There is more than one way to inhabit a city,

say these authors.

As the future of work is changing, we now find ourselves at a stage where demand for quality, convenience and flexibility in urban living is not being met by traditional inner-city apartment complexes. Long-term ownership doesn’t provide the flexibility required nor do younger occupants have the high capital necessary to participate. At the same time, short-term UK leasing legislation and the current supply is inefficient in both space, operation and capital reward.

In today’s fast-moving digital economy, we’re seeing a crossflow of knowledge from different property sectors with increasing velocity and the problem posed above has a readily available solution already evolving in the commercial sector, namely ‘co’, so will co-living provide a solution, what is it, what are its evolving characteristics and how does it work?

Co-living can be described as a way of living in cities that is focused on community, convenience and wellbeing. This manifests itself as a small apartment with kitchen facilities akin to a mini-studio apartment that is supported by larger communal areas that can include work areas, lounge areas, sundry services, storage and leisure facilities. More often than not, these communal areas are also curated such that events and activities are hosted for the residents.

As we have seen from the changes occurring in the office sector driven by the co-working environment, there are the same evolving characteristics that act as enabling agents, namely:

the paradigm shift from landlord and tenant to customer and customer service provider;

tech-enabled property management and customer relationship systems;

multiple revenue streams from services rather than FRI rent;

a cash-flow approach to valuation with a drive to increased margin to compensate for potentially higher overall volatility.

The co-living financial model works on attractive cashflows. The principle revenue being the room rent, which is usually on a fully inclusive furnished basis, with the landlord managing all services such as rates, heating, lighting, etc. Additional services, like digital connectivity (wifi), work stations, gyms, etc, and their costs are bundled together and a margin added. Increasingly, property assets are the platform for opportunities to enhance and diversify revenue streams that should be valued accordingly. These incomes can usually then be netted down with provisions for voids, refurb and CapEx and the resultant granular income stream discounted in the usual manner at an appropriate rate.

Looking at the discount rates for co-living, we have seen an interesting phenomenon in how capital markets are responding to this new asset class, which is allowing the asset class to grow. Namely, institutional investors normally being drawn to secure income streams to match long-term liabilities are accepting the granular and the short-term nature of co-living, whether the arrangement with the occupiers is on a daily, monthly or quarterly arrangement. The focus is on the quality and business attributes of the manager, as without this the new paradigm would not be possible.

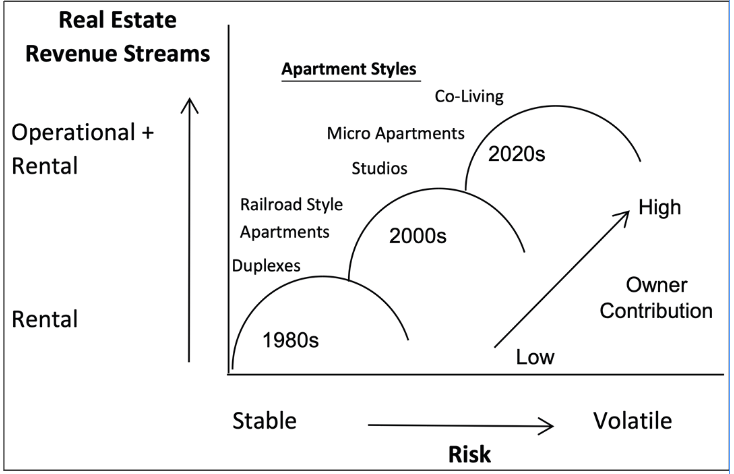

Of critical interest is the evolution of these models and a likely parallel movement between co-working and co-living, as the efficiency trend we have seen in relation to how operating models have evolved. This efficiency trend has manifested itself by funders seeing the opportunity for greater margin by directly operating assets. Generation 1: co-working was driven by trailblazing progressive intermediaries with bold ideas and branding, for example: We Work and The Office Group. Generation 2: saw a move to share the risk transfer between shareholders using management agreements akin to hotel operators and, with Generation 3: we are seeing landlords using the ideas and methods and systems directly – effectively cutting out the margin generated by the intermediary entities. It is likely as the landlord’s (service provider) knowledge base increases in the co-living sector that this trend will follow suit. See Figure 1 for changes in apartment styles and service provider’s income sources.

Figure 1: Property owners income sources: co-living space.

The need for new ways of accommodating younger generations and changes to how communities choose to live is being facilitated by the above enabling agents coupled with a tide of long-term capital. Institutional capital is focusing on anticipated growth areas and their need for both greater portfolio diversification and also better overall portfolio balance. It will be interesting to see the continued evolution of the operating models, the parallels seen in other property sectors and how the drive for efficiency manifests itself. As knowledge is made more freely available and digested by the digital economy, the pace of change and possibility can only increase.