The politics, economics and tech.

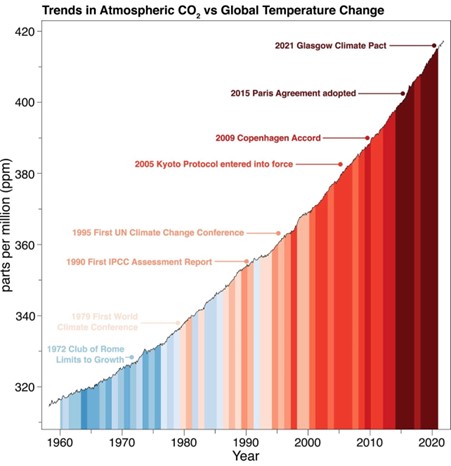

We inhabit a world where a distorted perception persists regarding the relationship between the value and expense of initiatives aimed at addressing climate change. Without proactive measures, regardless of their associated costs, we face the ominous spectre of global warming and the existential threats it poses. The benefits and advantages of taking action to mitigate the impacts of global warming far exceed the current costs of such actions. Our hope is that 2023 will be remembered as a pivotal moment of shared realization among humanity.

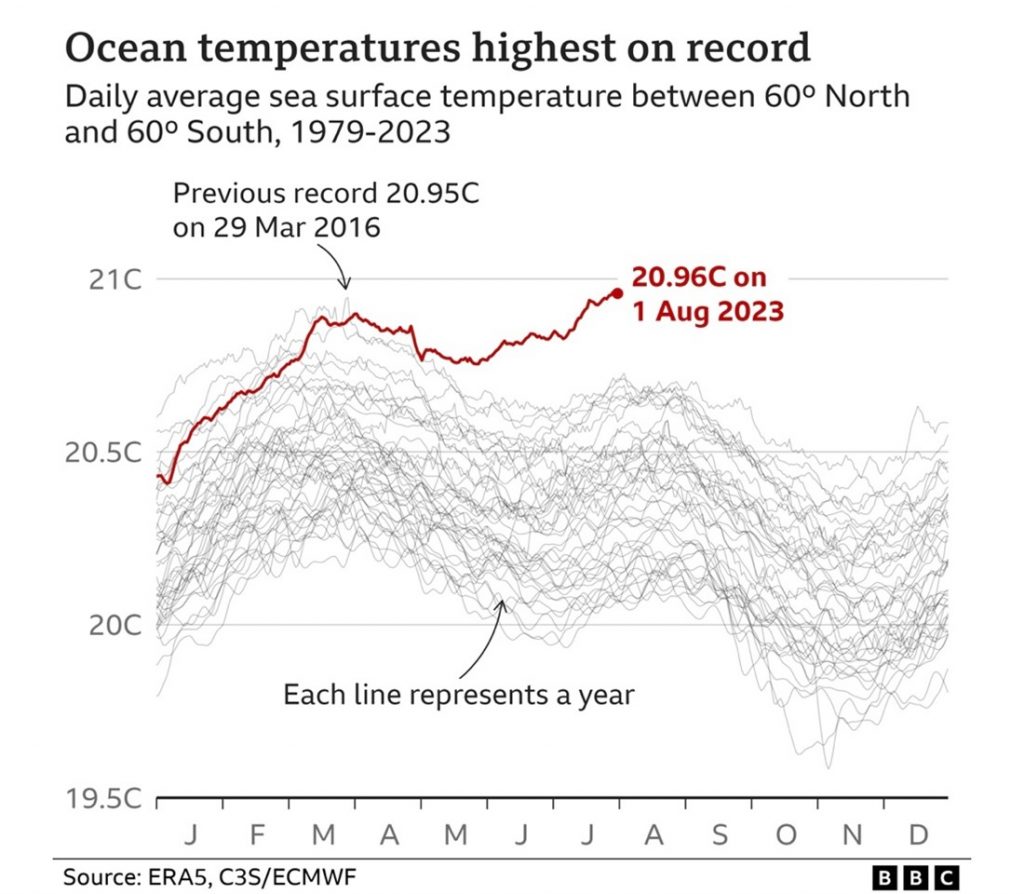

Today’s prominent headlines in mainstream media regularly feature dramatic wildfires, droughts, floods, severe heatwaves, rapid glacial melting, shifting ocean currents, a profound decline in wildlife, and widespread human suffering in various parts of the world. This “dystopian future,” marked by an unrelenting series of climate and ecosystem crises, is unfolding, affecting individuals within the familiarity of their own surroundings in both developed and developing nations. The stakes have reached an unprecedented level, as an escalating apprehension of perilous climate risks rapidly reshapes our way of life, impacting both the affluent and the less privileged. Disruption, uncertainty, resource scarcity, human suffering, and frustration are becoming the prevailing norm.

So, what can be done?

Churchill once said that “the pessimist sees the difficulty in every opportunity and the optimist sees the opportunity in every difficulty,” while Nietzsche said, “there are no such things as facts, only interpretations”. Both are right when it comes to climate action, but someone with pointy ears in a galaxy far, far away also said: “Do or do not; there is no try.”

Decarbonization stands as a critical imperative, and rewarding conservation is a close second. Achieving net-zero pollution means reaching a fundamental equilibrium between the amount of greenhouse gases emitted into the atmosphere and the amount removed. In this process, innovation, investment, and a shift in public perceptions and opinions are key. It is time to rethink the paradigm shaping our politics, economic measures, and technology application.

How can we shift the bias of national politics from pursuing short-term gains to prioritizing long-term benefits? In the realm of politics, the prevalent popularity contests often focus on immediate metrics, revolving around the upcoming election cycle. This atmosphere fosters a mindset of “what’s in it for me” among today’s voters. It has been a very long time since we have enjoyed an inspirational leader who has had the courage to talk about a future that requires sacrifice today.

Although multilateralism and consensus-building boast numerous merits, they often fall short when opinions become polarized and prompt action is imperative. The time has come to initiate a transformative revolution. This movement necessitates leading by example—our actions must extend beyond individual efforts, with the aim to energise and influence those around us. Voters should endorse politicians whose fundamental approach resonates with the principle of pursuing enduring advantages for both future generations and the broader community while disregarding feeble populists who pander to the insatiable greed of corporations.

At the same time, the private sector bears a pivotal responsibility, with its leaders obligated to set a meaningful example and effect substantial change. Investors entrusted with the management of others’ capital or resources that are meant for the benefit of future generations, shoulder a profound responsibility. It is imperative to re-evaluate strategic asset allocation models, addressing not just environmental impacts but also devising strategies to mitigate climate risks. Such strategies include actively championing carbon offset initiatives and recalibrating risk assessment models.

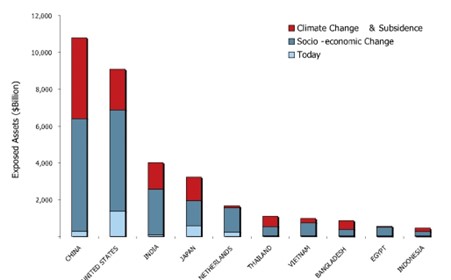

One may want to critically scrutinize the portfolios they oversee. Is it truly prudent, for instance, to invest in real estate projects in Miami or New York with a 10-15-year outlook? The idea of “stranded assets” is on the brink of becoming investors’ new reality; if it isn’t already. This phenomenon is particularly prevalent in the physical built environment. Consider structures that have outlived their functional lifespan and are no longer meeting customer needs or regulatory standards. The costs of retrofitting or, in some cases, rebuilding such edifices can be exorbitant. Coupled with the looming threat of rising sea levels, these buildings stand as monuments to a bygone era.

At long last, the technology is at our fingertips. Renewable energy solutions are already making a substantial impact and will continue to gain significance. Our ability to harness clean energy and establish the necessary infrastructure, comparable to our proficiency in handling fossil fuels, is pivotal. Green hydrogen will take on a more prominent role in our energy portfolio. A single kilogram of hydrogen can power a family car for 100-150 kilometres. We can generate green hydrogen through the electrolysis of water using renewable energy, followed by safe storage and global transportation in the form of green ammonia. This advancement can expedite the decarbonization of industries such as steel and cement production, improve various transportation, act as environmentally friendly fertilizers for carbon-neutral agriculture, and – undoubtedly – fortify energy grids to facilitate the cleaner electrification of power networks.

In addition, biomass, nuclear power, hydroelectricity, tidal energy, next-generation fusion, advanced battery technologies, and innovations yet to be imagined will each contribute to shaping our energy landscape in the future. The true challenge lies in rapidly adopting these innovations in a timely manner. To those who cling to the past, hesitant to change, it is time to reconsider.

Ultimately, when we commit ourselves to redefining our political landscape, economic structure, and technological innovation, we can witness, as Arundhati Roy beautifully expressed, that “another world is not a distant dream; she is already in the process of emerging. On a peaceful day, one can discern the subtle rhythm of her advancement, much like a gentle, steady breath.”

Top ten countries ranked by assets today showing the projected impact of climate change versus socio-economic change into the 2070s (OECD, 2007).