Achieving net zero emissions has a long way to go.

Some of the historical events accentuating the recent decade is the threat of pandemics and the urgency towards embracing common environment policies. Both points have either shaped or affected in various ways our current and future economic outlook. The expectation that the coronavirus rampage is going to end soon has not particularly materialised as of yet, but there are many good signs emerging globally. Now, however, we can observe the aftermath of the sudden economic downturn.

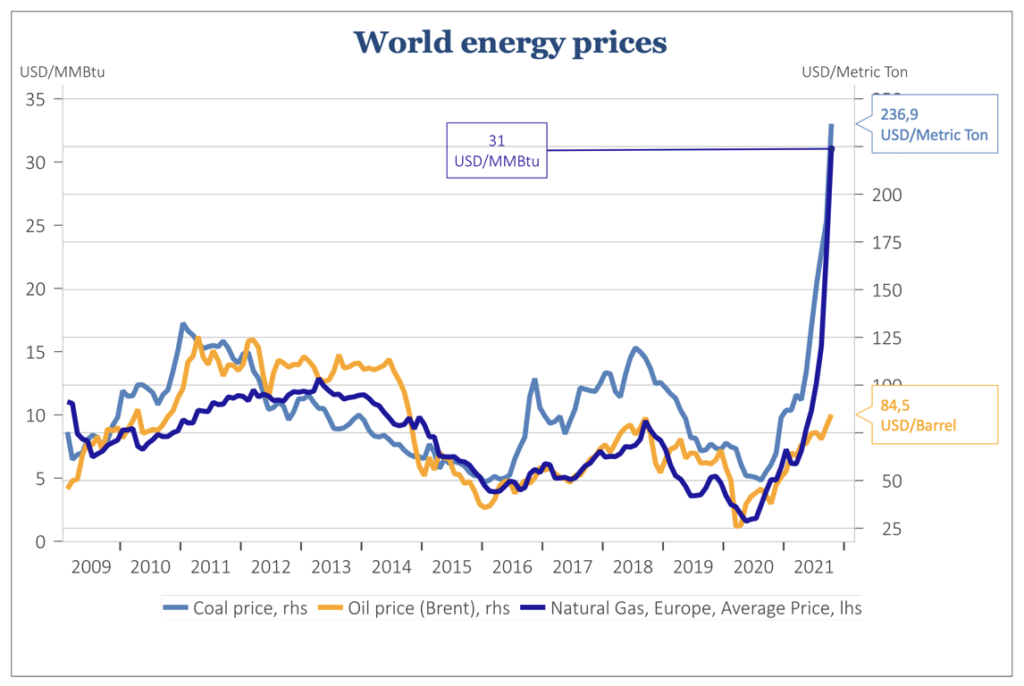

An increase in demand for energy commodities is usually a good sign of economic growth and recovery. The usual scenario is that recessions are expected to lead to a reduction in production capacity because of an assumed slump in demand. But the stimulus programmes implemented by many countries have helped accelerate recovery and maintain demand to a certain degree. Also, the asymmetrical policies by some countries opening up while others resume lockdown measures contributed to the global logistical havoc of an over-efficient supply chain. It is also worth mentioning that these issues in some instances are not solely logistical in nature but political as well.

The first chart gives a glimpse of the surge in energy prices of oil, natural gas and coal. Coal, the energy commodity of the past, has been in decline for many years now. Developed countries have been reducing their dependence on coal as they move towards more environmentally sustainable energy products as well as other fuels that produce less emissions. It is, however, not the case for developing countries, like China, that continue to depend heavily on coal.

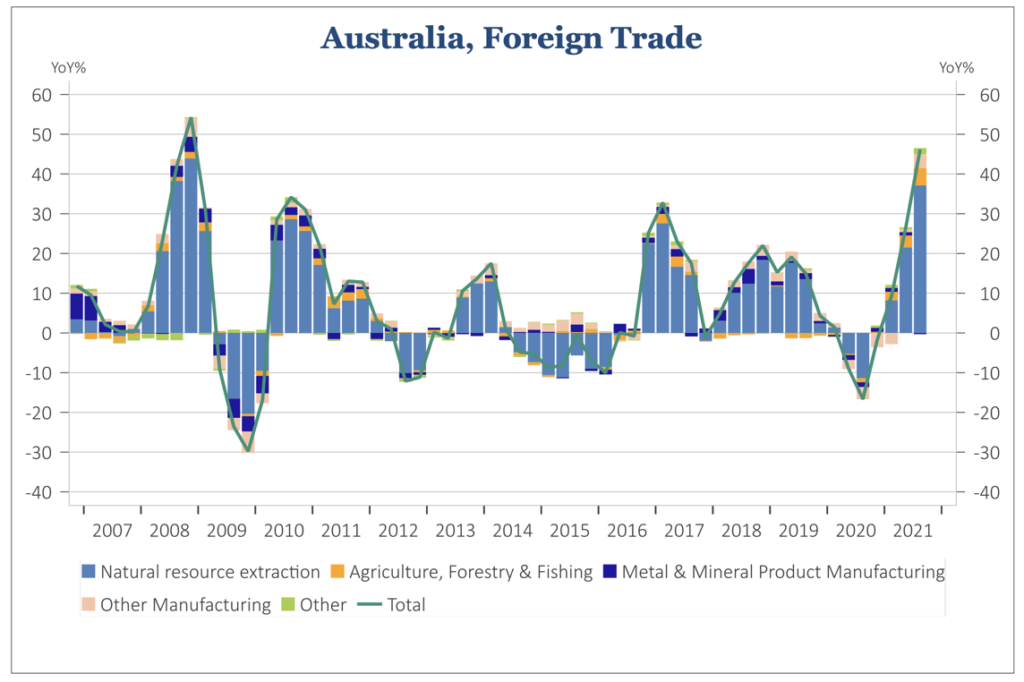

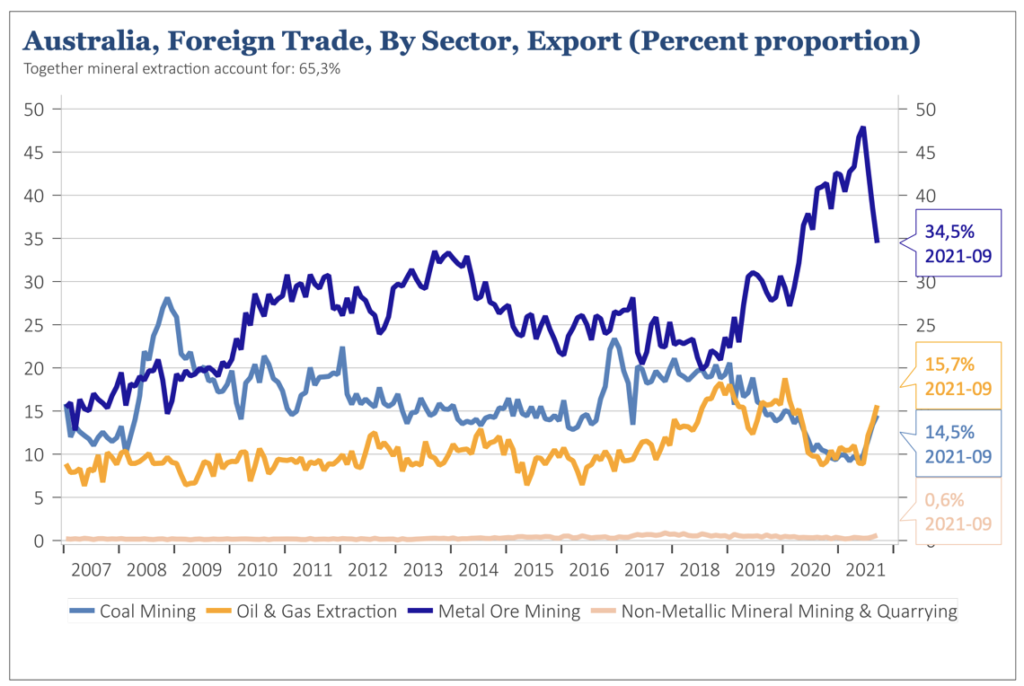

The climate policies agreed by world leaders in their latest summit meetings can only be realised if all countries fulfill their set plans towards net zero emissions. It is therefore, a difficult task not only for carbon emitter countries, but for countries that are outsourcing their emissions. The next two charts show Australia’s export growth components since 2007. The component that is visibly growing the most in the first chart is natural resource extraction, especially since the beginning of the pandemic.

Mineral extraction exports account for 65.3% of all goods export as of September 2021. Oil, gas and coal account for around 30% of total exports. The growth in fossil fuel demand resulting in the rise of prices is a great incentive for exporting countries to increase supply.

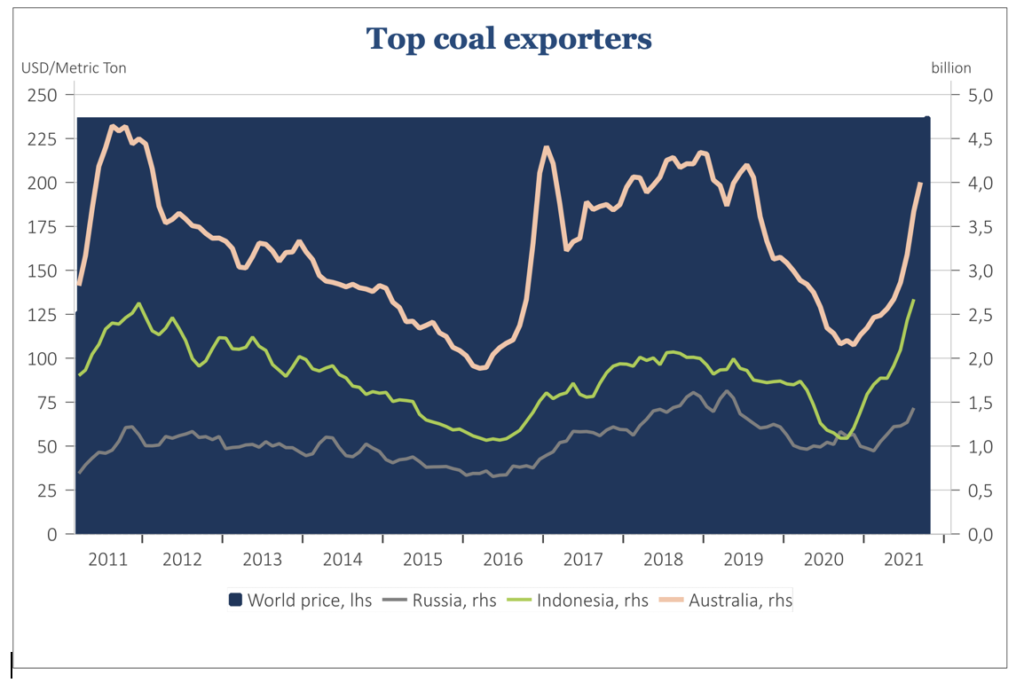

The next chart shows the effect of coal price growth on coal exports from the top three global coal exporters. There is a visible surge in coal exports by Australia, Indonesia and Russia since 2020 following the rise in prices.

Developed countries have found ways to align national economic interest with national environmental policies, while in some instances externalising pollution to other countries. There are many factors aligned against achieving net zero emission goals, both economic and political in nature. As many countries are implementing tough measures to tackle the coronavirus pandemic, the same is required by all countries to achieve emission goals in the coming decade.