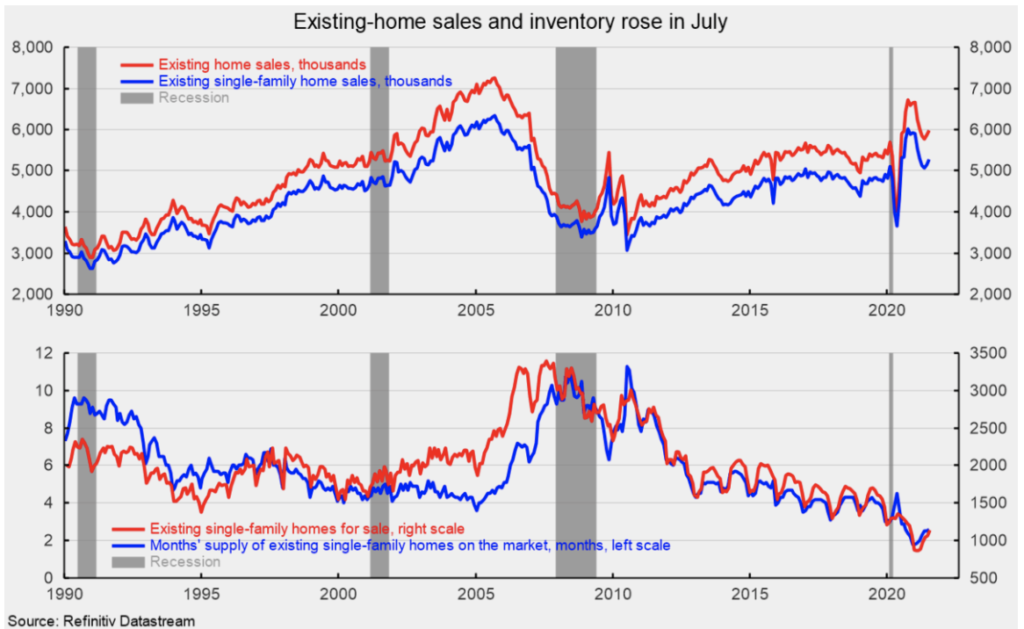

Sales of existing homes rose 2.0% in July, to a 5.99 million seasonally adjusted annual (see top of first chart). Sales are up 1.5% from a year ago. Sales in the market for existing single-family homes, which account for about 88% of total existing-home sales, rose 2.7% in July, coming in at a 5.28 million seasonally adjusted annual rate (see top of first chart). From a year ago, sales are down 0.8%. Condo and co-op sales fell 2.7% for the month, leaving sales at a 710,000 annual rate for the month versus 730,000 in June.

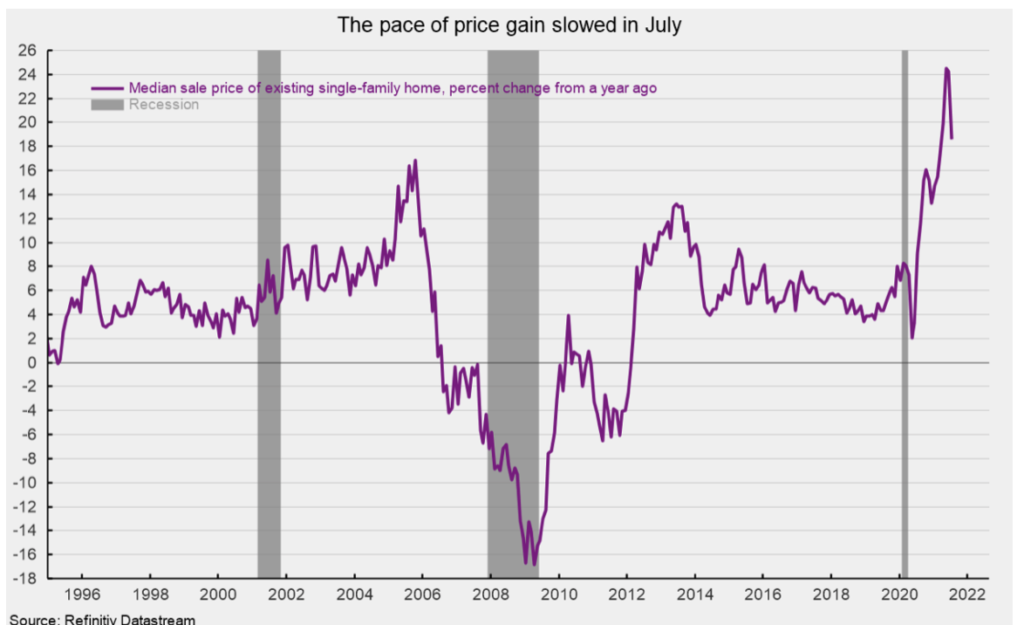

The median sale price in July of an existing home was $359,900, 17.8% above the year ago price and just below the record high of 362,800 in June (sale prices are not seasonally adjusted). For single-family existing home sales in July, the price was $367,000, an 18.6% rise over the past year. That pace is down from 24.2% in June and 24.5% in May (see second chart). The median price for a condo/co-op was $307,100, 14.1% above July 2020.

The record-high prices are helping push up inventory. Total inventory of existing homes for sale rose 7.3% to 1.32 million in July, pushing the months’ supply (inventory times 12 divided by the annual selling rate) to 2.6, the highest since September 2020 though still a very low supply by historical measure.

For the single-family segment, inventory increased 7.5% to 1.14 million, the highest since October 2020 (see bottom of first chart). The months’ supply rose 2.6 (see bottom of first chart). The condo and co-op inventory rose 4.1% to 177,000, putting the months’ supply at 3.0, the highest since November 2020.

Rising prices are pushing some buyers out of the market, helping to slow sales and ease the tight supply. Additionally, some fading of the rush out of dense urban areas for suburban housing or rural country homes may also be undermining housing demand. Housing is likely to be volatile over the coming months as fundamentals adjust to changing market conditions. The recent rebound in Covid cases related to the Delta variant is also boosting uncertainty for the outlook for housing.

Originally published by the American Institute for Economic Research and reprinted here with permission.