Many of you will be aware that the Prime Central London residential property market has been falling since June 2014. I know this better than most because I compile a quarterly index that measures the performance of both Prime Central London residential prices, as well as “Emerging” Prime Central London residential prices (an area of south and west London that abuts prime that investors now treat as a satellite of Prime).

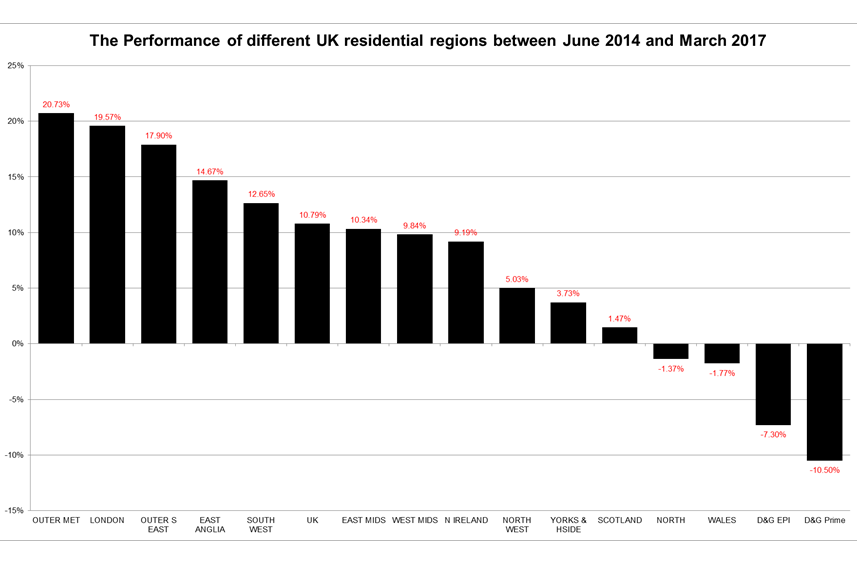

On the chart below you will note that whilst the Prime and Emerging Prime areas of London have fallen over the last three years, the areas moving out of Central London have actually been rising.

The data used for the chart is taken from the Nationwide regional quarterly house price index; special mention should be made of the fact that their definition of “London” encompasses the weak Prime Central region – which means that the capital’s suburbs must have performed extraordinarily well to produce the number (+19.57%) below.

The rate of divergence between these different areas over this relatively short period will surprise many – but is clear evidence that the UK property market isn’t one homogenous block, and that a broad array of factors have impacted UK residential property prices over the last three years.

Source: Nationwide, D&G Indices.