Recent European valuations data from MSCI for Q2 confirmed that capital values are still falling, but at a slower pace than they were last winter. This raises the question as to whether we have reached a turning point in this downturn. Our view is that European commercial real estate (CRE) is not out of the woods yet, despite things looking better than before the summer. There are five key headwinds that will weigh on a quick recovery: tight credit conditions, rock-bottom sentiment, high debt costs, inadequate risk premia, and stagnant economies.

Tight credit conditions will place further pressure on debt re-financings and the feasibility of using debt leverage for new transactions. The ECB bank lending survey has remained in tightening territory since the banking troubles in March, as indicated by business loan terms. The relationship between credit conditions and capital growth suggests that values should have fallen more over recent quarters than has been the case. Credit conditions imply that capital values should have fallen nearly 4% per quarter this year, rather than the 2% that was recently reported.

Investor confidence plays a big role in market activity. Recently, real estate sentiment has been at a record low, presenting a second headwind to valuations. We use the sentix global real estate sentiment index to track investor confidence which has a reasonable relationship with capital growth historically, particularly at big events. Following this relationship, we would expect a capital decline of 15% so far this year, rather than the reported 4%.

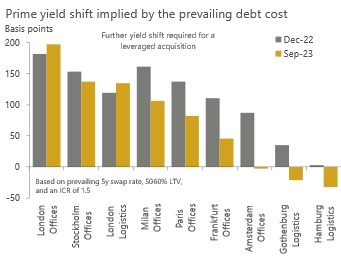

Debt costs will limit the ability to use leverage which adds further downside risks to capital values. Logistics pricing has made progress – meaning that an investor looking to use moderate leverage at a low-risk ICR would now be able to transact based on quoted market prime yields. Conversely, for a prime office transaction using 50%-60% leverage, yields still need to move out by anywhere from 50bps for Frankfurt offices to 200bps for London offices (Chart 1). This clearly signals that the bid-ask spread is still too wide for many investors to transact in the UK and European office markets.

Chart 1: Debt costs still prohibitive

A fundamental investment concept is the opportunity cost of capital. On this measure, yields look too low for all sectors except for perhaps retail, suggesting that property values need to adjust downwards. As a rule of thumb, some investors use a fixed spread of 200bps-300bps above bonds as sufficient compensation for the additional risk of owning CRE rather than government debt. Most sectors were below the lower threshold by this measure. We have developed a proprietary required return framework that also incorporates the cost of decarbonising into the risk premium. By using this approach, we again believe that expected returns are currently well below the required return in most sectors and locations in Europe.

A deterioration in the near-term macro outlook signals weaker occupier demand ahead. The eurozone economy flatlined in H1, and Q3 looks like it could be worse. The weak outlook for foreign demand and investment, combined with the slowdown in China presents a material headwind for the eurozone in the near term. The consumer recovery seems to have less momentum than we expected. A softening labour market and rising insolvencies could dampen consumer confidence and encourage precautionary savings.

That said, there is also some positive news for valuations. High development costs may constrain supply in 2024-2025, which may help to stabilise the market providing a floor for values in sectors where vacancy rates are already low. While in the long term, asset managers and financial markets can be optimistic about rising private wealth which should drive demand for investable assets and thus asset returns. In the near term though, we believe that it’s too soon to declare a recovery. We still expect value declines of 8%-10% this year in the eurozone and the US, but less in the UK, at around 5%, because of the larger correction that we saw last year. Given the extent to which rates have risen and the gradual transmission of those increases through to the market, due to fixed rates with differing maturity timings, even if the ECB starts to cut policy rates next year, the effective interest rate paid by the market will keep increasing. This means that many in the market are still not yet feeling the effects of higher rates. We think that this will drag on any potential recovery in the next year with virtually no growth in values overall for the UK and the eurozone.