Falling below the red lines.

Evergrande, the most indebted real estate company globally, faces mounting bankruptcy risks as the company has defaulted on payments and struggles to meet its financial liabilities of over US$300b.

Evergrande’s financial woes surfaced not long after the People’s Bank of China (PBOC) and the Ministry of Housing introduced new financing rules in August 2020, after home prices surged sixfold in over 15 years. Arising from fears of a property market collapse, the Chinese government tightened regulatory control over real estate developers through “three red lines”, before any developer can refinance their debt:

- 1) 70% ceiling on liabilities to assets,

- 2) 100% cap on net debt to equity, and

- 3) cash to short-term borrowing ratio of at least one.

Consequently, developers have been tirelessly rebalancing their investments by offloading their non-core businesses and cutting prices to shore up cash and meet the tightened measures.

Evergrande’s plight first came into the limelight in September 2020 when a letter the company had reportedly sent to the Guangdong provincial government warning of its potential liquidity issue emerged. Evergrande is China’s second-largest property developer by sales, with more than 1,300 residential developments across 280 cities in China and another 3,000 projects under planning. In recent years, the company has diversified into other sectors such as F&B, electrical vehicles, theme parks, healthcare services and media production.

While the company disputed the letter’s authenticity and subsequently averted any crisis when a group of investors waived their rights to force repayment, the underlying liquidity issue has resurfaced again. Evergrande has failed to meet its short-term debt obligations and struggles to complete its projects, leaving potentially over 1.4m purchasers without a home.

Given the social implications, the general opinion is that the government would intervene and restructure Evergrande. Some company assets could be sold to state-owned enterprises or other developers to raise cash, complete the unfinished housing projects and protect the small investors. An unmanaged messy collapse or direct government bailout would be unlikely, with the former having a significant impact on China’s economic and financial stability. At the same time, the latter will undermine the government’s efforts to instill greater financial prudence in the property sector.

Impact on China’s property market should be contained.

The Evergrande crisis is likely to be contained within its supply chain, with some spill-over effects to other Chinese residential developers and smaller banks should there be a freefall in home prices in a fire sale. According to a UBS report (UBS, “China’s three red lines”, January 2021. https://www.ubs.com/global/en/asset- management/insights/china/2021/china-three-red-lines.html) in January, only 6.3% of S&P rated developers could fully comply with the “three red lines”, and those with CCC-ratings would likely struggle to turn around.

However, the contagion effect should be manageable, as most residential developers are financially more robust than Evergrande. After the introduction of the “three red lines” by the Chinese authorities last year, many developers had already taken steps to reduce their debt obligations by selling down their assets at discounts, offering equity shares and reducing their spending. According to a Bloomberg report (Bloomberg, “Evergrande fails ‘three red lines’ test as peers improve”, 13 April 2021. https://www.bloomberg.com/news/videos/2021-04-13/evergrande-fails-china-s-three-red-lines-test-video) in April, while only 14 major developers could meet these new regulations when they were introduced, this number has increased to almost half of China’s 66 major developers by the end of 2020. In contrast, Evergrande has only been able to satisfy one of the three metrics by August 2021 (South China Morning Post, “Chinese developers to focus on debt reduction until 2023 to meet ‘three red lines’ deadline”, 30 August 2021. https://www.scmp.com/business/article/3146791/chinese-developers-focus-debt-reduction-until-2023- meet-three-red-lines). The Chinese property market is also highly fragmented, with no developers having a significant market share. According to Fitch ratings (Fitch Ratings, “Credit Event at China’s Evergrande Could Have Broader Effects”, 14 September 2021. https://www.fitchratings.com/research/corporate-finance/credit-event-at-chinas-evergrande-could-have-broader-effects-14- 09-2021, Evergrande only accounts for 4% of the total annual sales market in 2020 despite its size, so systemic risk is likely to be contained). As Chinese developers have limited exposure to commercial real estate, the impact on the commercial sector should also be muted, even if regulatory conditions were to tighten. According to a recent Standard Chartered credit note (Standard Chartered Global Research, “China property – revisiting the ‘three red lines’”, 14 September 2021), a handful of other Chinese developers have also crossed the limit when commercial bills are included as debt – a possible next regulatory tightening as reported by Cailian Press. These include Central China, Greenland Holdings, Guangzhou R&F, Jiangsu Zhongnan, Sunac and Yango. Like Evergrande, these developers have little exposure to income assets as compared to their development business.

According to data from RCA, only a small portion (10%) of these eight developers’ current real estate holdings (in transactional value terms) are in completed projects (office, retail, hotel, residential units). They are also in secondary locations such as in the outskirts of core cities and non-core cities. In the larger scheme of things, this current liquidity crunch is unlikely to cause much of a drag on the values of these investment holdings.

However, the hardened liquidity could stifle developers’ interest in non-residential assets, especially when the market is peppered with rumour of further regulatory tightening. The upside is we could expect developers to undertake more non-residential developments in the longer term.

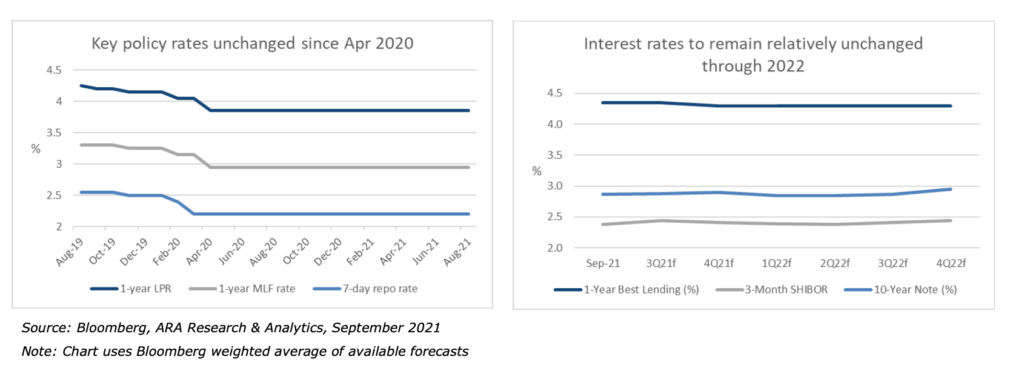

Meanwhile, Evergrande’s fallout could also result in higher financing costs for property developers in the short term, as banks become stricter with their loans, especially for smaller and weaker developers. Based on our analysis, China’s three key policy rates have remained unchanged since they were lowered in April 2020, during the early days of the Covid-19 pandemic. These include the one-year loan prime rate, one-year medium-term lending facility rate and seven day reverse repurchase rate.

The Evergrande crisis poses a limited risk to China’s interest rates and banking system for two reasons. First, according to a recent DBS report (DBS, “Opportunities in China bank credit”, 24 Aug 2021. https://www.dbs.com.sg/treasures-private-client/aics/templatedata/article/generic/data/en/GR/082021/210824_insights_credit.xml), China’s non-performing loans (NPL) ratio among commercial banks is relatively low, easing to a three-year low of 1.76% in 2Q2021. As a comparison, the CEIC data shows the US’s NPL ratio has risen due to the Covid-19 pandemic, hitting 1.63% in 4Q2020.) Secondly, the PBOC has moved to prevent a short-term liquidity squeeze and has other means to avoid such a scenario. Recent measures include a surprise cut in the required reserve ratio (RRR) by 50bps to a weighted average of 8.9% in July 2021. This cut in RRR released roughly RMB1tn in long-term liquidity to support slowing economic growth (

7 Reuters, “China frees up $154 billion for banks to underpin economic recovery”, 9 Jul 2021.

https://www.reuters.com/article/us-china-economy-rrr-cut-idUSKCN2EF0U4). Additionally, in September 2021, the PBOC injected RMB90bn in short-term liquidity via reverse repos. The move was to help ensure ample liquidity in the banking system amid concerns over Evergrande’s debt issues (8 Xinhua, “China’s central bank injects liquidity into market”, 17 Sep 2021. URL: http://www.news.cn/english/2021- 09/17/c_1310193246.htm).

Bloomberg data shows market expectations for key China interest rates to remain relatively unchanged through 2022. Yet, rate cuts are possible as domestic Covid-19 outbreaks, the regulatory tightening on internet companies and the Evergrande saga impact China’s economic growth. Some economists affiliated with the Chinese government see the potential for rate cuts, especially since the government’s curbs on debt growth means the PBOC can ease policy with fewer financial risks (Bloomberg, “China faces contrarian calls for a surprise interest rate cut”, 12 Aug 2021.

Other market observers believe another RRR cut is on the cards following the surprise reduction earlier in July this year (CNBC, “China leaves benchmark interest rate unchanged, as expected”, 19 Aug 2021.

https://www.cnbc.com/2021/08/20/china-leaves-benchmark-lending-rate-unchanged.html)

.

Feeling the pebbles as we cross the river.

While it is not the intention of the Chinese government to disrupt the financial market, the “three red lines” is crucial for a more sustainable property market. The Japanese property bubble of the mid-80s is not an event any government would want to replicate.

Some market observers have suggested that the three policy thresholds could be tightened gradually as the Chinese government continues to rein in excesses in the residential property market. However, we do not expect any policy adjustment anytime soon, but most likely after the current liquidity crunch has been placated.

This current Evergrande saga could, however, impact consumer confidence somewhat. The company directly provides employment to over 200,000 people and up to 4 million subcontractors for building construction every year. The company also holds deposits for 1.4 million properties that might not be delivered to the buyers.

An Evergrande default could result in mass retrenchment and loss of savings for buyers. The Chinese government is thus most likely to manage its default to minimise the fallout, especially with an anticipated slowdown in China’s economy due to the Delta virus outbreak.

Any spillage to the non-residential market is likely limited in impact although investment interest could be clipped. Policy rates are not expected to have any upside surprise in the short term, especially when there is still adequate headroom for other policy interventions.

Evergrande’s experience would serve as an early warning to all developers to rein in their debts quickly until the dust settles.

Across our portfolio of assets in China, which are largely located in Tier 1 cities, there is no direct exposure to Evergrande. We have not seen any major disruption arising from this recent fallout. The quality of our assets and our strong relationship with our lenders have helped us to successfully renew our loans at reduced, if not same, pricing. Regardless, we remain vigilant, actively managing our assets and tenant relationships while staying mindful of the risks as the situation unfolds.