One of the eternal questions posed in the canon of real estate academic literature is whether specialism pays, and if so, for who? In the case of Principals this would be defined as higher returns/valuations relative to a benchmark. In the case of Agents – or Capital Markets Professionals in today’s parlance – this would be defined as having a higher relative proportion of transaction revenue due to superior insights and knowledge of one area of the market.

The agent’s perspective

Historically, pre-the commoditisation of real estate data, agents held extremely detailed information about their specialist market, which they guarded jealously, as it was their USP and path to revenue generation. Over time, this information about transactions, and assets, once lovingly collected and hoarded in physical ledgers, has become widely available either through free or subscription services, where within seconds, photos and all relevant details of a building are immediately available.

This ease of access and availability allows the real estate market to become like the equity market, where all relevant information is required to be publicly available, with the subsequent assertion that all publicly available information is therefore captured in the share price/property valuation. The trend has therefore been from opaque to transparent in terms of publicly available information.

The asset owner’s perspective

From an asset owner perspective, the majority of listed real estate companies were historically diversified either by asset type or geography. The idea being that if a company’s management team wanted to go off and buy a building in Hawaii, develop schemes in the energy boom/bust cities of Dallas or Calgary, or develop an office building in Manhattan then off they toddled and did just that. Specialism was not seen as a virtue. Diversification was.

The theory was that diversifying reduced risk. I am not entirely convinced that history would prove that supposition correct in the case of the UK and European listed real estate sector but hey ho, we shall park that thought for the moment. In the 10 years between the end of the GFC and the beginning of COVID the broad trend was for LRECs to increase their specialism and focus, along the broad outline of their private market counterparts.

So where are we know?

In terms of data, we are now starting to return to the era when specialists could monetise their knowledge. How so you ask? Surely there is a deluge of information on offices, shopping centres, and warehouses. Well, there is indeed, and for those that we can call Old Core/previously cherished sectors that is true. However, are these the sectors that investors are buying or indeed are growing? No they are not.

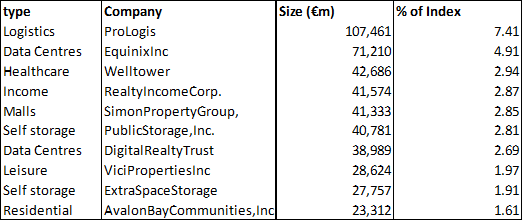

The sectors that are growing, where people are deploying capital and desperately want specialist information are what we can call the Modern Core/Alternative sectors such as residential, data centres, healthcare, student accommodation, self-storage and so on. How do we know that these sectors will remain relevant and attract capital? As a starting point we can look at the sectors owned by the largest LREs and assume that the largest have attracted the most equity capital and therefore exhibit greater growth prospects.

Looking at the largest listed real estate companies in the world at the moment, we can observe three points from Figure 1:

- They are ALL from the US;

- They are all specialist;

- Eight out of ten are from the Modern Core sectors.

Source: EPRA

Implications

The implications appear to be clear that specialist knowledge of the superior growth Modern Core sectors is rewarded from an asset owner’s perspective. But where does that leave agents and the issue of data availability? The answer is that the specialist information role has moved away from publicly available information towards the specialist asset owners and agents. All of the Modern Core sectors appear to have a combination of barriers to entry and operational aspects to the returns that mean information has turned back from transparent to opaque.

If you wanted to understand current pricing in, say, Data Centres, would you be able to access this via traditional property sources? Possibly, and you could certainly use the publicly traded REITs as a useful source, but the most informed sources of the health of the sector would be the owners of the operators as well as the assets. Similarly, the best indication of the performance say the Self-Storage sector would again come from regular scrutiny of the operator’s cash flows rather than generally available information.

Therefore, I would argue, in order to understand current – and predict future – pricing for these Modern Core sectors, new sources, in addition to pure real estate transaction data, are required. On that basis the competitive advantage of existing owners in these preferred sectors is likely to continue as the Knowledge Transfer can be controlled, and it is expected that Specialism in these areas for both owners and agents will continue to pay.