The route to enduring financial & sustainability out-performance.

Times are hard for real estate investors. Not only must they contend with higher interest rates and weaker economic growth, but they must also grapple with the impact of powerful structural trends that are reshaping performance. On one hand, occupiers are being more demanding than ever before on specification and sustainability criteria and are unwilling to compromise. On the other hand, financing, environmental and government impediments make it harder to find new development sites and deliver new supply.

The same trends which make it challenging though, increase the performance potential for investors who can facilitate the modern space occupiers need. That space is scarce, meaning that occupiers will pay a premium to access it. As the supply shortfall worsens, the premium will grow. That promises profitable returns for investors who can bridge the supply gap.

New asset requirements

Occupiers today have much higher expectations for the buildings they lease. Office occupiers need high quality space that can attract, retain, and engage sought-after workers who are empowered to work from home. They need offices which can facilitate hybrid working by providing a mix of environments, amenity, and seamless digital connectivity. Logistics occupiers are increasingly reliant on automation, operational efficiency, and fulfilment speed. That requires a modern asset which is power resilient, energy efficient, tall, well-doored, and situated close to customers.

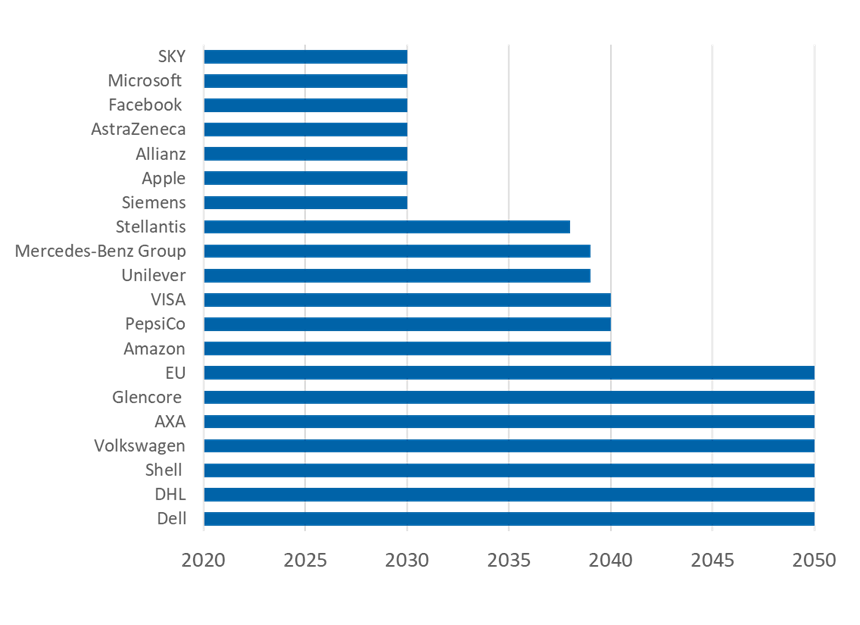

This is before we even consider sustainability. Responding to customer, worker and investor expectations, occupiers in all real estate segments are making serious carbon neutrality commitments alongside tangible ESG goals (Figure 1). This necessitates occupying assets with the highest sustainability credentials that minimise their environmental impact, promote staff health and wellbeing and which are integrated into their local communities. These are radically new asset-specific considerations.

Source: Cromwell Property Group

Increasingly unfit for modern occupation

Given the sheer pace of change, most European commercial floorspace falls far short of modern occupier expectations. What was considered a top of the range asset five years ago may not make the grade today. As occupier demand increasingly polarises onto the best quality space at the expense of secondary space, the acute undersupply will deteriorate further. New specification criteria is evident in a range of areas such as access to power, internet connectivity, transport links, floor-to-ceiling/eaves heights and amenity provision, but it is most apparent for sustainability.

BREEAM and EPC certifications are being used by occupiers to establish minimum sustainable thresholds below which they will not go. However, only 20% of European office stock was BREEAM certified as recently as 2021 and only 27% is rated above an EPC B. This reflects the dated nature of existing space which was built for a different era; only 24% of European offices were constructed post-2010.

Despite a large volume of new supply being built recently, the supply shortfall for logistics is just as acute. Only 22% of existing stock in the UK is rated EPC B or above according to Savills, with energy performance especially poor in units of below 100,000sq. ft/9,000sq. m. The situation is similar in Europe. As a result, 40% of logistics occupiers state there is currently a lack of suitable space.

The result is competitive bidding for quality assets, rising rents and lower yields. BREEAM certified logistics assets command a 30-basis point yield premium to the European prime logistics average according to CBRE. It has higher leasing velocity and shorter voids too. Analysis by JLL on the Central London Market has established that green certified offices achieve a 21% higher sales value and 11% higher rent. Stock which meets sustainability criteria and the other stringent specification requirements that occupiers expect already outperforms. That outperformance will only grow as the supply crunch widens.

New routes to performance

To increase supply, new space is needed, especially in the cities and their surroundings where demand is strongest. However, it is precisely in such locations that development sites are in shortest supply. Minimising real estate’s sizeable carbon emissions means that we can no longer demolish and reconstruct buildings when their existing use becomes unviable. We must seek to retain and adapt their existing structure for new uses instead. Most of the increasingly targeted occupier demand will therefore need to be fulfilled within existing buildings and on brownfield sites. It follows that the best performance from both a financial and sustainability perspective will be captured by investors who own or can acquire suitably located assets or sites with densification potential.

These include secondary offices in vibrant macro and micro locations where occupiers and their staff want to be. Poor quality offices with good physical characteristics such as generous floor-to-ceiling heights, central cores and regular floorplates can be repurposed as prime or super prime space relatively cost-effectively if you know how. The embodied carbon saving from such a brown to green conversion provides a compelling occupational draw too.

Logistics outperformance beckons for assets whose use can be intensified in the near future as lease events occur, or which can facilitate multi-storey logistics, a segment which is becoming increasingly viable. So too will urban industrial sites that can be redeveloped for mixed-use purposes to deliver much needed new logistics, office and living uses.

The scarcity premium can be accessed through densification

Successful space is less generic than ever before as occupier operational and sustainability expectations have evolved rapidly to focus squarely on a specific type of stock. That stock is heavily undersupplied in a European commercial market that was largely designed for a pre-technology, pre-ESG era. With occupiers unwilling to compromise and government authorities resistant to new greenfield development and building demolition, the existing shortage of quality space suitable for modern occupiers will only deteriorate further..

The solution is to facilitate new supply by densifying existing assets, either through their adaptive reuse or through comprehensive redevelopment of urban sites capable of delivering substantial new supply. Investors who own or can acquire assets and sites suitable for densification will capture the scarcity premium and benefit from sustained occupier demand. This will manifest in stronger rental growth, higher valuations, and greater liquidity. Densification is the route to enduring financial and sustainability out-performance.