Keen sport watchers will have witnessed the use of ‘head-fakes’ to deceive an unsuspecting opponent. Indeed, the phrase is used generally to describe not only using a fake move with one’s head to wrong-foot opponents, but legs, arms and even – with the head remaining motionless – one’s eyes. Whether one considers such behaviour unsporting gamesmanship or perfectly legitimate often turns on whether it is performed by or against ‘our team’ or ‘our player’.

It is with head-fakes in mind that I wish to consider the recent and seemingly ‘unstoppable’ near waterfront rise in the dollar.

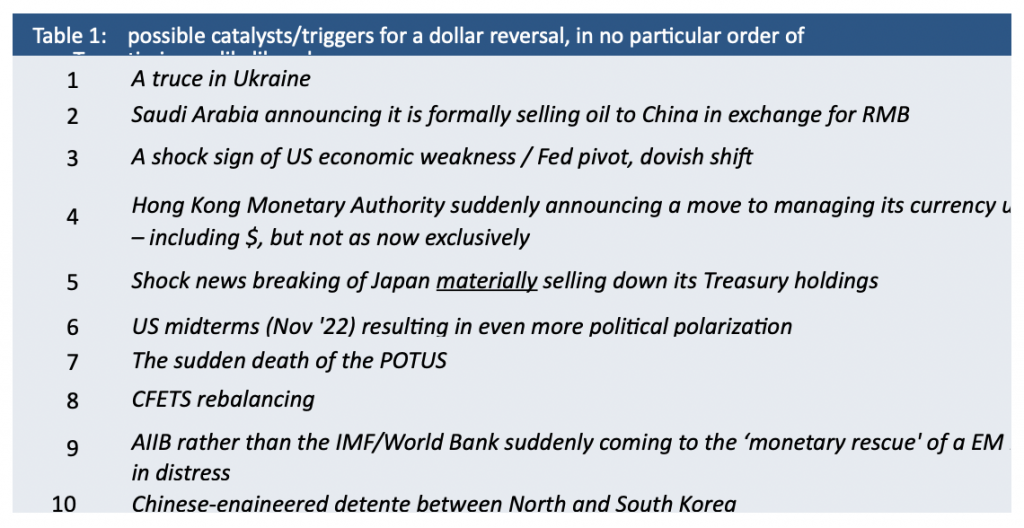

The reality at the moment is that whether we consider the dollar’s level against a trade-weighted basket of other currencies or its level against a basket of commodities, what we have witnessed is dollar strength; after all, very recent falls in commodity prices have per se equated to just that. As to why we have seen it move upwards in practically all dimensions – the rouble a remarkable exception – there are a host of explanations, many connected. There is for one, the time-honoured surge in the dollar which happens with a hawkish shift in Fed policy. Under such circumstances we see a flooding back of those hitherto cheap-to-fund dollars which had journeyed overseas in search of yield arbitrage. Another force lifting the dollar is its perceived safe-haven status; ‘safe-haven’ when there are concerns over global economic growth and/or global geo-politics. Since we are in a period when we cannot be sure what awaits us economically or militarily, can one be surprised by the rise in the dollar? Well, I for one will not be taken in by this head-fake. As to when others realise they have been taken in, the table below provides 10 possible wake-up calls.

One seeking precedents for what awaits the dollar will not go short of reasons to go short. The reality is that history is littered with instances of currencies which having soared, then suffer gravitational pull. Just as there was a time when the Florentine florin was recognised across Europe, and indeed far beyond it, or when the British pound was a trading titan medium of exchange, used to price commodities and prized as a store of wealth. While no two global currencies experience the same life cycle, monetary mortality comes to many, with those that survive proving far, far less a force than they were at their apogee.

Those seeking a more recent precedent for what awaits the dollar should merely look east to what is now the Land of the Setting Sun. Consider, that is, how having been closely managed by the Bank of Japan, the yen was allowed by it – forced by its trade partners – to rapidly soar from the late summer of 1985, reaching a trade-weighted dominant peak a handful of years later, only to fall to earth. This is not the place to fully chronicle the yen’s stellar rise and no less relentless reversal. What I want to do is make clear that stories of a currency rising then suddenly falling are not parables. For in my working life I have witnessed the yen trace just such a parabola. What then of gold?

Any assessment of how two financial measures move against one another has to begin with the caveat “There are of course other factors at play”. So too with the relationship between the dollar’s trade-weighted value and the dollar price of gold. Yes, they appear to have largely moved inversely in the years since 2005, but yes too there have been periods – albeit rare and brief – when this has not been the case.

Looking out to the future, I see gold as continuing all its roles of the past as well as a destination for those escaping the tightening grip of central bank digital currencies. This said, money going into gold which has already been digitalised will de facto mean the gold acquired is traceable. And once in gold, one will struggle to find ways of realising its store of wealth without being traced. So, as the track and trace vice closes on informal economies far and wide around the world, and gold seems all the more attractive as an escape from that vice, it will in fact be no real escape at all.

“If the dollar is the last of the main fiats to go ‘tracker’, its role as the world’s most used currency within the grey and black parts of the world economy will only increase”

What of crypto currencies in all this? Since they have it as their numeraire, does the prospect of a USD reversal mean a revival in crypto prices? Well, categorically no. The digitalisation of the world’s main currencies ensures the only conceivable end result for cryptos is a price of nil. As for the dollar in a world of CBDCs, let me be clear that its outlook is in no way altered, with one caveat. If the dollar is the last of the main fiats to go ‘tracker’, its role as the world’s most used currency within the grey and black parts of the world economy will only increase. If this increased demand acts to provide the dollar with some support, then that is flattering to deceive.

In short, King Dollar will be dethroned

As with any prediction, one has to test it against the possibility it is proven wrong. And in total honesty I have been concerned over the dollar long enough that I qualify squarely – albeit far from boastfully – for the moniker ‘very stale, dollar bear’. Recognising the error of my ways thus far, I will persist. Persist, not out of sheer bloody-mindedness, but because whatever ‘the market’ may be telling me, the fundamentals do not agree with it, but align with me. And to those convinced the dollar is robust enough to withstand all the brick bats I and others throw at it, I simply say this – its head-fake strength has failed in the past and will fail again. To those who say don’t be short the dollar, my reply is don’t fall for its head-fake.