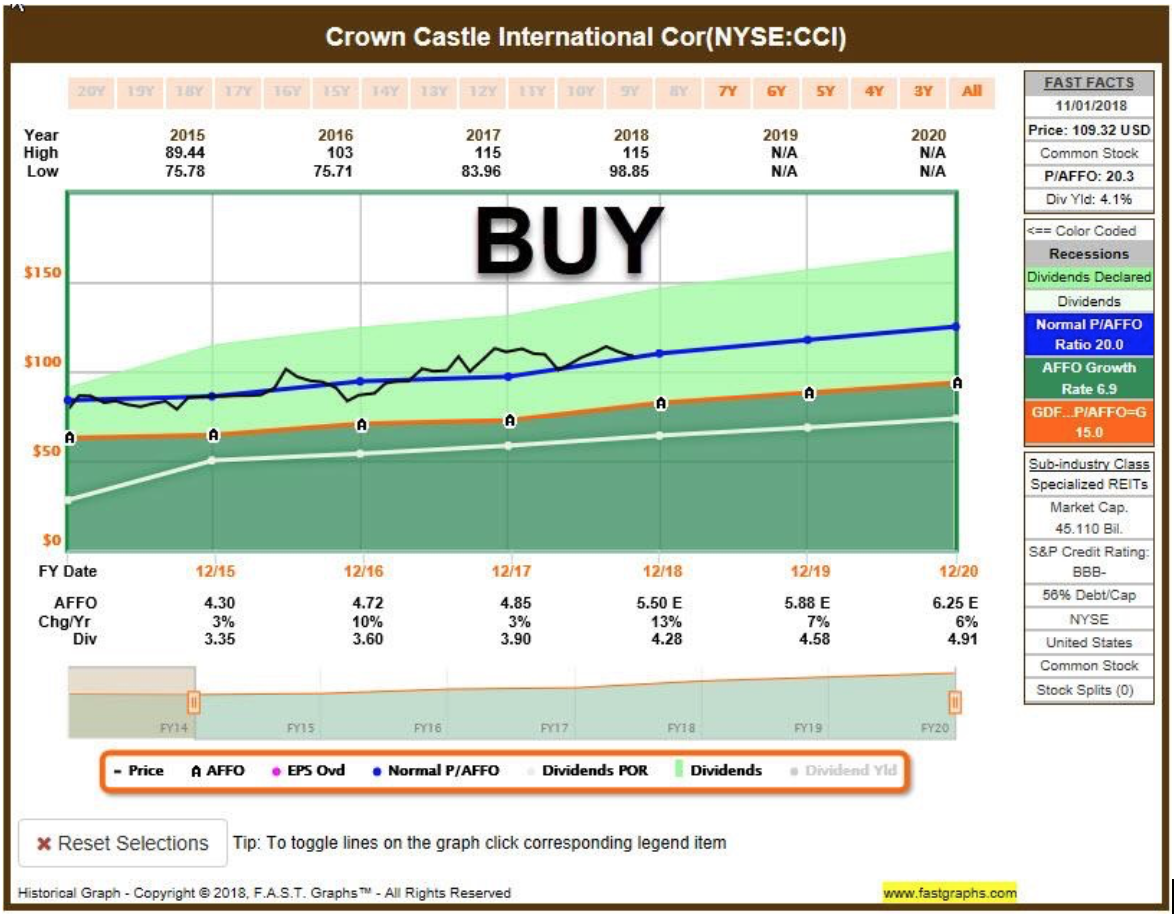

Crown Castle International (CCI) beat their 3Q estimates for AFFO of $568 to $578 million ($1.365 to $1.389 per share) by achieving a total AFFO of $579 million in the third quarter ($1.391 per share). This is a 26% increase in total AFFO from the previous quarter, which was $459 million ($1.21 per share). In addition, their 3Q EPS of $0.33 beats estimates by $0.06. The 4Q guidance indicates an estimate of $591 to $601 million in total AFFO. In addition, CCI declared a quarterly cash dividend of $1.125 per common share, representing an increase of 7% over the previous quarterly dividend of $1.05 per share. One highlight of the third quarter is the $52 million in Organic Contribution to Site Rental Revenues represents approximately 5.8% of their growth. Maintain BUY on CCI.

American Tower (AMT) beat Q3 beats FY guidance and raised total property revenue from $7.2B to $7.26B (was: $6.84B to $6.97B), net income of $1.285B to $1.315B (was: $1.275 to $1.335B), adjusted EBITDA, $4.58B to $4.62B (was: $4.255B to $4.315B), and consolidated AFFO of $3.47B to $3.5B (was: $3.2B to $3.26B). Since 2007 AMT has grown its U.S. segment free cash flow at an average annual rate of about 12% and the International segment free cash flow by an average of about 25%. Since 2007, AMT has grown consolidated AFFO per share at over 16% on average each year. Maintain HOLD on AMT (due to valuation).

Data Center REITs

CoreSite (COR) reported FFO for 3Q as $1.25 per share. The firm saw a 13.6% YoY increase in FFO. The firm also executed 120 new and expansion data center leases with an average rate of $193 per square foot. Other highlights include a 13.1% YoY increase in operating revenues per share and a 13.0% YoY increase in net income per share. Maintain HOLD on COR.

Digital Realty (DLR reported Q3 2018 FFO as $1.63 per share, an increase from Q3-17 FFO of $1.51. However, the Q2-18 FFO for the firm was $1.66 represented a 2% decrease between Q3 and Q2. Additionally, the firm closed on the sale of 360 Spear Street in San Francisco and entered into an agreement to acquire the leading data center provider in Brazil Ascentry. Maintain BUY on DLR.

CyrusOne (CONE) reported Q3 adjusted FFO per share of $.79 missing consensus by a penny and unchanged from Q3-17. Q3 revenue was $206.6M missing the average analyst estimate by $2.7M; up 18% from $175.3M in the year-ago period. Q3 net operating income was $128.9M, rose 15% Y/Y; adjusted EBITDA of $110.8M increased 16%; adjusted EBITDA margin 53.6% vs 56.2% in Q2 and 54.7 in the year-ago quarter. Upgraded CONE from BUY to STRONG BUY.

QTS (QTS) reported Q3 consolidated available FFO of $20.6M, down 46.6% (mainly due to one-time restructuring expenses), core available operating FFO was $35.5M, up from a year-ago $35.3M. Core adjusted EBITDA was $55M (up 19.8%); core NOI was $68.8M (up 17.2%). It reaffirmed 2018 guidance for FFO/share of $2.55-$2.65 and capex of $425M-$475M. Maintain BUY on QTS.

Equinix, Inc. (EQIX) reported Q3 revenues of $1.284 billion, a 2% increase over the previous quarter (11% year-over-year), Operating Income of $266 million, a 24% increase over the previous quarter, an operating margin of 21%. Adjusted EBITDA was $613 million, a 48% adjusted EBITDA margin, AFFO was $402 million, a 6% decrease from the previous quarter (includes $9 million of integration costs for acquisitions). Maintain BUY (with pullback) on EQIX.

How To Play It? Q3 was rough for data center REITs amid the broader technology sell-off and concerns over hyperscale competition (Amazon, Google, and Microsoft, etc..). Data centers are down by around 15% since last earnings season despite favorable earnings results from the REITs. Given the pullback, we are recommending all of the Data Center REITs, and we still favor the pair trade: CONE and DLR. (We upgraded CONE from BUY to STRONG BUY).

This article appeared previously in The Forbes Real Estate Investor Newsletter.