A Property Chronicle regional series.

The Northeastern US is the most densely populated region of the country, with more than 30 million people living in the roughly 250-mile expanse of near-continuous urbanisation that stretches from Philadelphia to Boston.

This area encompasses New York City and its sprawling suburbs on Long Island, in New Jersey and in the Hudson Valley and Connecticut, as well as dozens of smaller cities dotting the New England coastline between New York City and Boston.

The megalopolis is threaded together by Interstate 95, along with Amtrak’s Northeast Corridor line and the Acela Express, the only stretch of high-speed rail in North America. This region is connected nationally and globally by several major seaports, cargo airports and a dense checkerboard of highways.

The Northeast’s broad-based economy offers employment opportunities in nearly every industry. The region’s vast collection of academic institutions encapsulates nearly one-third of the nation’s top 100 universities. They continue to attract young people who support the expansion of the area’s highly skilled labour force and spur the creation of new businesses that attract billions of dollars annually in public and private investment.

Industrial market continues to thrive

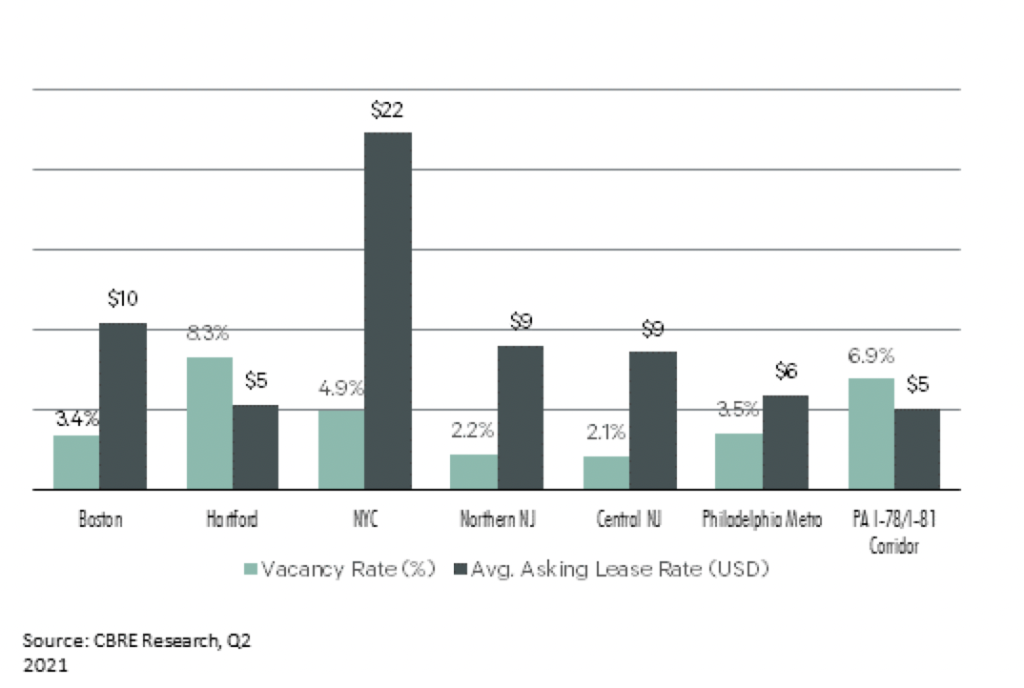

Industrial markets in the Northeast are among the strongest in the country. Inventory in the region totals over 1.8 billion square feet and vacancy levels are at an all-time low of 3.3%. As of Q2 2021, base rent in northern New Jersey, directly west of New York City, was up 33% year-over-year – the strongest growth of any market in the country. Philadelphia’s base rent growth was the third largest, Boston the sixth and central New Jersey – south of New York City – the ninth. The PA I-78/I-81 corridor – a region which encompasses a patchwork of small cities in eastern Pennsylvania north of Philadelphia – ranked fourth nationally for year-to-date net absorption with 12.2 million square feet.

Increased e-commerce demand and the need for safety stock to counter supply chain disruptions put upward pressure on asking rents, which average over $9 per square foot in the Northeast and contributed to the low vacancy rates. For Class A industrial space in coveted locations like northern New Jersey’s Meadowlands, rents can go as high as $18 per square foot. Prices are being pushed upward by a lack of development opportunities in areas of high demand – near ports and urban cores – pushing new construction towards the region’s periphery in southern New Jersey and the PA I-78/I-81 corridor, where there is nearly 10 million square feet and 26 million square feet of space under construction respectively. There is currently over 56 million square feet of industrial space under construction across the Northeast markets, 49% of which is pre-leased.

Tight vacancy and high lease rates characterise Northeast industrial markets

Non-traditional industrial users tied to emerging industries are also competing with 3PL and e-commerce occupiers for properties near city centres. In Boston, biotechnology and pharmaceutical firms are taking manufacturing space in the suburbs as the region’s life sciences firms look to keep their production close to their research operations centred in Cambridge. There is currently 3.8 million square feet of life sciences manufacturing space in the Boston metro area, with nearly 700,000 more in development.

In the New York tri-state area, generous tax credits and abundant talent are attracting an increasing number of film and television productions, and driving the conversion of warehouses into film studios across the region. There is currently 2 million square feet of film studios in the region that were previously industrial manufacturing buildings.

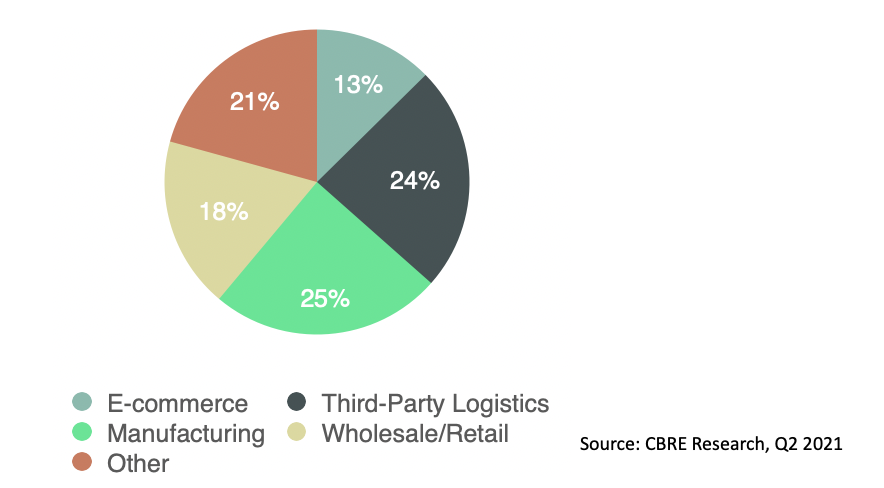

The space constraints are made worse by supply chain woes that are delaying construction completion timelines and pushing delivery dates into 2022. The lack of available space is contributing to lower absorption rates, specifically in the greater New York area, compared to other coastal markets in the US, with third-party logistics, manufacturing and e-commerce generating the highest occupier demand.

Variety of uses driving industrial demand

Retail real estate seeing new opportunities despite headwinds

Brick-and-mortar stores in the Northeast’s office-centric city centres remain under enormous strain after 18 months of pandemic-induced lockdowns and altered commuting habits. Vacancies have proliferated, particularly in Manhattan, where availability has increased over 30% between the end of 2019 and Q2 2021 in select retail corridors tracked by CBRE. Rents, already in decline for years before the pandemic, continue to trend downwards. Despite the headwinds, depressed rents and recovering foot traffic in urban areas are creating new opportunities.

While below 2019-levels, retailers continue to take space in Manhattan, led by food and beverage (F&B) purveyors who are taking advantage of a tenant-friendly leasing environment. So far in 2021, F&B retailers account for over 32% of transactions, suggesting that these retailers are optimistic about the city’s economic recovery, as retail sales continue to tick upwards quarter-over-quarter. Click-to-brick retailers, who do most of their sales online, and pop-ups have also been taking space, albeit on a short-term basis, as they test the waters of physical retailing.

This optimism in Manhattan’s urban core retail appears well-founded. Despite stories of mass-exodus from densely populated metros early in the pandemic, property markets are now rebounding as residential rents and home sales return to pre-pandemic levels. While Northeastern metros are not expected to see rapid population growth, their large populations will remain stable or grow slightly while household incomes, already among the highest in the country, are projected to grow between 10-12% by 2030, according to data from ESRI.

Office sector positioned for strong comeback

The office sector in the Northeast continues to combat challenges, but is positioned for a strong recovery as vaccination numbers improve and Covid-19 restrictions lift. Given their population density, Northeastern office markets were profoundly affected by the pandemic and the subsequent restrictions and regulations. As office-using tenants shifted to work from home, sublease availability increased throughout 2020 as did total availability and vacancy, and rents decreased. Even in Manhattan, rents dipped by 7% between the start of 2020 and Q2 2021.

Northeast office markets may be turning a corner. Boston has outperformed the country throughout the pandemic, braced by a powerful life sciences sector that has continued to seek out space and sign leases at relatively robust levels. Manhattan has experienced a gradual, but steady recovery of tenant interest and the summer months saw modest monthly improvement in leasing activity.

Both Manhattan and Boston have seen their sublease space fall off in recent months as companies withdraw space from the market or find tenants. While Philadelphia’s office market faces stronger headwinds, one-third of all pandemic-era sublease space has been withdrawn by occupiers as they gain greater clarity on their long-term workplace strategies. On the demand side, transactions have been picking up for the sublease space that remains on the market.

Office markets in the Northeast have two growth industries bolstering their recovery: life sciences and technology. Boston, Philadelphia, New Jersey and New York all appeared in the top 10 of CBRE’s recent ranking of life sciences markets, and each of these markets is uniquely positioned for continued growth. Two of the top 10 markets for tech employment – New York City and Boston – are in the Northeast. Philadelphia appeared at #26 on that same list and is regarded as an up-and-coming location with a startup scene that bodes well for progress.

Investor interest to continue

The rail-based transit networks that make Northeastern metros so efficient at moving people have proven to be a liability in the Covid-19 era. Weekday ridership on the three major mass-transit systems in the region – New York City, Philadelphia and Boston – remain at about half of their pre-pandemic ridership totals. The commuter railroads, which are more likely to carry office workers, have had similarly depressed ridership. A full recovery of Northeastern urban centres and the ecosystem of shops and hotels that they support seems unlikely without substantial weekday ridership gains.

Other challenges for the region include slowing population growth, high wages and housing costs, and land constraints that limit greenfield development, especially for industrial properties. Despite these obstacles, the region continues to show its adaptability, enabled by high-volume infrastructure, a skilled workforce, and the raw creative energy of the region’s large and vibrant cities. This combination of assets will continue to attract new firms in emergent industries to the Northeast while retaining its attractiveness to traditional office stakeholders in finance, insurance, real estate and media. The abundant opportunities in a variety of industries makes the Northeast an exciting and versatile region for continued investment.