The Federal Open Market Committee (FOMC) voted to hold their federal funds rate target in the 5.25 to 5.5 percent range on Tuesday. The move was widely expected, with financial markets pricing in a mere 1.8 percent chance of a rate hike prior to the announcement. But it marked a departure from earlier guidance. In September, twelve of nineteen FOMC members projected that the federal funds rate would exceed 5.5 percent by the end of 2023.

“While we believe that our policy rate is at or near its peak for this tightening cycle,” Federal Reserve Chair Jerome Powell said at the post-meeting press conference, “the economy has surprised forecasters in many ways since the pandemic and ongoing progress toward our 2-percent inflation target is not assured. We are prepared to tighten policy further if appropriate.”

Powell added that, although FOMC members “do not view it as likely to be appropriate to raise interest rates further, neither do they want to take the possibility off the table.”

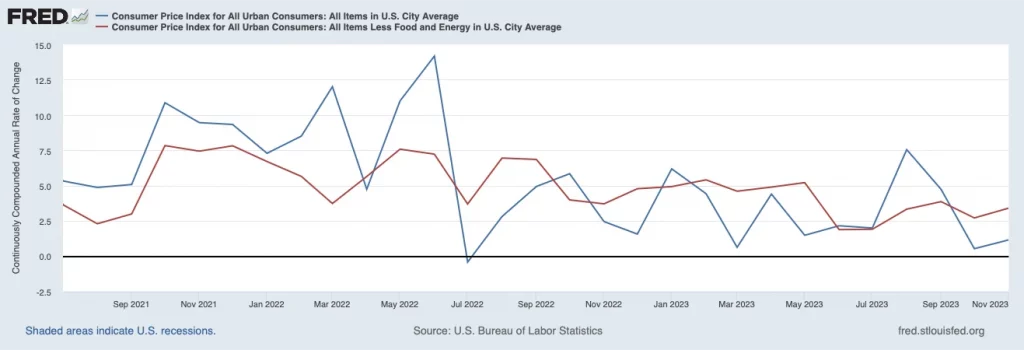

Inflation has declined over the last few months, following an uptick in August. The Consumer Price Index grew at a continuously compounding annual rate of 1.2 percent in November, down from 7.6 percent in August. Core CPI, which excludes volatile food and energy prices, grew 3.4 percent in November.

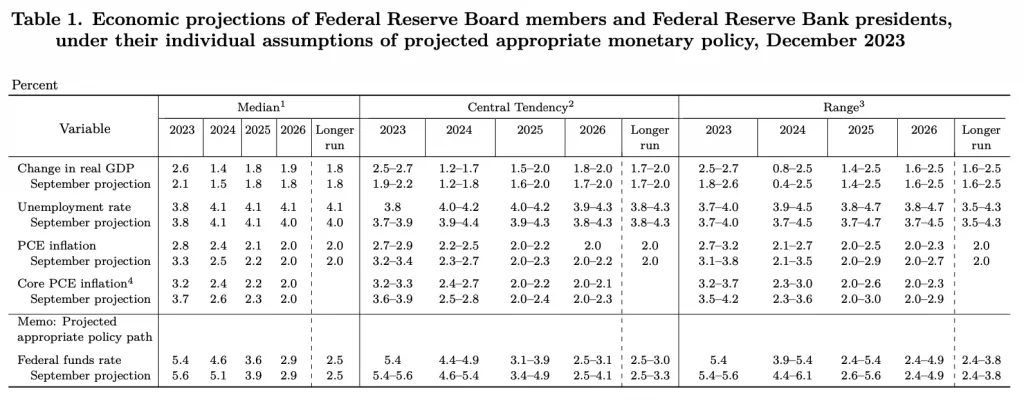

FOMC members also revised their projections of output growth, inflation, and the federal funds rate. FOMC member projections are submitted under the assumption that monetary policy is conducted appropriately, as determined by the submitting member. The median, central tendency, and range of projections are presented below.

The median FOMC member now projects 2.6 percent real Gross Domestic Product (GDP) growth in 2023, up from 2.1 percent in September. Real GDP has generally outpaced FOMC member projections this year, growing 2.3 percent (3.1 percent annualized) over the first three quarters. The median FOMC member projected just 0.5 percent growth in March and 1.0 percent in June.

Early data suggest real GDP growth has started to slow. The Atlanta Fed’s GDPNow model estimates real GDP will grow at an annualized rate of 1.2 percent in Q4-2023. The median FOMC member projects real GDP will grow 1.4 in 2024 and 1.8 in 2025.

The median FOMC member now projects the Personal Consumption Expenditures Price Index (PCEPI), which is its preferred measure of inflation, will grow 2.8 percent 2023 and 2.4 percent in 2024, down from 3.3 percent and 2.5 percent respectively in September. Headline PCEPI has grown 2.6 percent (3.0 percent annualized) over the first ten months of 2023.

The median FOMC member is also projecting lower core inflation. Core PCEPI, which excludes volatile food and energy prices and is thought to be a better predictor of future inflation, is now expected to grow 3.2 percent in 2023 and 2.4 percent in 2024. In September, the median FOMC member projected 3.7 percent core PCEPI inflation in 2023 and 2.6 percent core PCEPI inflation next year. Core PCEPI has grown 2.8 percent (3.3 percent annualized) over the first ten months of 2023.

With inflation falling faster than previously anticipated, FOMC members now look likely to cut rates more quickly, as well. That’s the right call. If the Fed holds its nominal interest rate target constant as inflation expectations decline, the ex-ante real interest rate increases and, all else equal, monetary policy becomes even tighter. Hence, the Fed must initially reduce its target rate to keep from over tightening and then later reduce it even further in order to shift the stance of policy from tight to neutral.

In September, the median FOMC member projected the midpoint of the federal funds rate target range would fall to 5.1 percent in 2024 — i.e., one 25 basis point cut from the current target. Given the median member’s previous projection for inflation, that implied a real federal funds rate of 2.6 percent. Now, the median FOMC member is projecting the midpoint of the federal funds rate target range will fall to 4.6 percent next year — that is, three 25 basis points cuts from the current target. Given the median member’s current inflation projection, that implies a real federal funds rate of 2.2 percent.

The federal funds rate is also projected to fall further in 2025, with a midpoint at 3.6 percent in comparison with the September projection of 3.9 percent. After adjusting for projected inflation, the real federal funds rate is now expected to be around 1.5 percent in 2025, whereas it had previously been expected to be around 1.7 percent.

Altogether, this week’s meeting looks like a turning point at the Fed. After months of worrying that they had not yet done enough, FOMC members now seem to think they have a handle on inflation and will see it gradually return to 2 percent. Let’s hope they are correct.

This article was originally published in AIER and is republished here with permission.