Here’s how it played out.

Originally published March 2022.

It’s impossible to predict how the crisis in Ukraine will progress, but the rupture in relations between Russia and the West is unlikely to heal any time soon. At the very least, trade between these two sides is going to be badly affected for a long time. To get a sense of how the global economy might function in the coming months and years, it makes sense to look at what happened during the Cold War.

It’s difficult to make exact comparisons, but the relative economic power of the two sides was very different in that era. In 1979, just before the start of the Soviet-Afghan war, the Soviet Union accounted for 9% of world GDP. In contrast, Western Europe, the US, Canada, Australia and New Zealand accounted for about half.

Today, Russia accounts for about 3% of world GDP, while the EU (now incorporating much of Eastern Europe) plus those other countries accounts for 40%. So while both sides have clearly been squeezed in overall global economic importance by the rise of particularly China, Russian interests have fallen further.

Russia and Europe

Russia and Europe have much closer economic links than Russia and the US. Russia is the fifth largest export destination for the EU after China, the US, UK and Switzerland; and the EU is Russia’s largest export destination – followed closely by China. On the other hand, Russia doesn’t even break into America’s top 25 largest export destinations, while America only buys 5% of Russian exports. This is broadly similar to how things were during the Cold War.

The trading relationship between Russia and Europe has a similar composition to during the Cold War era. Raw materials move west and manufactured products like cars, heavy machinery and pharmaceuticals move east.

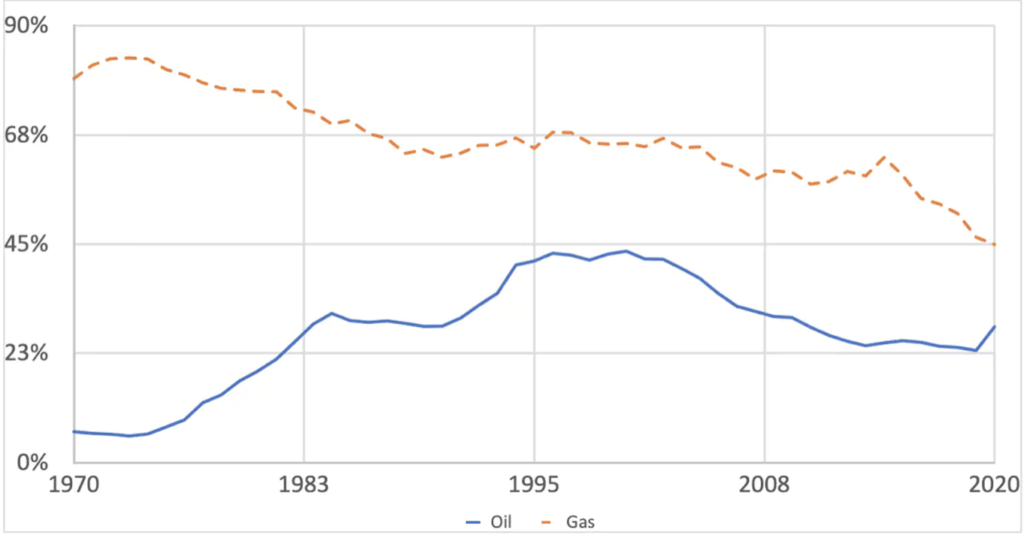

Western Europe has been dependent on Russia/USSR for oil and natural gas throughout the fossil fuel era. The chart below shows to what extent Western Europe has been self-sufficient in oil and natural gas since 1970. As you can see, its natural gas supplies (in orange) have steadily declined throughout this period, while oil (in blue) has been moving in the same direction since the mid-1990s.

Western Europe’s self-sufficiency in oil and gas (%)

The reality is that Western Europe’s fossil-fuel production in the North Sea has never been enough to cover its ever-growing needs: its natural gas consumption has doubled over the period, while its oil consumption has gone up between four and fivefold. The current situation is that Western Europe needs to import 75% of its oil and 50% of its gas, and Russia fulfils most of this requirement.

If these are the similarities, I see two important differences between now and the Cold War era. First, we live in a more globalised and integrated world than ever before. After the Second World War, trade started to grow. Today the sum of exports and imports across nations amounts to more than 50% of the value of total global output, compared to 30% in 1979.

During the Cold War, the USSR was also much more closed off. Only about 3% of its GDP came from exports and over half was to other Warsaw Pact countries. Russia is significantly more open now, with 25% of GDP made up of exports. For both these reasons, Russia is somewhat more vulnerable to international sanctions than in the past.

The conflicted alliance

Just like today, the US was generally more enthusiastic about sanctioning the Soviets than the more dependent Europeans. In the earlier decades of the Cold War, the American embargo on trading with the Soviet Union was quite severe, hitting lows as a result of events like the Korean War (1950-53) and the Cuban missile crisis of 1962.

With the growing detente of the 1970s, the restrictions were relaxed to some extent. For example, the USSR, which was not self-sufficient in food, was granted permission to buy large amounts of American wheat when its crops failed in 1973.

But US restrictions were tightened again after the Soviet invasion of Afghanistan. In 1983, President Ronald Reagan approved National Security Decision Directive 75, which used economic pressure to limit the Soviets’ foreign policy and military options.

Stricter trade sanctions led to considerable conflict with America’s allies on the Coordinating Committee for Multilateral Export Controls (COCOM), especially over the export of oil and gas equipment. France and Japan were particularly unhappy – less so West Germany, which was more closely aligned with the US. These nations and others lobbied successfully for more and more goods to be exempted from the restrictions, which undermined them to a fair extent.

Where we go from here

Today’s trade restrictions against Russia have probably surpassed the Cold War measures. Russia is currently the world’s most sanctioned nation, having surpassed Iran and North Korea with nearly 3,000 new sanctions since the invasion.

One important question for the Western alliance is whether the EU is able to introduce, in the words of European Commission president Ursula von der Leyen, “measures to further isolate Russia”. Given that the next step is probably a ban on oil and gas exports, it seems unlikely.

Even if the US (and UK) persuaded the EU to join the ban that they introduced earlier in March – which is already telling you something – it is hard to believe that it would last long. Imagine halving your energy consumption and still paying more.

If it does happen, it is likely to become a question of whether Europe can last longer without Russian fuel than Russia can last without European machinery and pharmaceuticals. It’s hard to predict how that plays out, but it would come with a lot more inflation: many people, including those of us on lecturer’s salaries, would have to seriously look for a second job.

Originally published by The Conversation and reprinted here with permission.