Butterfield Mortgages Ltd is the UK property finance subsidiary of the Butterfield Group, the 150 year-old Caribbean bank, which is also listed on the New York Stock Exchange. Its CEO, Alpa Bhakta, is a phenomenon. She entered the financial sector aged 16 – and has been there, seen it and done it; and done it with verve and passion. Today, her core market is mortgage lending to High Net Worth clients (HNWs) buying residential property in London and the prime home counties. Such is the demand, Alpa has to keep hiring;and “we are picky because we need skills and personality. Everything we do is about relationships”.

Starting out

“In 1988, the Holborn Circus branch of NatWest Bank employed around 120 people. It was a different era. In today’s branches you are lucky to meet even one bank employee”.

Alpa was 16 at the time and, against the wishes of a strict Indian family, she took her first step into the workforce. Alpa’s father did not want her to leave school. He wanted her to be an accountant. But Alpa says “yes, I missed out on the experience of going to college as a young person, but starting work at NatWest aged 16 was the best thing I ever did. I learned the nuts and bolts of financing”.

“Starting work at NatWest aged 16 was the best thing I ever did”

Simultaneously with joining NatWest, Alpa enrolled to study – two nights per week for two years – for the BTEC National in Business and Finance. This covered everything from accounts through marketing to dealing with people.

At NatWest, Alpa started at the bottom in “the machine room”, processing cheques and the like. From there she moved to looking after clients’ accounts and troubleshooting – followed by a spell at NatWest’s Premier Centre, where customers needed to be earning £50,000 a year to be included.

Alpa stayed nine years at NatWest Holborn Circus, which even then was unusual. “But there was no scope to move functions”.

Private banking

“Life was simple. Client relationships were built on mutual trust and no one had heard of KYC”

Like all of her jobs, they have tended to come to Alpa rather than the other way around and, in 1996, through a contact and word of mouth, she joined Crédit Agricole Indosuez (CAI) and its Private Banking Division as an assistant to one of their managers. The team specialised in East Africa and, with her origins, it was assumed that there would be a cultural fit with the share dealing client base. “Life was simple. Client relationships were built on mutual trust and no one had heard of KYC” (i.e. know-your-customer). The term is used to refer to bank and anti-money laundering regulations which govern these activities; it is the process of a business verifying the identity of its clients.

After 12 months with CAI her manager unexpectedly resigned and Alpa was left to run all client relationships which her predecessor had been doing for more than 10 years.

Alpa managed a difficult situation very well. However, the Private Banking division of CAI was in a state of flux in terms of its staff – and there were question marks about its stability. These were all sources of concern – compounded by the fact that Alpa had recently married and bought a house. Fortunately, she was presented with – and accepted – an opportunity to join Generale Bank in 1999 prior to it being acquired by Fortis Bank that same year. This was also hot on the heels of Fortis acquiring MeesPierson (and its mortgage book) in 1997 from ABN AMRO in what increasing looked like an international game of banking Pac-Man.

After almost a decade at NatWest, Alpa had four employers in so many years. But Fortis was growing fast and was very keen to develop the private bank. “We were based in Appold Street and, at the time of the takeover, there were only two ladies in the mortgage department and three mortgages on the books”. But it rose exponentially with Fortis. “We started helping Belgian clients buy property in London and I morphed into a relationship manager”. Business was good and growing. Alpa’s clients were HNWs who were buying UK assets with multi-currencies. “Many were traders – and it was an exciting product”.

“At that time – and now – I meet every client face-to-face. Everything we do is about relationships”. Similarly, “my ethos is to understand and deliver – and, if you can’t, then work with them until you can find a solution”.

“I meet every client face-to-face”

In fact, Alpa had learned and developed the foundations of this tenet very early at NatWest, where she says the training was first class. But it was refined at Fortis by her first acknowledged mentor – an ex-school teacher in her 50s, who had joined Banking as a secretary. “But she was much, much more than that. She was also used to children and open to nurturing and training. Brilliant”.

Eighteen months in to her Fortis tenure, the first of her two children was born (a girl now aged 17). A year and a day later, number two (a boy now aged 16) was born. Here, again, the presence of her mentor was a significant support in a sharply male-dominated work force. “I was the only person in the department with young children”.

Alpa was similarly fortunate on the home front. “I had my in-laws living with me; and my parents around the corner. Without them it would have been impossible to work and have a family”.

“As for my business day, I worked flat out from 10am through 4pm with half an hour for lunch; and I got more done than in a full day”.

The global financial crisis

But “it all changed big time in 2007-08. Lehman Brothers went bust in September 2008 and there was nowhere to hide”. Yet “we had just three repossessions in 12 years and on only one did we lose money”.

Nonetheless, “the loan book came under stress. It was assumed that there would be a 40% fall in property values. As always, though, we met every single client face-to-face”.

In 2007, Fortis was the 20th largest business in the World by revenue but, like many, it encountered severe problems in the Global Financial Crisis (GFC), which began in 2008. To be fair, much of this stress arose because it had joined forces with RBS and Santander in a consortium bid for ABN AMRO. Ultimately, its fate was sealed in 2009 when it had to be bailed out by the Benelux Governments – and, very quickly, its Belgian banking operations were sold to BNP Paribas “and my unit became BNP Paribas Fortis”. By this time my manager had retired and I was now Director of Property Finance.

“My ethos is to understand and deliver – and, if you can’t, then work with them until you can find a solution”

At first flush, with a new employer, it was positive. “Initially, though, they had not appreciated what our little unit did until we were discovered by the Personal Finance Department. Okay, they knew very little about UK mortgages – but were keen to have a mortgage presence here in the HNW space to complement their HNW mortgage offering in Europe. And, following a thorough due diligence process, they took us under their wing and we became their next success story”.

At this time, Alpa’s mentor number two emerged. He was one of the Directors in the Personal Finance Department in France – a Yorkshireman who had lived in France for a long time. “He was a black and white sort of guy and very down to earth. He also knew how to deal with the French and French bureaucracy. And, he taught me how to operate in a male-dominated board room. He knew a lot and brought out the best in me”.

“We were writing a lot of business too and were on a growth trajectory but BNP Paribas had its own issues in Europe and struggled with the concept – and practice – of taking capital out of France and investing it in the UK. Ultimately, BNP took the decisions to stop UK mortgages overnight but they kept the mortgage book – which meant we had to wind it down”.

The move to Butterfield

“I was made redundant in August 2011. Once more, though, through keeping my ear to the ground, an opportunity emerged almost immediately at Butterfield – and I joined the Butterfield Private Bank in October 2011”. Alpa was charged with developing the UK Property Finance Unit at the Private Bank in the UK. Unsurprisingly, this was food and drink to her and, following her successful turnaround of this service area, Alpa was promoted to a Head of European Lending across the private bank in London and the bank in Guernsey with a remit to align the two service offerings and grow market share.

“In December, the Group’s Executive Committee decided to amalgamate the Guernsey and London operations and my job got bigger. I quickly discovered, however, that each jurisdiction was doing its own thing – and there was no consistency in the product offering. It was thus important to align both teams quickly and ensure that they were following a common strategy. This was a lot more difficult than I imagined and, at first, I was spending two or three days per month in Guernsey”.

In 2011, the Butterfield Group stopped commercial lending in the UK through the private bank. At the same time, though, the residential loans business was growing fast with its catchment of essentially HNWs and Ultra HNWs taking out with mortgages through the private bank. “The customers liked it but it was very difficult to establish a private banking relationship. We had a great loan book but the private bank struggled”.

Moving away from private banking

In February 2016, the strategic decision was taken to close the private bank but continue with mortgages as a stand-alone business, which was to be known as Butterfield Mortgages Ltd (BML). Thus, began an orderly wind down of its deposit taking and investment management businesses in the UK, which was known as Butterfield Private Bank. The Group intended to utilise the capital which was deployed in the UK operations to support the development of other businesses within the Butterfield Group.

Butterfield Chairman and CEO, Michael Collins said “Butterfield Mortgages Limited has retained a highly experienced team of residential mortgage specialists with strong connections in the London real estate market, developed over many years. As part of our global wealth management service, we will continue to assist high net worth families, based in the UK and internationally, with the acquisition of unique properties in the most desirable neighbourhoods in central London. From a balance sheet perspective, BML will provide our highly liquid Guernsey bank with low-risk, floating rate Sterling loans to invest its Sterling deposits”.

Butterfield Bank

Butterfield is specialist provider of international financial services. The Butterfield Group offers a full range of community banking services in Bermuda, and the Cayman Islands, encompassing retail and corporate banking and treasury activities. Butterfield also provides services to corporate and institutional clients from offices in Bermuda, The Bahamas, the Cayman Islands and Guernsey, which include asset management and trust services.

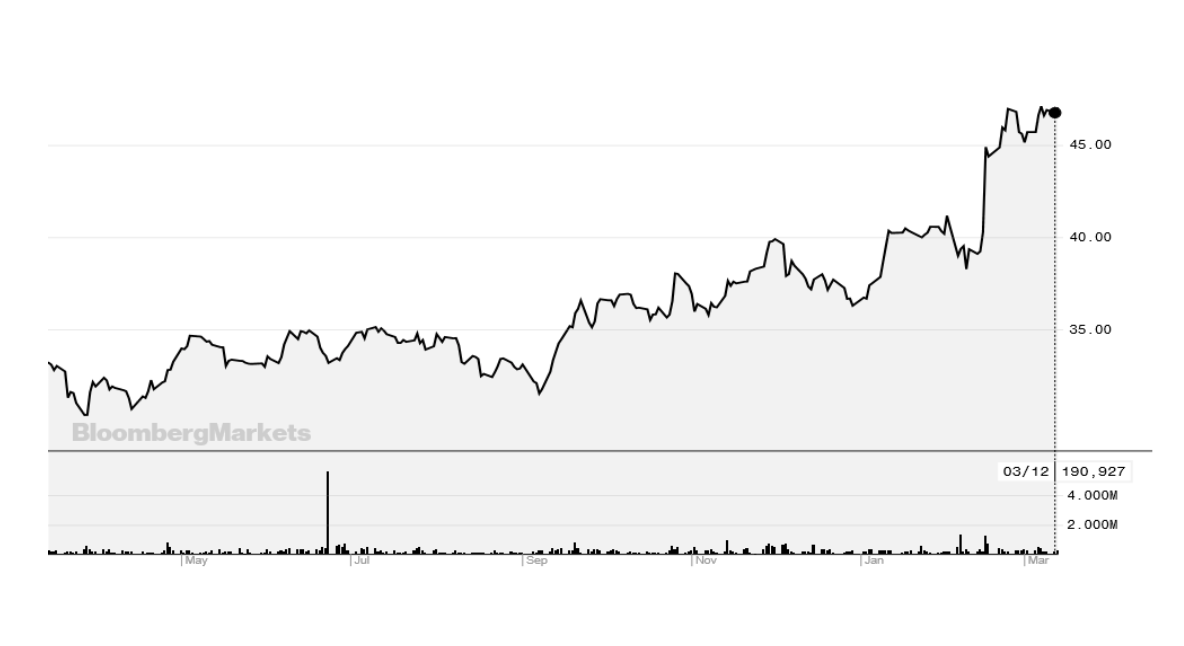

Butterfield is publicly traded on the New York Stock Exchange (NTB:US) following a successful IPO in September 2016. Its shares also continue to be listed on the Bermuda Stock Exchange (NTB.BH).

Butterfield Bank enjoys a record 2017

KEY FINANCIAL METRICS

- Market capitalisation: $US 2.57 billion on 13 March 2018

- In the past 12 months, the shares have returned 47% to shareholders (data are from Bloomberg); and since the IPO the share price has doubled to $47.00

- Net income for the year was 32% higher at $153.3 million with net income per diluted common share comfortably more than doubling to $2.76.

- Core net income for the year increased 15% to $158.9 million and 16% on a per share basis to $2.86.

- Total assets of the Bank were $10.8 billion at 31 December 2017, down $0.3 billion from 2016.

Bank of N T Butterfield & Son Ltd

- The Bank maintained a highly liquid position at the year-end with $5.3 billion of cash and demand deposits with banks, reverse repurchase agreements and short and long term investments, excluding held-to-maturity investments, representing 49.1% of total assets (2016: 55.0%).

- The loan portfolio totalled $3.8 billion at 31 December 2017, a slight increase from 2016 ($3.6 billion), as new residential mortgages loans, principally loans underwritten in the UK, were partially offset by pay-downs in commercial lending.

- The loan portfolio represented 35.0% of total assets at 31 December 2017 (2016: 32.2%), whilst loans-as-a-percentage-of-customer-deposits were at 39.7% (2016: 35.7%). Both increases are due to an increase in the loans portfolio and slightly lower customer deposits.

- Assets Under Administration and Assets Under Management: Total assets under administration for the trust and the custody businesses were $95.4 billion (minus 3% year-on-year) and $27.5 billion (+11%) respectively, whilst assets under management were $5.0 billion (+6%) as at 31 December 2017.

A focus on mortgages

Due to the continued success of her service area, however, Alpa was promoted to MD of Butterfield Mortgages Limited immediately and she now manages a specialist team servicing niche areas of the HNW mortgage industry.

The transition, however, was “a grueling process and the incumbent private banking clients did not want to go; and many were incredulous at the news. It was a challenge to wind it down but the Group was amazingly responsible. There were approximately 100 staff and Butterfield Group did everything it could to assist staff in finding alternative employment – and the majority had another position lined up before being made redundant.

“It was tough but exciting; and I believed implicitly in the product and strategy”

But Alpa says that extracting the mortgage business from the Bank was a lot harder than expected.

On a practical note, too, without a bank, there was no way for clients to pay their mortgages. “We therefore had to stop taking on any new facilities whilst we established ourselves operationally and became direct debt originators”.

“I was also pretty much on my own. The Head of Credit had left and our head office in Bermuda is a long way away. It was tough but exciting and I believed implicitly in the product and strategy”. Also, having 150 years of tradition at Butterfield of forging strong relationships with clients globally and the Bank providing bespoke mortgages for over 20 years greatly assisted in re-launching ourselves as Butterfield Mortgages Limited.

Officially now BML is a UK-based property finance subsidiary of the Butterfield Group. “BML shares the heritage of – and enjoys the support of – the Butterfield Group, which has a long reputation for integrity, reliability and innovation; and its business truly spans the community”.

Alpa also says that “our customers love the fact that we are owned by Caribbean-based entity, particularly one which is so long established; and that it is listed on the New York Stock Exchange. For me, too, on a subjective basis, there is a lyrical quality about the name Butterfield”.

The benefits of specialisation

BML’s specialisation in property finance also means that it can partner with mortgage brokers, wealth managers, private banks and other advisers to provide complementary services – as well as possessing the regulatory expertise to deal with client directly. BML is flexible and innovative in its business approach. Essentially, it is a prime property mortgage provider with a particular focus on the needs of local and international HNW individuals; and, exclusively, the wider residential sector only. It also understands that formula-driven mortgages are not always suitable; and instead offers a selection of terms and repayment options. BML also lends on re-financing, refurbishment, investment properties in the residential sector (including buy-to-let), bridging loans – in addition to prospective and incumbent residential owner-occupiers.

The core product offering, however, is a five year interest only mortgage which can be re-mortgaged at the end the term; “but often they are paid off” says Alpa.

It also has a geographical focus of London and the prime Home Counties.

For the record, Alpa says that BML has a loose definition of a HNW as someone with £300,000 of net income or £3 million of assets. It appreciates, too, that not all clients will qualify on the conventional mortgage measures of income and outgoings but rather on assets and ability to pay ultimately.

“We have an experienced relationship management team based in our London office, dedicated to working efficiently with the client to design the right solution, shaped to suit his or her needs to secure the finance required to buy a property”.

In November 2017, Alpa was promoted from MD to CEO of Butterfield Mortgage Ltd. Over the past 12 months, too, Alpa has made a string of key appointments and the head count has now topped 20 (and this is pretty much 50:50 men and women). This includes adding three business development managers, a sales director and a key relationship manager (January 2018). “We were very lucky to be able to seize the opportunity to take on a number of seasoned business development managers from an organisation that was in the process of selling its operations to a digital challenger bank”.

No details, however, are made public as to the size of BML’s loan book, save for Alpa saying “we are very happy with it”. There is also unquantified but positive mention of it in the Group’s 2017 Annual Results. Alpa is similarly Delphic about a number of clients: “it is a small elite number”.

Chain of command

In terms of the chain of command, Alpa reports to the MD of Butterfield Bank (Guernsey) Ltd, Richard Saunders, who in turn reports to Group. Richard is also an Executive Director on Alpa’s BML Board and brings to the table a long history in the private banking sector. Also on the BML Board are Tim Brooke as a Non-Executive Director and Jayne Almond, Non-Executive Chairman. Tim has wide experience in professional and financial services with the likes of JP Morgan Chase and PwC; and is a Non-Executive of digital bank Monzo.

For her part, Jayne has extensive experience of the financial services industry and has sat on the Competition Commission and the council of Oxford University. She also spent a long time in the mortgage space with Lloyds and Barclays and set up – and subsequently sold – her own internet-based mortgage business, Stonehaven.

For Alpa, too, Jayne is Mentor number three. “She is very supportive and provides great guidance” and the management structure works very well. “For example, an opportunity arose to hire four Business Development Managers, but we needed to act quickly. With Jayne’s help and encouragement we received swift support from Group Board to progress – and the hires were made within 48 hours, which was remarkable”.

THE ACTORS STUDIO

These 10 questions originally came from a French series, ‘Bouillon de Culture’ hosted by Bernard Pivot. They are better known as the questions which James Lipton asks every guest at the end of ‘Inside the Actors Studio’ TV show.

1. What is your favourite word? Approved

2. What is your least favourite word? Can’t

3. What turns you on creatively, spiritually or emotionally? Success

4. What turns you off? Laziness/lack of drive

5. What is your favourite curse word? Sh*t

6. What sound or noise do you love? The ocean

7. What sound or noise do you hate? Scratching on the blackboard

8. What profession other than your own would you like to attempt? Event organising

9. What profession would you not like to do? Beauty therapist

10. If Heaven exists, what would you like to hear God say when you arrive at the Pearly Gates? “Welcome to Paradise”

Regulation

“The Bermudian regulatory climate is stricter than either New York or London”

Given that Alpa works for a Caribbean-based entity, the conversation inevitably turned to rules and regulations. In her opinion, though, the Bermudian regulatory climate is stricter than either New York or London – it and has been for many years. She agreed, too, that annually the regulatory environment seems to tighten. Despite this could there be another Global Financial Crisis? “Highly possible”.

The future

And will Brexit help or hinder this? Alpa is a staunch Remainer and believes all round that Brexit is a “minus”.

Inevitably, given the cross-border element of Alpa’s business, I ask whether Brexit has affected the UK residential property market? “Yes, there has clearly been a number of postponed transactions but then the weakness of the British Pound has been a positive for the majority of cross-border buyers. That said, the market will be down in 2018 with London volumes off by a double digit percentage. But then London is unique; and I believe it never really collapses. In fact, the UK is unique internationally in terms of the attitude of home owners to the roof over their head being an asset class too. It is a different mentality. I also believe that the UK is far more secure than many other countries”.

“The UK is unique internationally in terms of the attitude of home owners”

And, finally, what is your Number One Challenge? “Brand awareness and the right space”.

“We do not advertise other than issuing brochures. Yes, we have direct clients, repeat business, recommendations and word of mouth. But we also rely on referrals from brokers, private banks, family offices (of which there are many), wealth managers and the like”.

Alpa is a senior figure in the UK’s HNW property finance landscape, with rare depths of knowledge and experience. Her achievements with launching BML – together with her record in promoting women in finance – have also been recognised when Alpa was short-listed for the 2018 Citywealth Powerwomen Awards in the category Leadership within a Financial Organisation. Similarly, Alpa has been included in Citywealth’s Leaders List.

Prior to this interview, we had not met. But I liked her on paper and even more in person. She is delightful, diminutive and dynamic. Alpa also emanates warmth and an inclusiveness, particularly with her eyes. But there’s steel pipe in her spine too, which gives her a decisiveness and the zephyr of leadership, both of which are empirically proven. There is no doubt I would follow her.

VITAL SIGNS

DoB: 18.03.72

Status: Married; two children 16 (boy) and 17 (girl)

School: Enfield

First job: NatWest

Remuneration: not disclosed

Shareholding in NTB: happily yes, but it is very small

Homes: Harrow

Car: Toyota Avensis

Books: ‘Hidden Figures -The American Dream and the untold story of the Black Women Mathematicians who helped win the Space Race’ by Margot Lee Shetterly

Last film: ‘Sully’ (but you sort of knew how it would turn out……). Before that ‘Girl on a Train’ which was much better

Favourite music: Zara Larsson; Ed Sheeran; and anything mainstream

Gadget: Not really a gadget person; my iPhone, I guess

Last holiday: LA at Xmas (a family visit); and then the Cape Verdi – beautiful but there is nothing there

Charity: Kidney research (my Father-in-Law died of kidney disease)

Advice to a youngster: “Learn to verbally communicate”

Typical working day: up at the crack of dawn; kids; their lunches; arrive at work around 08.30 and then meetings, management issues and presentations. Around 5pm I do my “own work”. Once or twice a year, I visit our parent in Bermuda

Not working: run around after the kids; I am their Uber